Talking Points:

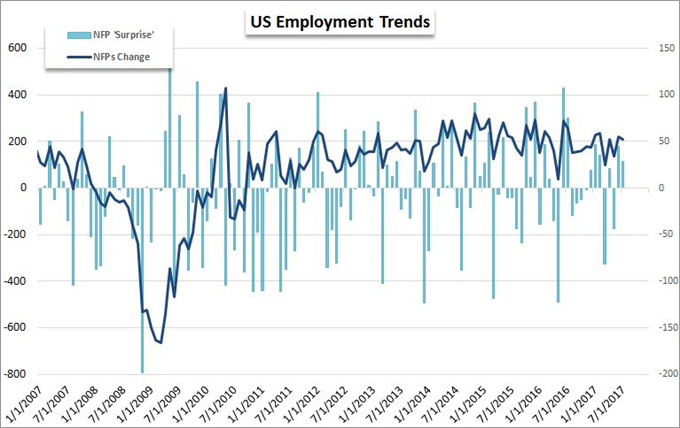

- NFPs beat expectations Friday, but the update hasn't meaningfully altered the Fed's timetable or US growth forecast

- The Dollar's jump Friday produced impressive EUR/USD and GBP/USD technical reversals

- Top event risk next week amid a condensed docket will be the RBNZ rate decision with plenty of Kiwi opportunities

Both the EUR/USD and S&P 500 have stalled and threaten reversal. What has this remarkable progress meant in terms of speculators' trading? See the IG positioning data on the DailyFX Sentiment page.

Just as it seemed that the market was going to call it a week with a settling into tight congestion and VIX retreat below 10, the July NFPs shifted speculators' expectations back towards reversal and trend calls on the Dollar. The Greenback managed one of its biggest rallies of the year to draw a sharp contrast to the months of steady decline suffered through 2017. Given the lack of truly momentous and dramatic market developments as of late, it is understandable that the Dollar's charge has attracted exceptional interest. However, we shouldn't let desire dictate our assessment of probabilities. Though pairs like EUR/USD and GBP/USD have cleared support on notable trend channels, these are very early developments and surrounding conditions are not particularly conducive to high profile reversals or robust trends. We are always trading probabilities; and even though this may the world's most liquid currency, the chances of a permanent change in pace and direction amid such restraint is worryingly low.

Global financial conditions offer the most overbearing restriction on the Dollar. Trends are rare, reversals of multi-month trends even more so. However, there are also fundamental and technical limitations to consider. Fundamentally, the Dollar has lost significant ground through the first half of the year despite the Fed's escalation of monetary policy to the tune of two rate hikes and the announcement of its QE reduction plan. Skepticism about an accelerated pace of normalization and the 'catch up' by other central banks had significantly curtailed the premium perceived in the USD. That said, the employment report to close this past week did little to change the outlook. The NFPs beat was a modest one, the jobless rate slipped further but reflects a very persistent trend and wage growth does little to force the authority's hand due to inflation expectations. Further, other US-based assets showed little of the same enthusiastic response that the Dollar exhibited. I like AUD/USD, NZD/USD and USD/CAD among the majors as they are staging possible reversals but not yet committing. This seems a call better made after the weekend when more motivation could be potentially served up.

Meanwhile, risk trends are increasingly showing the cracks in confidence and coming off as complacency in the face of rising threats. While the blue chip Dow Jones Industrial Average extended its run to record highs to a ninth session; the S&P 500 was virtually unmoved, the tech-heavy Nasdaq was sliding, global equity indexes were in different states, and high risk assets such as the EEM emerging market ETF and HYG high-yield fixed income ETF were in varying states of retreat. This is not a wholesale decline but rather a clear erosion of correlation. When risk-oriented markets are following different courses, it is a strong indication that risk trends are no in charge. That may seem reassuring, but true turns in the market occur when systemic themes like risk trends disappear. In addition to Dollar pairs; I'm watching the Yen and Swiss Franc crosses for opportunities that see technicals and fundamentals cross. Top event risk ahead is the RBNZ rate decision - a capable driver with a heavily skewed New Zealand Dollar after its week's of bullish run. Not as pressing into the weekend, but in addition to risk trends and RBNZ anticipation, traders should also keep a close eye on Bitcoin as its seeks out its next motivator post-fork and the USD/HKD moving far off the path set out by the Chinese Yuan. We discuss market conditions that will usher in the new week of trading along with trade opportunities in this weekend Trading Video.

To receive John’s analysis directly via email, please SIGN UP HERE