GBP/USD PRICE OUTLOOK: POUND STERLING, US DOLLAR LOOK TO BOE & FOMC INTEREST RATE DECISIONS DUE FOR RELEASE

- Spot GBP/USD is anticipated to be the most active major currency pair over the next 24-hours judging by an overnight implied volatility reading of 13.09% ahead of the BOE and FOMC

- The Pound Sterling faces major event risk stemming from the highly-anticipated Bank of England interest rate decision due January 30 at 12:00 GMT

- US Dollar outlook hinges on an expected monetary policy update from the Federal Reserve slated for release January 29 at 19:00 GMT

Traders searching for currency volatility should look no further than spot GBP/USD considering the Bank of England and Federal Reserve are expected to release their latest monetary policy updates on January 30 at 12:00 GMT and January 29 at 19:00 GMT respectively.

GBP/USD PRICE CHART: DAILY TIME FRAME (SEPTEMBER 2019 TO JANUARY 2020)

Above-average volatility in GBP/USD is to be expected, however, in light of uncertainty surrounding the January 2020 BOE meeting and FOMC decision on tap for release. This is due to the material impact that changes in central bank monetary policy can have on their respective currencies and the broader forex market.

GBP/USD implied volatility for the overnight tenor was just clocked at 13.09% and is the highest reading since the December 12 UK General Election. The elevated implied volatility figure derived from forex options contracts ranks in the top 90th percentile of measurements taken over the last 12-months and compares to a 20-day average reading of 7.6%.

That said, spot GBP/USD price action is estimated to fluctuate within a 178-pip trading range between 1.2915-1.3093 over the next 24-hours with a 68% statistical probability.

Judging by GBP/USD 1-week implied volatility of 7.45%, which is roughly in-line with its 20-day average reading of 7.29%, spot prices are expected to gyrate within a 1-standard deviation trading range between 1.2869-1.3139 over this specified time frame.

Looking further out, spot GBP/USD prices are anticipated to remain contained between 1.2603-1.3405 with a 68% statistical probability judging by the Pound-Dollar’s 3-month implied volatility reading of 6.21%.

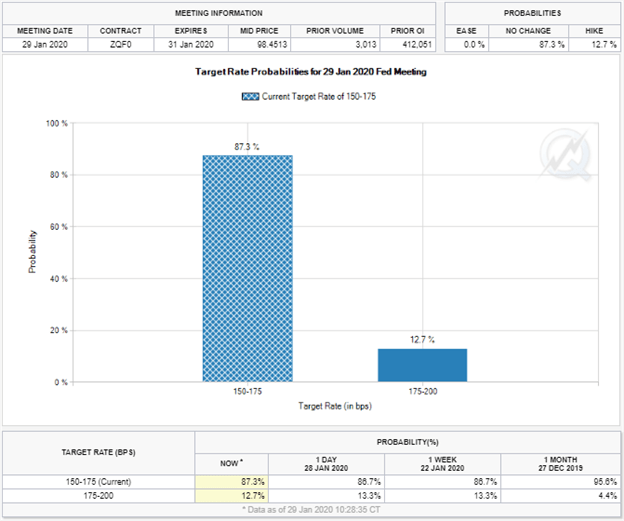

JANUARY 2020 FOMC INTEREST RATE DECISION EXPECTATIONS

According to the latest CME FedWatch Tool reading, market participants are currently pricing a 12.7% probability that the FOMC raises interest rates by 25-basis points.

Read More – USD Forecast: US Dollar at Risk as the Fed & GDP Loom

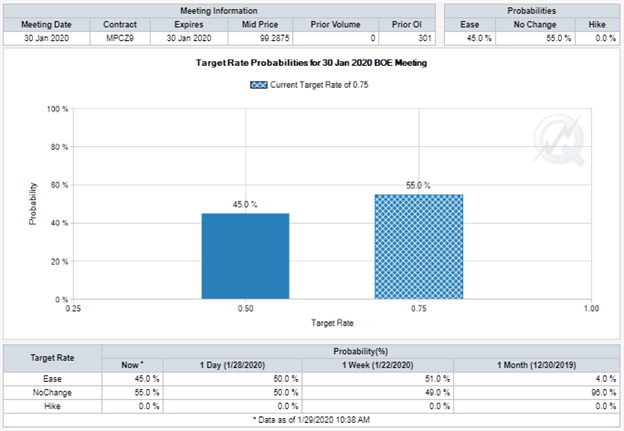

JANUARY 2020 BOE INTEREST RATE DECISION EXPECTATIONS

On the other hand, futures traders are far less certain about what the Bank of England will do on Thursday considering the implied probabilities for an interest rate change are nearly split.

As such, uncertainty around the BOE and whether its Governing Council will turn dovish has serious potential to dominate the direction of the Pound Sterling and spot GBP/USD.

Read More – GBP/USD Faces a Stubborn Support Level

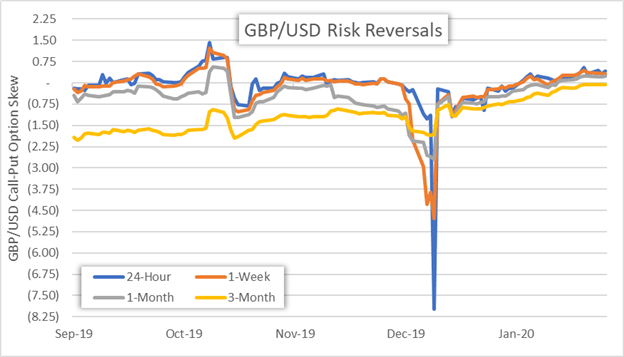

CHART OF GBP/USD RISK REVERSALS: POUND STERLING TO US DOLLAR 25-DELTA SKEW

Turning to GBP/USD risk reversals, we find that forex options traders have a bullish bias toward the Pound Sterling relative to the US Dollar over the next month. A risk reversal reading above zero indicates that the demand for call option volatility (upside protection) exceeds that of put option volatility (downside protection).

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Although, the 3-month GBP/USD risk reversal reading remains in negative territory and suggests a bearish bias over the medium-term.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight