DAX/CAC Technical Highlights:

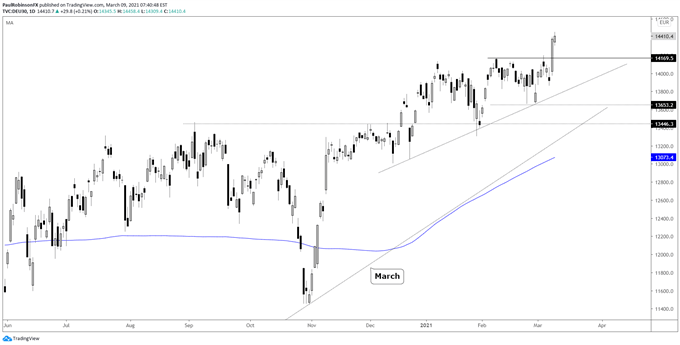

As we were discussing last week, European stocks were demonstrating relative strength compared to the U.S. markets, especially versus the tech-heavy Nasdaq. The DAX was consolidating with a break below 13653 needed to turn the outlook from neutral to bearish.

With yesterday’s powerful breakout the DAX is looking to stay in record territory. As long as U.S. stocks don’t completely fall apart, Europe can continue to head higher. A rapid deterioration in the S&P 500 and broad risk sentiment, though, will almost certainly put a hold on the advance, if not worse.

A pullback to the top of the recent congestion phase may present would-be longs with a decent risk/reward opportunity to enter in the direction of the prevailing trend. The support zone to watch is 14200/150.

As far as how high the DAX can run, it’s hard to say. If general risk appetite improves then the rally could grow serious legs. If we see a somewhat subdued appetite by market participants to take risk, then look for the rally to potentially be a grind.

It will take some strong downward price action to turn the outlook from neutral/bullish to outright bearish.

DAX Daily Chart (looking to sustain record high breakout)

The CAC 40 is in the February 2020 gap, and on that it is seen as likely to fill it up to 6031. Should that fill, it won’t take much to etch out the best levels since 2007. The 2020 high is at 6111 followed by the 2007 high at 6168.

To turn the outlook bearish a breakdown below the late October trend-line is needed. The importance of this trend-line just grew a little bit more last week when it was touched and held as support for the second time in the past two weeks.

CAC Daily Chart (in corona-gap)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX