Canadian Dollar Outlook:

- CAD/JPY rates have cleared multi-year resistance, while USD/CAD rates are nearing support in a multi-week descending triangle – a bearish breakout pattern.

- Gains in commodities has been driving gains by the trio of commodity currencies, even if central banks like the Bank of Canada and Reserve Bank of Australia have complained about FX markets.

- According to the IG Client Sentiment Index,

Canadian Dollar Bulls Back on Track

For many weeks, Canada trailed many of its G10 counterparts in terms of vaccination rates. But improvements in distribution in recent weeks has seen the Canadian distribution program pick up its pace, and its now possible that market participants are no longer considering this an impediment, or at least a relative burden (compared to vaccination rates in the UK or US, for example). When we first examined how vaccines were weighing down the Loonie, Canada’s vaccination rate was 2.6 per 100 people; now it stands at 3.6 per 100 people. Not great, and still not the pace seen in the UK or US, but it’s an improvement.

Alongside the vaccination pace starting to improve, a key pillar of the Canadian economy has been bolstered: energy markets have seen prices surge higher in recent days (in part, thanks to the Texas energy disaster). Energy accounts for approximately 11% of Canadian GDP, so there has been the typical cross-asset flow of funds into the Canadian Dollar as a proxy for rising oil prices.

As the polar vortex contracts, upside momentum in energy markets may be curtailed, meaning that the Loonie may have a bit of a fight on its hands as it attempts bullish breakout attempts vis-à-vis CAD/JPY and USD/CAD rates.

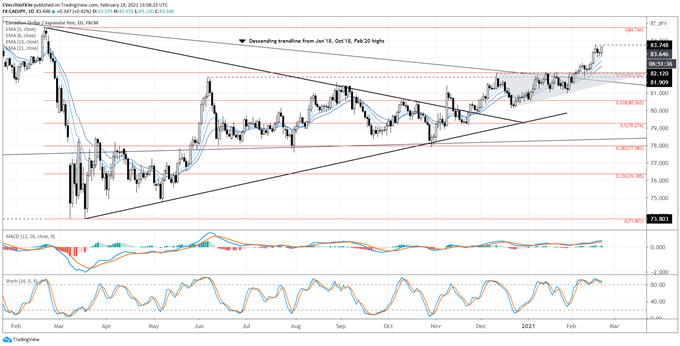

CAD/JPY Rate Technical Analysis: Daily Chart (February 2020 to February 2021) (Chart 1)

For weeks it was noted that “CAD/JPY rates have tested parallel channel resistance in the 81.58/91 area, but have struggled to make headway, a common occurrence since June 2020. But the more times resistance (or support) is tested, the more likely it is to break as supply on the other side of the trade is exhausted. As trading is a function of both price and time, by simply maintaining their elevation, CAD/JPY rates are now above the descending trendline from the January 2018, October 2018, and February 2020 highs, and holding right at the 76.4% Fibonacci retracement of the 2020 high/low range at 82.16…While more patience may still be required, CAD/JPY bulls may be on high alert for a bullish breakout attempt.”

This patience has paid off, with CAD/JPY rates breaking above the 81.58/91 area, currently trading at 83.65 at the time this report was written. CAD/JPY rates are above their daily 5-, 8-, 13-, and 21-EMA envelope, which is in bullish sequential order. Daily MACD is rising while above its signal line, while daily Slow Stochastics are holding overbought territory. A break of the yearly high at 83.75 would signal bullish continuation.

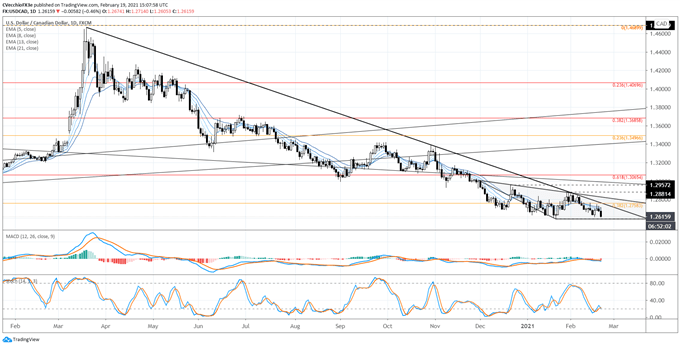

USD/CAD Rate Technical Analysis: Daily Chart (February 2020 to February 2021) (Chart 2)

In the most recent Canadian Dollar forecast update, it was noted that “USD/CAD rates have run into downtrend from the March and October 2020 highs, which has served as resistance on four such attempts over the past two weeks.” The pair was never able to break this downtrend, and instead, a reconstituted chart suggests that a descending triangle has been forming dating back to early-December 2020, with support defined by the 2021 yearly low at 1.2589.

USD/CAD rates are seeing bearish momentum gather pace. USD/CAD rates are below their daily 5-, 8-, 13-, and 21-EMA envelope, which is now in bearish sequential order. Daily MACD is declining and is now below its signal line, while daily Slow Stochastics are falling back into oversold territory. A test of the yearly low appears highly likely.

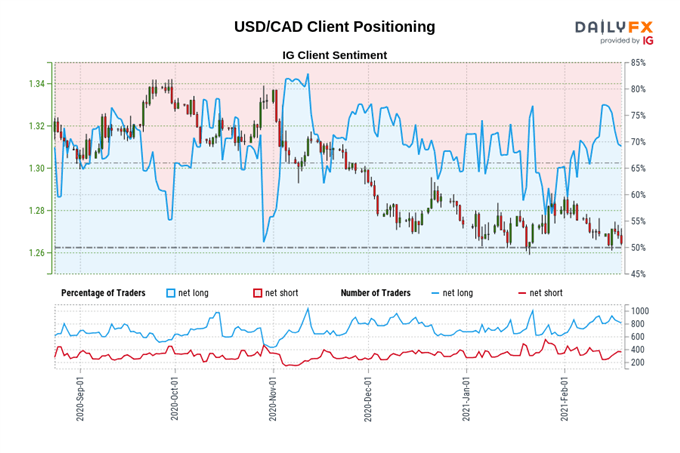

IG Client Sentiment Index: USD/CAD Rate Forecast (February 19, 2021) (Chart 3)

USD/CAD: Retail trader data shows 68.48% of traders are net-long with the ratio of traders long to short at 2.17 to 1. The number of traders net-long is 5.74% lower than yesterday and 11.55% lower from last week, while the number of traders net-short is 21.44% lower than yesterday and 8.50% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed USD/CAD trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist