DAX 30/CAC 40 Technical Highlights

- DAX broke out of bull-flag, looking for new swing-high

- CAC out of consolidation, challenging 2018 high

For fundamental and technical forecasts, trade ideas, and educational guides, check out the DailyFX Trading Guides page.

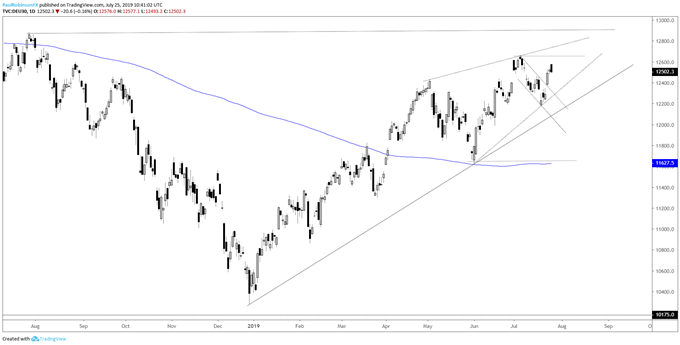

DAX broke out of bull-flag, looking for new swing-high

The pullback in the DAX for much of the month taking the shape of a bull-flag was snapped on Tuesday, leaving it in position to challenge and break the July 4 high at 12656. If indeed this is the case, there could be minor resistance at a top-side t-line connecting the May and July highs.

The next level of price resistance beyond the July high is a peak from July of last year, arriving at 12886. Turning to near-term support, the trend-line off the June low will be watched, followed by the trend-line rising up from the December low.

Often the best position is no position. Tactically speaking, risk/reward on new longs isn’t particularly appealing, but that is also the case for shorts. Existing longs from lower prices may want to consider giving the market a chance to trade to new heights.

DAX 30 Daily Chart (looking for new swing-high)

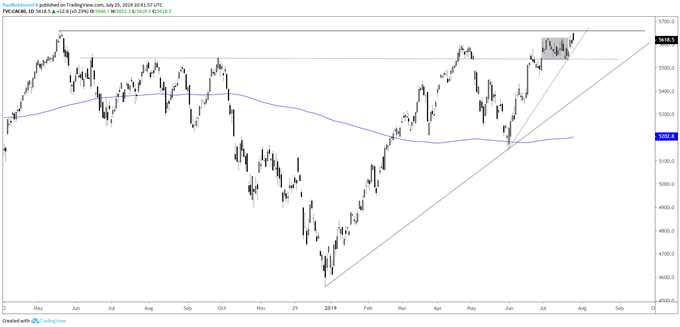

CAC out of consolidation, challenging 2018 high

The CAC posted a solid consolidation pattern from July 4 until it gapped higher today. The caveat to the breakout from congestion is the fact that the French index is now trading at the 2018 high. This makes risk/reward tricky for new longs, as risk of a reversal has increased despite the breakout.

However, a break through the 2018 high, in-line with overall summer trend will continue to keep things rolling for bullish traders. Shorts aren’t all that appealing even with resistance at hand.

CAC 40 Daily Chart (holding up, but has lots or resistance ahead)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX