DAX 30/CAC 40 Technical Highlights

To see our intermediate fundamental and technical outlook for the DAX & Euro, check out the DailyFX Q1 Forecasts.

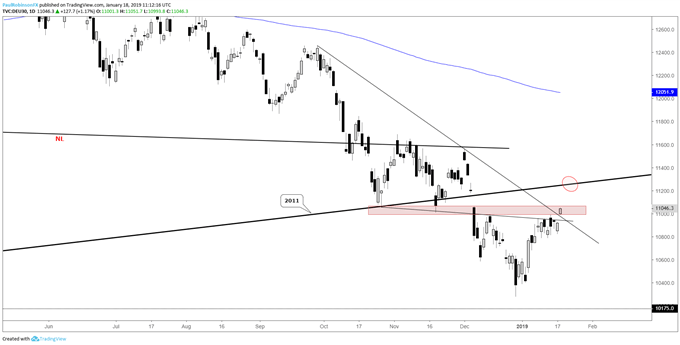

DAX trying to push towards 2011 trend-line

The other day I noted that if the DAX broke support at 10786 bearish momentum could kick in and send the German index lower. Instead, the market furthered its consolidation along and is trying to rally beyond the October/November lows, September trend-line.

If it can, then look for a retest of the broken 2011 trend-line. This would be an important test if it can climb to that point. Given the general trend and push of the December low it seems likely the long-term trend-line would put a cap on the advance.

A push lower will still require 10786 to break at this time to undermine the consolidation it is currently pressing out of. A break below would be both a failed breakout and a confirmed breakdown. It’s currently the lower probability scenario, though.

For market sentiment and to learn more about how to use it in your analysis, check out the IG Client Sentiment page.

DAX Daily Chart (Test of 2011 trend-line coming?)

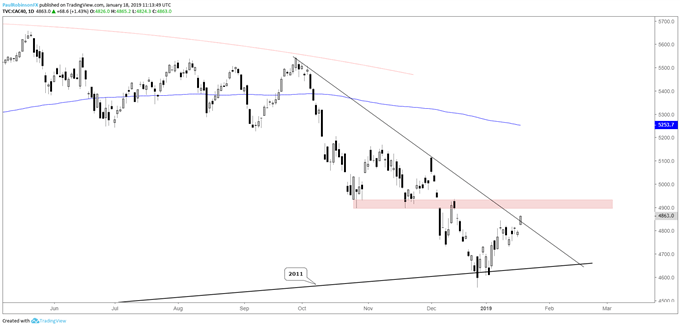

CAC against trend-line, may head towards price resistance

Like the DAX, the CAC is up against the 2011 trend-line but looking like it wants to break it. If it does, then the next area of resistance to focus on consists of two swing lows and a swing high from late last year. The area to focus on is 4895/935. A sharp turn lower from here will be needed to turn the picture bearish.

CAC Daily Chart (Eyeing price resistance)

Want to learn more about trading the DAX? Check out ‘How to Trade the DAX’, and join me weekly for technical updates in the Indices and Commodities webinar.

Forex & CFD Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX