- USD/CHF grinds into uptrend resistance- risk for exhaustion while below 9951

- Check out our 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Swiss Franc has fallen more than 2.7% against the US Dollar from the mid-August / yearly extremes with USD/CHF stretching into key resistance this week. The advance remains vulnerable while below this threshold with the weekly opening-range now in focus. These are the updated targets and invalidation levels that matter on the USD/CHF charts. Review this week's Strategy Webinar for an in-depth breakdown of this Sterling price setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

Swiss Franc Price Chart – USD/CHF Daily

Chart Prepared by Michael Boutros, Technical Strategist; USD/CHF on Tradingview

Technical Outlook: In my most recent Swiss Franc Trade Outlook, we noted that USD/CHF was approaching a major, “resistance zone at 9931/48 – a region defined by the 100% ext of the August advance and the 50% retracement of the yearly range.” Out bottom line cited that we were,“looking for a pivot here with the broader advance at risk while below 9951.” Price registered a high this week at 9946 before turning lower with Swissy poised to mark an outside-day reversal off fresh monthly highs today.

Why does the average trader lose? Avoid these Mistakes in your trading

Swiss Franc Price Chart – USD/CHF 120min

Chart Prepared by Michael Boutros, Technical Strategist; USD/CHF on Tradingview

Notes: A closer look at Swissy price action sees USD/CHF trading within the confines of an ascending pitchfork formation extending off the August lows with the recent advance holding below the 75% parallel for the last two weeks. Note that this slope converges on the 9948/52 region over the next few days and further highlights the technical significance of this threshold.

Weekly open support rests at 9875 backed closely by the highlighted trendline confluence. A break back below the lower parallel / yearly open at 9839 would be needed to suggest a more significant high was registered this week. A topside breach of the weekly opening-range highs / 9952 would mark resumption of the broader uptrend with such a scenario targeting pitchfork resistance (currently ~9990s) and the 61.8% retracement at 1.0016.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: USD/CHF is testing uptrend resistance here with the recent price advance vulnerable while below 9948/52. From a trading standpoint, a good spot to reduce long-exposure / raise protective stops. Look side-ways to lower with a break of the weekly range lows to challenge the lower parallels. Ultimately, a larger decline would offer more favorable long-entries closer to trend support.

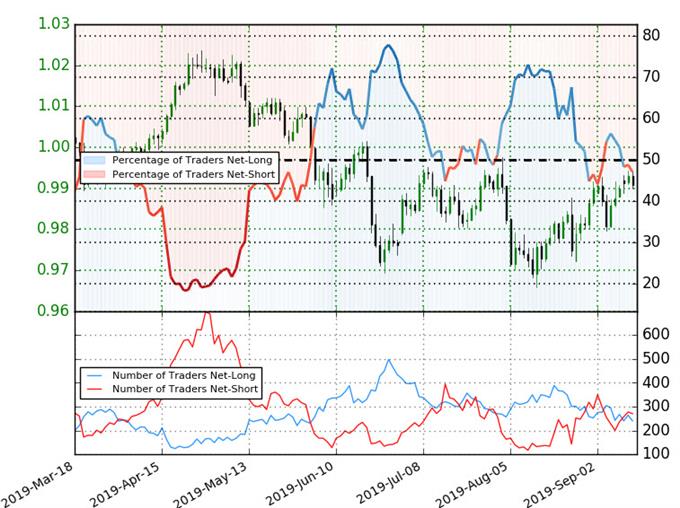

Swiss Franc Trader Sentiment – USD/CHF Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/CHF - the ratio stands at -1.12 (47.1% of traders are long) – weak bullish reading

- Long positions are 1.6% lower than yesterday and 20.5% lower from last week

- Short positions are0.7% lower than yesterday and 12.0% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/CHF prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/CHF-bullish contrarian trading bias from a sentiment standpoint.

See how shifts in Swissy retail positioning are impacting trend- Learn more about sentiment!

---

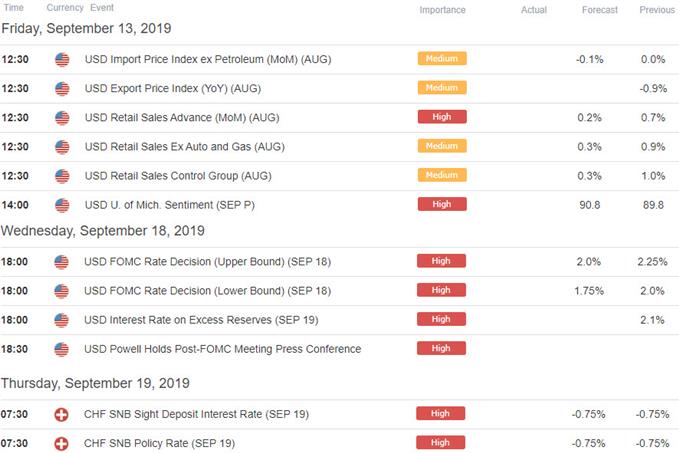

Key US / Swiss Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Trade Setups

- Gold Price Targets: XAU/USD Recovery Remains Vulnerable- GLD Levels

- Near-term Trade Setups in USD/CAD, GBP/USD & USD/CHF

- Sterling Price Outlook: British Pound Rally Stalls– GBP/USD Levels

- Canadian Dollar Price Chart: USD/CAD Breakdown Plummets into Support

- Gold Price Targets: XAU/USD Searches for Direction at Six-Year Highs

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex