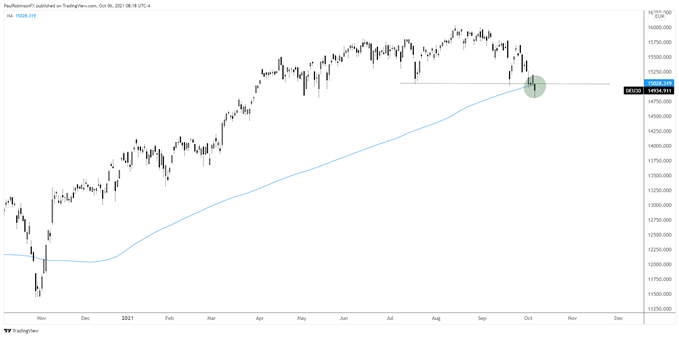

DAX/CAC Technical Highlights:

- DAX trading around the 200-day, expect volatility

- CAC holding up better, yet to break support from two weeks ago

DAX and CAC Technical Outlook: German Benchmark at 200-day

The DAX is trading around the important 200-day moving average, a threshold that is widely watched by the market and as a result can induce a fair amount of volatility. Today we are seeing the index losing the threshold, but we will need to see how the rest of the day and days ahead unfold.

We may see a reversal that has price close back above it by the close of today, perhaps indicating that the slide is coming to an end, at least temporarily. It’s possible we lose the level but then turn right back around and rally above it within days or less. Things can get a little unpredictable around the 200-day.

A persistent amount of trading below the 200 and confluent price support from July and September would indicate that the DAX wants to continue lower. More broadly speaking, we could be amidst a larger topping sequence as the churn since April proves to be a distribution top.

It is too soon to confidently say we have seen a long-term top in stocks, but if again price action remains weak below support we could at least be in for more of a bumpy ride this month.

DAX Daily Chart

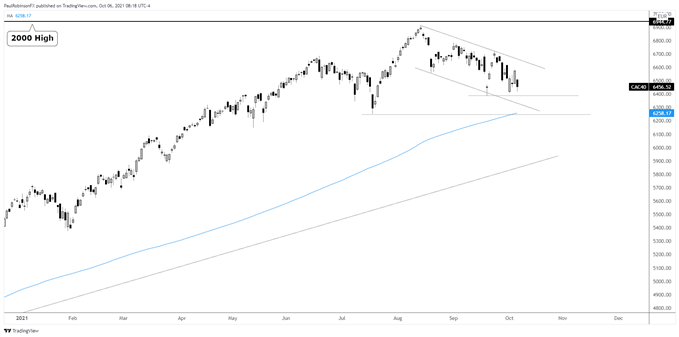

The CAC is off by a bit today and generally weak, but certainly not to the degree that its German counterpart is. The CAC has yet to break below the September low, and is still sitting a couple hundred points off its 200-day.

Should we see European stocks solidify, the CAC may outperform on the top-side as it demonstrates relative strength. Even though it would be premature to act on, one can make the case that the CAC is forming a bull-flag ever since topping in August. More on that later if it becomes relevant.

For now, watching how the larger DAX plays out and if support around 6389 can hold up. If neither can hold here, then the CAC may make a run towards the 200-day at 6258 and confluent price support at 6253.

CAC Daily Chart

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX