Highlights:

- Weak USD selling could continue on PCE disappointment on Friday

- EZ Economic confidence at decade highs as German CPI surprises, EUR/USD at 13-month highs

- JPY surges late in the session as stocks push lower and global yields move higher

- Sentiment Highlight: USD/CAD trend appears undeterred as retail Bears' exit the trade

DXY price broke below the November low on Thursday to show that the Dollar hashadan increasingly hard time finding buyers on the back of Draghi’s comments this week. EUR/USD traded 1.1445 and is within 1X ATR of 1.15. A close near these levels on Friday would be the highest close since the second week of 2015, and likely open the doors to a momentum extension higher in EUR against weak currencies like USD and JPY. On Friday, the US will report core Personal Expenditure Consumption, a favorite Fed inflation predictor and another miss could take the Citi US Economic Surprise Index to its lowest level (showing consistent underperformance relative to expectations) since 2011 and likely take the DXY lower with it. Expectations for the event are for a reading of 1.4%.

Want to know what our top minds are watching over the long-term in markets? Click Here.

In markets, sometimes everything is going right, and other times everything is seemingly going wrong. The former appears to be the case for Europe as Euro area economic confidence is currently at the highest levels in a decade. Such a positive sentiment picture is expected to align with a further sell-off in Bunds and align with higher inflation. In short, a self-fulfilling prophecy of good things developing in Europe could propel EUR/USD higher toward the August 2015 high of 1.1714. Friday will provide traders with optimism in action with Euro-Zone Consumer Price Index Estimate that is expected to come in at 1.2%, 1.0% core.

JoinTylerin his Daily Closing Bell webinars at 3 pm ET to discusstradeable market developments.

Late in the session, JPY moved to session highs while USD remained weak and EUR supported. JPY strength aligned with a rare duality of equity and bond market weakness where stocks fell, and yields moved higher. The 100-DMA on USD/JPY is short-term support at 111.80. While JPY strength is hardly encouraging, the rebound in base metals like Iron Ore and Copper is worth encouraging traders over the medium term. A continued pick-up in base metals may help change the tone of the RBA, which meets on Tuesday and could keep the commodity FX train rolling if they see a reason to prepare for rate hikes like the Bank of Canada has recently communicated.

You may like this analyst pick if you think JPY weakness will prevail.

Closing Bell’s Top Chart: June 29, 2017, Is a significant Bullish break coming for Copper (6-yr trend line)

Chart Created by Tyler Yell, CMT

Tomorrow's Main Event: USD Personal Consumption Expenditure Core (YoY) (MAY) – Exp: 1.4%

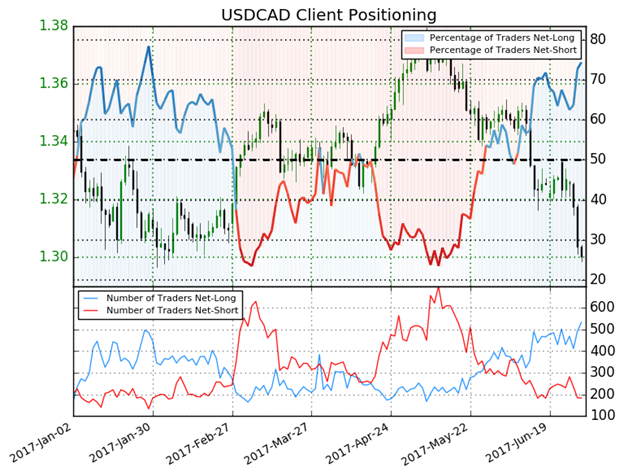

IG Client Sentiment Highlight: Canadian Dollar Forecast favors trend continues per IGCS

The sentiment highlight section is designed to help you see how DailyFX utilizes the insights derived from IG Client Sentiment, and how client positioning can lead to trade ideas. If you have any questions on this indicator, you are welcome to reach out to the author of this article with questions at tyell@dailyfx.com.

USDCAD: Retail trader data shows 74.3% of traders are net-long with the ratio of traders long to short at 2.9 to 1. In fact, traders have remained net-long since Jun 07 when USDCAD traded near 1.34768; the price has moved 3.5% lower since then. The percentage of traders net-long is now its highest since Jan 25 when USDCAD traded near 1.30675. The number of traders net-long is 19.8% higher than yesterday and 9.9% higher from last week, while the number of traders net-short is 8.9% lower than yesterday and 22.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDCAD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDCAD-bearish contrarian trading bias. (Emphasis mine)

---

Written by Tyler Yell, CMT, Currency Analyst & Trading Instructor for DailyFX.com

To receive Tyler's analysis directly via email, please SIGN UP HERE

Contact and discuss markets with Tyler on Twitter: @ForexYell