Canadian Dollar Forecast Overview:

- The Canadian Dollar rally may be slowing, but a deceleration in gains doesn’t mean the bullish trajectory has been altered. A short-term bout of CAD weakness can be digested in the CAD/JPY and USD/CAD rate charts.

- The Bank of Canada’s final policy meeting of 2020 will likely see the status quo maintained, which has been beneficial for the Canadian Dollar, all things considered.

- According to the IG Client Sentiment Index, USD/CAD rates have a bullish trading bias.

Canadian Dollar Sustains Breakout Attempts

The Canadian Dollar has seen gains accumulate in recent weeks, in particular versus the slew of lower yielding safe haven currencies amid a tide of rising risk appetite. Spurred by much better than expected Canadian economic data, including the recent November Canadian jobs report which tripled job growth expectations, USD/CAD rates have broken down to fresh multi-year lows while CAD/JPY rates have jumped to test critical resistance – the final hurdles on the way to a bullish breakout of their own.

The December Bank of Canada rate decision concluding on Wednesday, December 9 may not prove to be an impediment to further Canadian Dollar strength. The BOC has been maintaining its emergency low interest rate regime since the start of the coronavirus pandemic, and amid building economic momentum, it appears unlikely that policymakers will be acting again anytime soon. In turn, the BOC doesn’t necessarily have the ability to stand in the way of further Canadian Dollar strength.

Read more: FX Week Ahead: December BOC Rate Decision and USD/CAD Rate Forecast

BOC Staying on Hold for Some Time

In recent weeks, BOC Governor Tiff Macklem has been quite forceful in his commentary to reassure financial markets, noting that “if you are a household considering making a major purchase, if you’re a business considering investing, you can be confident that interest rates will be low for a long time.” In other words, the BOC appear poised to keep its low interest rate regime in place for the foreseeable future.

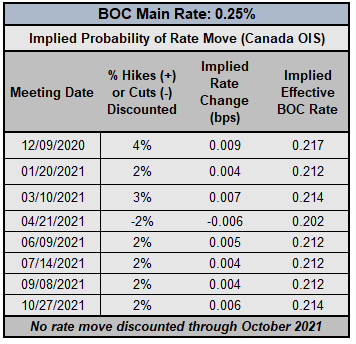

Bank of Canada Interest Rate Expectations (DECEMBER 8, 2020) (Table 1)

As such, interest rate expectations are non-existent around the clear forward guidance offered by BOC Governor Macklem. Just two months, in mid-October, there was a 17% chance of a 25-bps rate cut by December 2020. Now, there is a 4% chance for December 2020. No month carries an expectation in excess of 5% through October 2021.

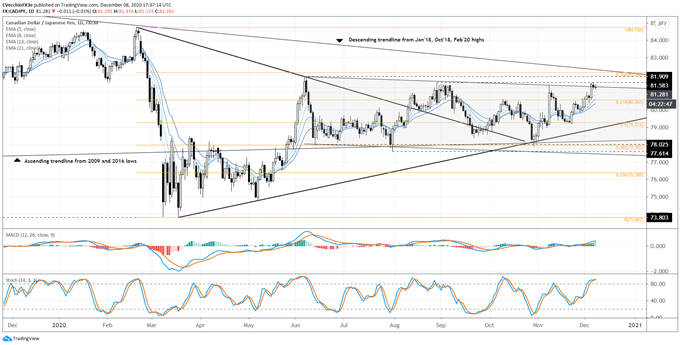

CAD/JPY Rate Technical Analysis: Daily Chart (December 2019 to December 2020) (Chart 1)

The prior interpretation that “CAD/JPY rates have formed into a new symmetrical triangle, dating back to mid-May; this new perspective trumps the prior symmetrical triangle in place from the February high” may not have been valid in hindsight, with the consolidation taking the form of a sideways channel rather than a “new symmetrical triangle.” This new interpretation suggests that CAD/JPY rates are nearing the top of the range (incidentally resistance in the triangle from the prior interpretation).

Poking through the downtrend from the June, August, and November highs is important, but what will be more important for CAD/JPY rates is if the pair is able to close through some of these recent swing highs; breaking the series of lower lows will be a signal that the consolidative downtrend, however slight, has given way to a new regime of bullish trading. Clearing 81.58 and 81.91 would be strong indications that CAD/JPY rates were embarking on an earnest bullish breakout attempt.

CAD/JPY rates retain bullish momentum, even as they have stalled near the November swing high at 81.58. Daily Slow Stochastics are trending higher while in overbought territory, while daily MACD continues to trend higher above its signal line; in tandem, these are signs of a bullish market trending strongly. Furthermore, with CAD/JPY rates above their daily 5-, 8-, 13-, and 21-EMA envelope, which is in bullish sequential order, the path of least resistance appears to be higher.

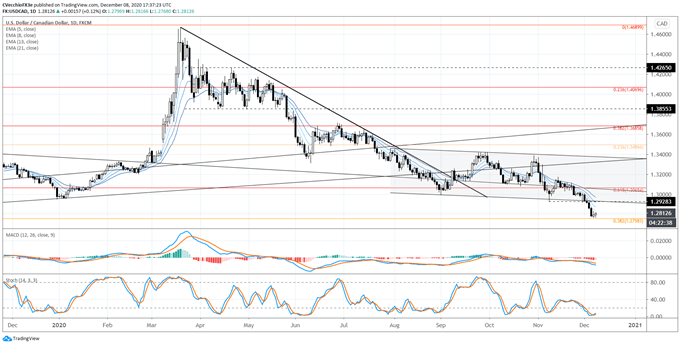

USD/CAD Rate Technical Analysis: Daily Chart (December 2019 to December 2020) (Chart 2)

It’s been less than 24-hours since we last updated the USD/CAD rate chart, and as a trader whose personality alters between swing trading and position trading, my perspective has not changed materially. Presented unaltered:

“In our last update it was noted that, ‘Now that the fresh yearly lows have emerged, USD/CAD rates may be biased to continue lower towards a longer-term Fibonacci retracement: the 38.2% retracement from the 2012 low to 2016 high at 1.2758.’Since the prior update, USD/CAD rates fell as low as 1.2770 before rallying at the start of this week.

“USD/CAD rates continue to trade below their daily 5, 8-, 13-, and 21-EMA envelope, which is in bearish sequential order. Daily MACD is trending below its signal line (and gaining pace), while Slow Stochastics are holding firmly in oversold territory. The path of least resistance is lower for USD/CAD rates, at least until the daily EMA envelope is broken (USD/CAD rates close above the daily 21-EMA). A near-term bounce higher won’t negate the significant technical damage done in recent weeks.”

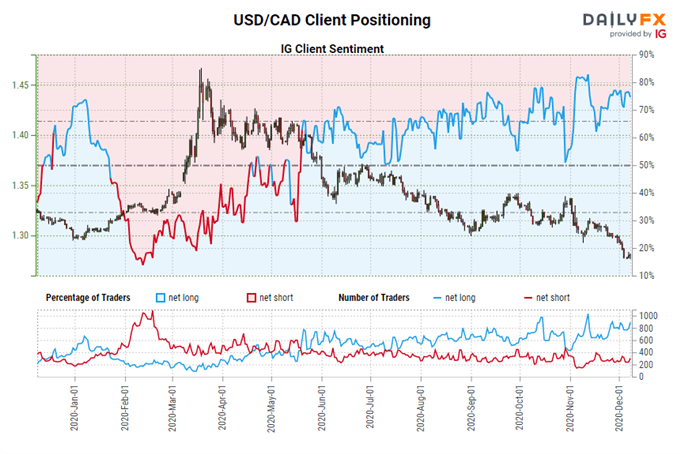

IG Client Sentiment Index: USD/CAD Rate Forecast (December 8, 2020) (Chart 3)

USD/CAD: Retail trader data shows 73.88% of traders are net-long with the ratio of traders long to short at 2.83 to 1. The number of traders net-long is 8.28% higher than yesterday and 7.17% higher from last week, while the number of traders net-short is 8.47% higher than yesterday and 20.65% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USD/CAD prices may continue to fall.

Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current USD/CAD price trend may soon reverse higher despite the fact traders remain net-long.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist