- Gold price correction rebounds off key support- recovery approaching downtrend resistance

- Check out our 2019 projections in our Free DailyFX Gold Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Gold prices rebounded off a critical support zone yesterday, shifting the near-term focus higher in XAU/USD. That said, the recovery keeps price within the confines of a descending pattern off the highs heading into Friday’s US Non-Farm Payrolls report and the bulls aren’t out of the woods yet. These are the updated targets and invalidation levels that matter on the XAU/USD charts this week.

New to Gold Trading? Get started with this Free How to Trade Gold -Beginners Guide

Gold Price Chart - XAU/USD Daily

Chart Prepared by Michael Boutros, Technical Strategist; Gold on Tradingview

Technical Outlook: In my latest Gold Price Outlook we noted that the, “battle lines are drawn and the immediate focus is on a reaction here at 1522/26 with the gold price recovery at risk while below- watch the close.” XAU/USD plummeted more than 6% off the September highs before rebounding off a critical support confluence yesterday at 1460/61- a region defined by the 100% extension of the decline off the highs and the 61.8% retracement of the August rally and converges on the lower parallel. Note that daily momentum also held 40 on this last drop- So was that it?

Its decision time from here. Looking for resistance ahead of the May trendline IF gold prices are heading lower with bearish invalidation steady at 1522/26. A break below 1451 would ultimately be needed to fuel a deeper correction targeting 1433 – an area of interest for possible downside exhaustion / long-entries IF reached.

Gold Price Chart - XAU/USD 120min

Notes: A closer look at gold price action shows XAU/USD trading within the confines of a near-term descending pitchfork formation extending off the late-September highs. Note that the lower parallel further highlights the 1460/61 support zone defended yesterday with the current advance now breaking through the median-line. A breach here at 1494/96 exposes the 75% parallel / 61.8% retracement at 1506- look for a bigger reaction there IF reached. Initial support rests at 1475.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: IF this pullback was corrective, these lows should hold. That said, taking a neutral stance here near-term from a trading standpoint. Look for exhaustion on a stretch towards confluence resistance at 1506- a reaction there should offer some guidance. Stay nimble here as we head deeper into the monthly / quarterly opening-range with US Non-Farm payrolls still on tap Friday. Review my latest Gold Price Weekly Outlook for a closer look at the longer-term XAU/USD technical trading levels.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

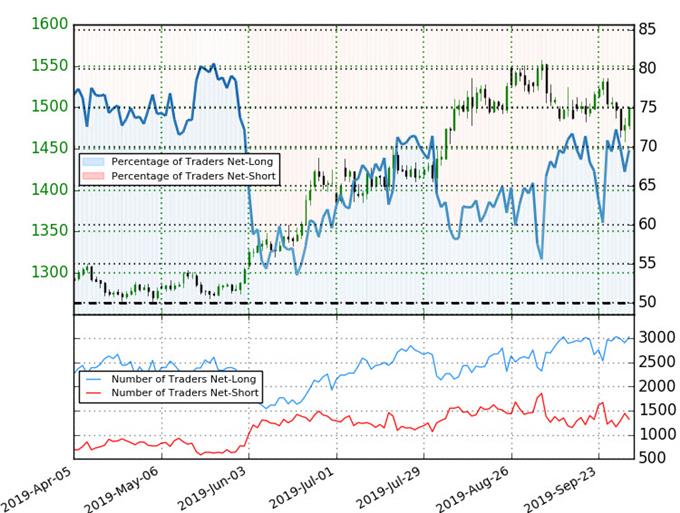

Gold Trader Sentiment - XAU/USD Price Chart

- A summary of IG Client Sentiment shows traders are net-long Gold- the ratio stands at +2.28 (69.6% of traders are long) – bearishreading

- Long positions are2.9% lower than yesterday and 6.7% higher from last week

- Short positions are1.2% lower than yesterday and 21.8% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Spot Gold prices may continue to fall. Traders are less net-long than yesterday but more net-long from last week and the combination of current positioning and recent changes gives us a further mixed Spot Gold trading bias from a sentiment standpoint.

See how shifts in Gold retail positioning are impacting trend- Learn more about sentiment!

---

Active Trade Setups

- Japanese Yen Price Outlook: USD Reversal Risks Deeper USD/JPY Losses

- Euro Price Outlook: EUR/USD Stalls into Monthly Open- Bears Beware

- Canadian Dollar Price Outlook: USD/CAD Creeps Towards Capitulation

- Australian Dollar Price Outlook: Aussie Drops into Downtrend Support

- Swiss Franc Price Outlook: USD/CHF Rally Grinds into Trend Resistance

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex

https://www.dailyfx.com/free_guide-tg.html?ref-author=Boutros