- Updated levels on trade setup we’ve been tracking in Loonie (USD/CAD), Sterling (GBP/USD), and Swissy (USD/CHF)

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30 GMT (8:30am ET)

- Check out our 2018 projections in our Free DailyFX US Dollar Trading Forecast s

Review this week’s Strategy Webinar for an in-depth breakdown of these setups and more.

Loonie Price Chart - USD/CAD 120min

Chart Prepared by Michael Boutros, Technical Strategist; USD/CAD on Tradingview

In my most recent Canadian Dollar Price Outlook, we noted that USD/CAD was, “testing the first major support hurdle on the back of last week’s reversal and we’re looking for a reaction here.” The level in focus was the 1.3145/55 confluence zone where the 61.8% retracement of the July rally converges on the July opening-rang high. Price registered a low at 1.3134 before rebounding with the advance breaching the weekly opening-range high today.

The immediate risk remains higher for now after rebounding off downtrend support with initial resistance objectives at 1.3228 & 1.3246 – both levels of interest for possible topside exhaustion IF reached. Any higher and you’re risking a run on the upper parallels with broader bearish invalidation at 1.3288. Bottom line, higher then lower again is the game-plan while within this formation. A break of the weekly lows would mark resumption targeting the 78.6% retracement at 1.3094. Review my latest Canadian Dollar Weekly Price Outlook for a longer-term look at the technical picture for USD/CAD.

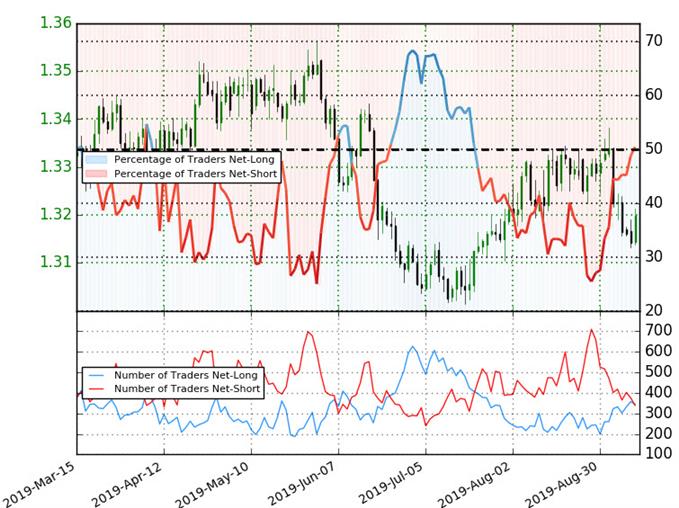

USD/CAD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long USD/CAD - the ratio stands at +1.02 (50.4% of traders are long) – neutral reading

- The percentage of traders net-long is now its highest since July 16th

- Long positions are5.2% lower than yesterday and 25.0% higher from last week

- Short positions are 21.3% lower than yesterday and 37.9% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall. Traders are further net-long than yesterday & last week, and the combination of current positioning and recent changes gives us a USD/CAD-bearish contrarian trading bias from a sentiment standpoint.

See how shifts in USD/CAD retail positioning are impacting trend- Learn more about sentiment!

Sterling Recovery Stalling

Highlighted this setup including the near-term trading levels in today’s GBP/USD Price Outlook. Sterling tested uptrend resistance early in the week and while our broader focus is higher, we’re looking for near-term weakness to offer more favorable entries while above the monthly open. For a longer-term look at the Sterling technical trading levels review my latest GBP/USD Weekly Outlook.

New to Forex? Get started with our Beginners Trading Guide !

USD/CHF 240min Price Chart

Chart Prepared by Michael Boutros, Technical Strategist; USD/CHF on Tradingview

USD/CHF is testing a big resistance zone at 9931/48 – a region defined by the 100% ext of the August advance and the 50% retracement of the yearly range. We’re looking for a reaction up here. Failure at this zone would put the focus back on the lower parallels of the ascending pitchfork formation we’ve been tracking for weeks now. Weekly open support at 9875 backed by broader bullish invalidation the 2019 yearly open at 9839.

A topside breach above this region would likely see an accelerated advance with such a scenario targeting the upper parallel (currently ~9990s) backed by the 61.8% retracement at 1.0016. Bottom line, looking for a pivot here with the broader advance at risk while below 9951.

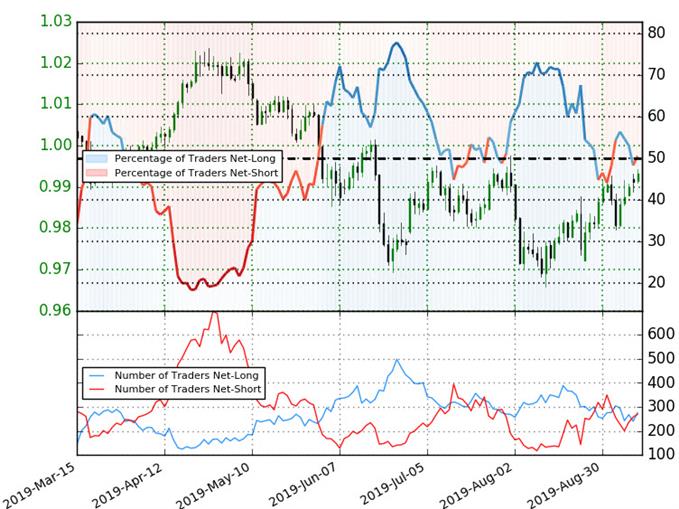

Swiss Franc Trader Sentiment – USD/CHF

- A summary of IG Client Sentiment shows traders are net-long USD/CHF - the ratio stands at +1.02 (50.5% of traders are long) – neutral reading

- Long positions are 13.1% higher than yesterday and 1.8% lower from last week

- Short positions are unchanged from yesterday and 20.8% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CHF prices may continue to fall. Traders are further net-long than yesterday & last week, and the combination of current positioning and recent changes gives us a stronger USDCHF-bearish contrarian trading bias from a sentiment standpoint.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

-Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex