DAX 30 / CAC 40 Technical Highlights

- DAX 30 nearing the point where a move looks imminent

- CAC 40 nestling up into the apex of a wedge pattern

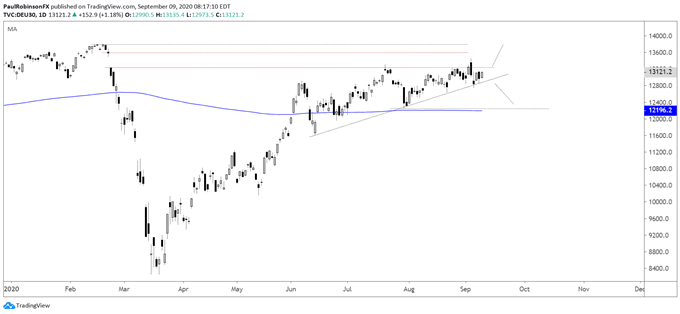

DAX 30 nearing the point where a move looks imminent

The sideways path in the DAX looks close to ending. The convergence in price over the summer months is setting up for a breakout scenario. Last week, the index attempted to fill the corona-gap, but the attempt was very short-lived as the gap-up into the gap was swatted back lower shortly after the open of trade of that day.

This brought an underside trend-line from June into play, a line that has several inflection points that make it a solid line of support. A break below it would likely lead to a sell-off towards the 200-day and July low at 12253.

But in recent sessions when the U.S. markets have worked off some their froth, Europe has held it together. This did not seem a likely scenario before as relative weakness in the DAX and CAC appeared to be sending a signal that they wanted to trade lower once the leading stock market took a break from rallying.

If the DAX can continue to show short-term relative strength in the face of further U.S. weakness, then this could set up for a sustained breakout into the corona-gap towards new record highs. In either event, up or down, time is running out for the DAX to continue to trade sideways.

DAX Daily Chart (breakout nearing)

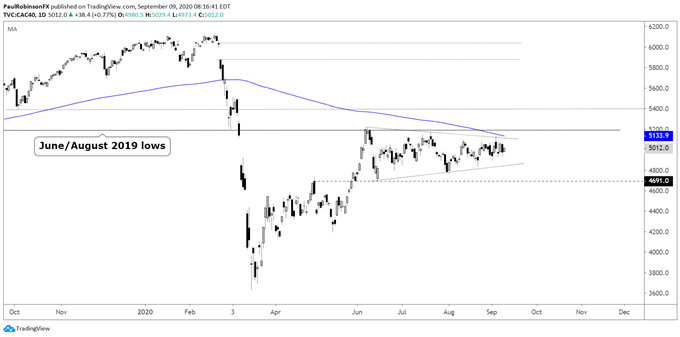

CAC 40 nestling up into the apex of a wedge pattern

The CAC continues to work on building a wedge formation that suggests, like the DAX, that it will move soon. It has been the laggard of the two major European indices, so a downside break may come first in the French benchmark if indeed markets are to sell off.

There is a good amount of resistance to overcome if the wedge is to be broken cleanly to the upside. The June/August 2019 lows that have kept price in check (most recently in June) are in near confluence with the falling 200-day MA at 5133. A climb into the 5200s is needed to provide some breathing room.

On the downside, a break of the underside trend-line of the wedge along with a drop below 4691 should have the CAC rolling downhill. For now, it is a game of wait-and-see, but that time may soon be over…

CAC 40 Daily Chart (near apex of wedge)

Forex Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX