DAX/CAC Technical Highlights:

- DAX poised to make a run at new record highs soon

- CAC eying a gap-fill from the massive Feb 2020 decline

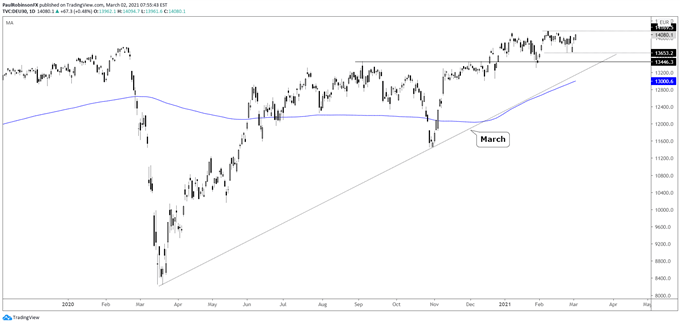

Last week, the DAX was coming off a bit as risk trends weakened, but as it was said at the time the selling didn’t appear too meaningful. But with further selling in U.S. markets that would have likely changed, however; the firming up in the states puts that notion at bay and has general conditions firmed up.

And when looking to Europe, stocks are a bit more than buoyed with the DAX looking towards a new record high on a crossing of 14169, and the CAC is currently trading at its best levels since last year’s meltdown. The DAX might not power higher in a meaningful way, but the trading outlook is bullish.

To turn the picture negative, a breakdown from the recent consolidation will be needed. This will require a drop below 13664 on a daily closing basis. Should this happen then it is likely risk trends as a whole are souring again.

DAX Daily Chart (near a breakout to a new record)

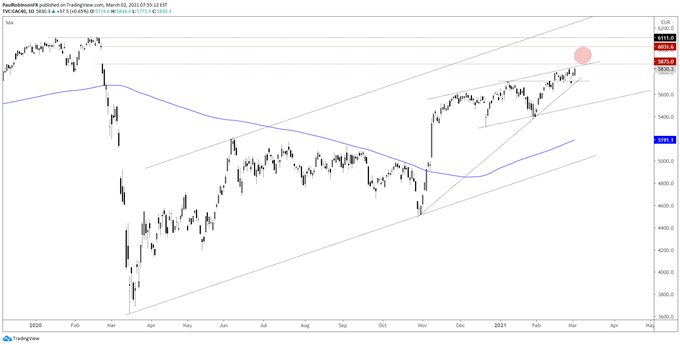

The CAC is trading at its best levels since the meltdown days of a year ago. This has the big Feb 24 gap-down in focus from 5875 up to its fill point at 6029. Should that fill a breakout could soon develop to the best levels since 2007. The level to cross is 6111 before testing the 14-year high at 6168.

As is the case with the DAX, to turn the picture bearish a break lower that undermines the recent consolidation period will be needed. To achieve this we will need to see a decline below 5688.

CAC Daily Chart (looking to fill corona-gap)

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX