Talking Points:

- US Political risk held down the accelerator into the week's close with news of Steve Bannon's exit as Trump's Chief Strategist

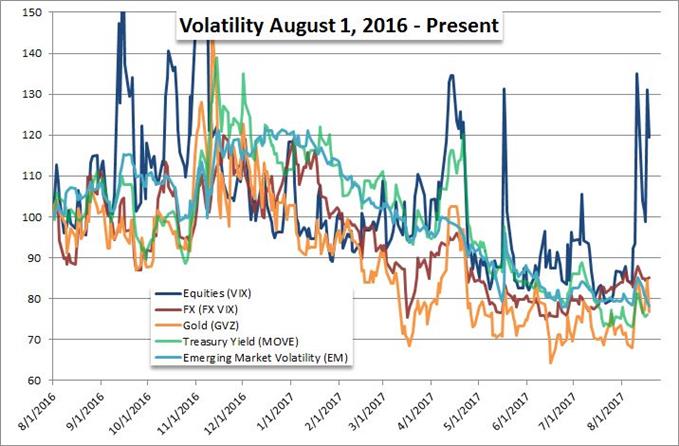

- Stronger response from the VIX, US equities and Treasuries relative to other 'risk' assets suggests fear not yet global

- Monetary policy - both relative and cumulative - will stir both exchange rates and risk trends into Jackson Hole Symposium

Are retail traders positioning for true reversals from EUR/USD, the S&P 500 and Gold? See the IG positioning data on the DailyFX Sentiment page.

Risk trends took a serious stumble this past week, but we have yet to see a full commitment to finally unwind some of the excessive exposure we have taken on as a market. From my favorite, skewed benchmark for sentiment - the S&P 500 - we were met with a break of the impressive trendline support that has carried the market in a steady channel for nine months. Yet, despite stepping off the technical cliff, speculative gravity didn't immediately pull the benchmark down to earth. What's more, we have yet to see similar commitment to a soured view on sentiment in other corners of the globe. Respond from US equities, Treasuries and the US Dollar still sport contrast to global shares, emerging markets and some of the most renowned carry currencies. This reflects the nature of this fundamental consideration. US political uncertainty poses explicit risk to the US economy and financial system, but its global ramifications depend on whether or not the forthcoming developments can catalyze complacency to renewed appreciation for value.

On the political front, this past week pushed a fundamental theme from the abstract into the explicit. The atrophy of advisors from various Presidential boards lead to the important disbandment of the Manufacturers Council and the Strategic Forum. These groups were populated by important CEOs and business leaders that were set to work with Donald Trump on his policy agenda to promote growth and employment to achieve the 3 percent growth target that he had set out for the United States. Under pressure, the planned council for Infrastructure was officially cancelled. That in particular carried a significant weight for investors as the often touted $1 trillion infrastructure spending program during the campaign was seen as a cornerstone for accelerating moderate US growth and in turn justifying further speculative reach across the markets. Coupled with the lack of tangible progress on any serious legislation for the economy or markets between the Executive and Legislative branches to this point, concern has bled through. The end-of-week announcement that White House Chief Strategist Steve Bannon was out only exacerbated the issue to suggest the administration is in disarray and had little hope of leading through what were already believed to be difficult but important legislation.

If the markets had not rallied since the US election, this would not necessarily be an issue. Complacency has weathered more troubling storms. However, the S&P 500 has climbed as much as 20 percent since the ballot was tallied back in early November. That affords considerable premium behind an infrastructure program and tax reform among other economic efforts. Should risk trends metastasize moving forward, the options are many. Global equities and volatility products are just a few assets well positioned for a tumble. In the FX market, the Yen crosses offer a range of appealing technical patterns - though they are starting to play out now. Rather than USD/JPY, there is greater technical appeal and clearer fundamental standing through EUR/JPY and GBP/JPY. The high yield carry history of AUD/JPY, NZD/JPY and CAD/JPY offer their own appeal.

The Euro may ultimately prove the most sentiment laden of the majors given its own stretched speculation based on a best case monetary policy scenario at least nine months forward. That makes EUR/USD particularly remarkable for its standings with the Dollar weighing its haven status against its proximity to the source of current uncertainties. While political risks may be the most volatile concern as of late, it isn't the only possible catalyst for wide speculation. Monetary policy still holds a systemic influence that has fueled years of complacency and yield reach. How are central banks acting this late in the day? The Economic Symposium hosted by the Fed in Jackson Hole will seek to answer that question. We discuss all of the developing themes and the trade opportunities forming behind them in this weekend Strategy Video.

To receive John’s analysis directly via email, please SIGN UP HERE