DAX 30 Technical Highlights

- DAX running into confluent resistance lines

- CAC nearing multiple turning points from last year

Fresh quarterly forecasts are out, to see where our team of analysts see the Euro, DAX, and other markets are headed in the coming weeks, check out the DailyFX Q2 Trading Forecasts.

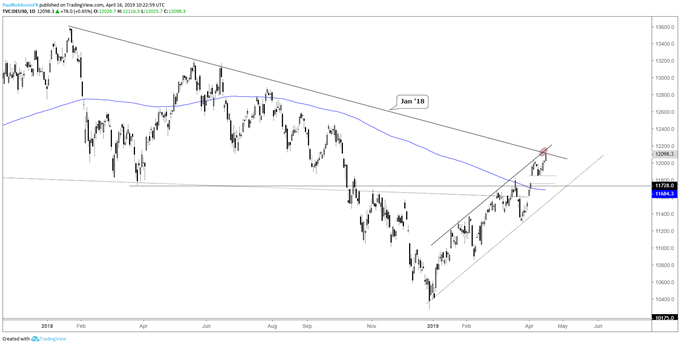

DAX running into confluent resistance lines

Last week, the DAX was able to hang onto the gap from April 3, and with that we are seeing a push higher into an area of resistance that comes via a pair of t-lines. The trend-line running down off the record notched in January 2018 is the most important of the two, but also the top-side parallel from the beginning of this year is running in line with the trend-line.

This potentially makes the current 100 or so point zone (~12100/200) an important one to watch. The trend off the low in December has been persistent, and other major global indices (namely the U.S.) have shown no signs of turning just yet, so it’s possible the DAX trades on through.

From a tactical standpoint, existing longs may want to give the market a chance to break above the trend-lines, and if it doesn’t and price action shows a rejection at resistance, then looking to turn defensive may be the prudent play. On the flip-side, ‘would-be’ shorts will likely be best served waiting for obvious signs of selling to show up first before getting too aggressive.

All-in-all, the trend and tone generally remain positive for the DAX, so despite resistance it may not pull off in a meaningful manner. That outlook could change, though, should we see a violent turnabout here soon.

DAX Daily Chart (confluent lines of resistance)

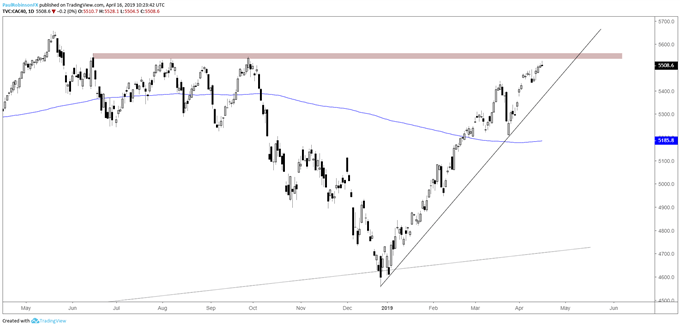

CAC nearing multiple turning points from last year

The CAC is coming up on several swing highs created from June to September in the 5539/60-area. This could certainly be enough to at least dent the latest advance higher and push price back down to the trend-line off the December low. Watch how price action plays out here, along with how the DAX responds to its own set of obstacles.

CAC Daily Chart (Jun-Sep swing highs)

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX