- Technical trade setups we’re tracking across the USD Majors / Commodities this week

- Check out our New 2019 projections in our Free DailyFX USD Trading Forecasts

- Live Weekly Trading Webinars on Mondays on DailyFX at 8:30ET

New to Forex Trading? Get started with this Free Beginners Guide

US Dollar Reversal Under Review – Gold Holds Critical Resistance

The US Dollar plummeted more than 1.3% off fresh yearly highs last week with numerous USD Majors testing critical long-term technical inflection zones. In this webinar we review updated technical setups on DXY, EUR/USD, GBP/USD, AUD/USD, USD/JPY, USD/CAD, Gold (XAU/USD), SPX (S&P 500), Silver (XAG/USD) and EUR/AUD.

Why does the average trader lose? Avoid these Mistakes in your trading

Key Trade Levels in Focus

US Dollar – DXY turned from multi-year uptrend resistance last week and leaves the index vulnerable heading deeper into September trade. Initial support at the 98-handle backed by 97.71- weakness beyond this threshold would suggest a more significant reversal is underway. Monthly open resistance at 98.83 with bearish invalidation at 98.94.

EUR/USD – Euro rebounded off confluence slope support last week – Resistance at 1.1107 with a breach / close above needed to suggest a more significant low was registered last week. Monthly open support / near-term bullish invalidation rests at 1.0987/90.

GBP/USD – Sterling is probing a critical resistance zone at 1.2374-1.2433- we’re looking for a reaction here. A topside breach / close above the 1.25-handlewould be needed to shift the broader focus higher in the British Pound. Monthly open support at 1.2147/51 with break below the low-day close at 1.2084 needed to mark resumption of the broader downtrend.

AUD/USD – The immediate focus is on a reaction at the 6827/55 pivot zone – a close above this sets the stage for a larger recovery in Aussie targeting 6910. Look for support ahead of the low-day close at 6756 If price is indeed heading higher.

Gold – Price has failed to breach the 1522/26 critical resistance zone for the past month with XAU/USD marking an outside-day reversal off the highs last week. Look for a reaction at key near-term support at 1494/97 - a break below this threshold is needed to suggest a larger correction is underway.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

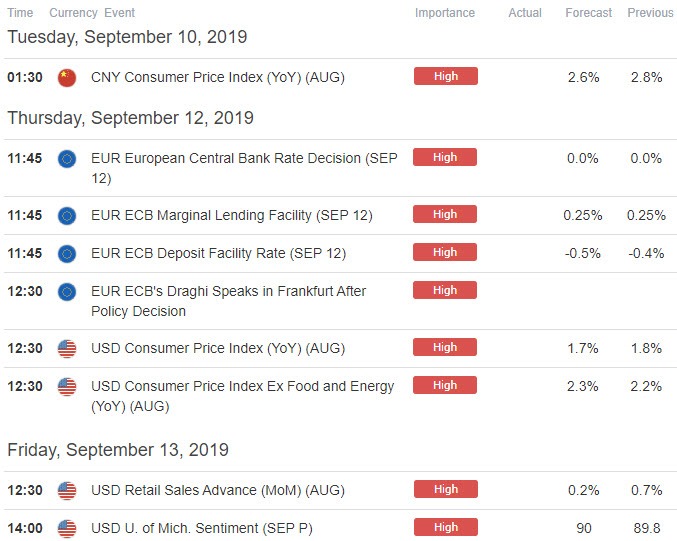

Key Event Risk This Week

Economic Calendar - latest economic development and upcoming event risk

Learn how to Trade with Confidence in our Free Trading Guide

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex