Euro Forecast Overview:

- With US yields (both nominal and real) on the rise, the US Dollar is proving resilient. Euro bulls may prefer EUR/JPY to EUR/USD as a result of this one key reason.

- EUR/USD rates may break a near-term uptrend (mirroring the DXY Index holding above the March to November 2020 downtrend), but EUR/JPY rates have already crossed significant bullish thresholds.

- Per the IG Client Sentiment Index, the Euro still has a bullish bias in the short-term.

Euro Gains Splinter

The world of FX is based on relativity, and relatively speaking, the EU is trailing other developed economies with its vaccination rates, and the EU is growing less robustly than other regions. By all considerations, the Euro is not doing well. The trio of commodity currencies crosses, EUR/AUD, EUR/CAD, and EUR/NZD, continue to decline, not surprising in the face of rising risk appetite.

Yet it’s worth noting that amid the risk-on mood coursing through global financial markets, EUR/JPY rates have been able to maintain their positive momentum. This is markedly different than EUR/USD rates, which have been unable to gain traction in recent weeks like EUR/JPY (or even EUR/CHF). The key differential between EUR/JPY and EUR/USD is the shift in relative yields (FX is all about relativity, after all): JGBs remain pegged near zero, while US Treasury yields have burst higher.

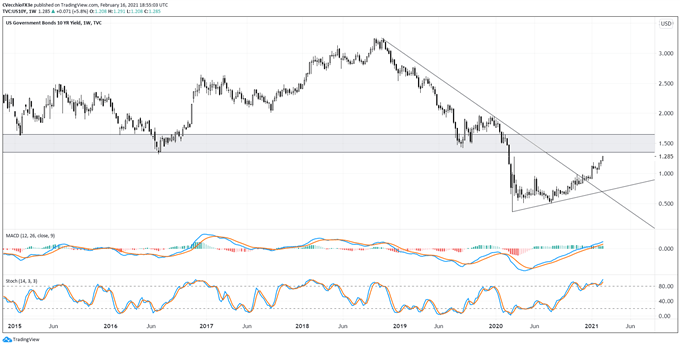

US TREASURY 10-YEAR YIELD TECHNICAL ANALYSIS: WEEKLY CHART (December 2014 to February 2021) (CHART 1)

The US Treasury 10-year yield continues its trek higher, now at its highest level since the start of financial markets’ panic at the beginning of the coronavirus pandemic. Keeping it simple, as long as US Treasury yields continue to climb (and they can likely move higher into the area around 1.500%), EUR/JPY will be a better vehicle to express Euro bullishness than EUR/USD.

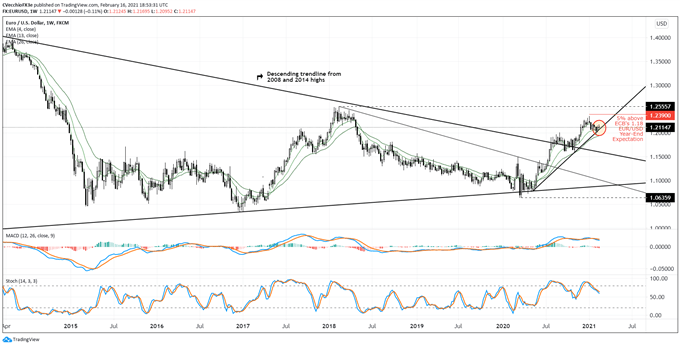

EUR/USD RATE TECHNICAL ANALYSIS: WEEKLY CHART (February 2020 to February 2021) (CHART 2)

In the last update it was noted that “the downtrend from the nascent intrayearly highs has been broken, suggesting that the continuation effort higher is beginning.” This was wrong; the pair has turned lower.

Taking a step back, looking at the weekly timeframe, the rising trendline from the May and November 2020 lows is being pressured once more, which comes near: the 23.6% Fibonacci retracement of the 2019 low/2020 high range at 1.1945; the August and September 2020 highs at 1.1967 and 1.2011, respectively; and the 23.6% Fibonacci retracement of the 2017 low/2018 high range at 1.2033. It thus once again is the case that “failure below here would be a significant bearish technical development.”

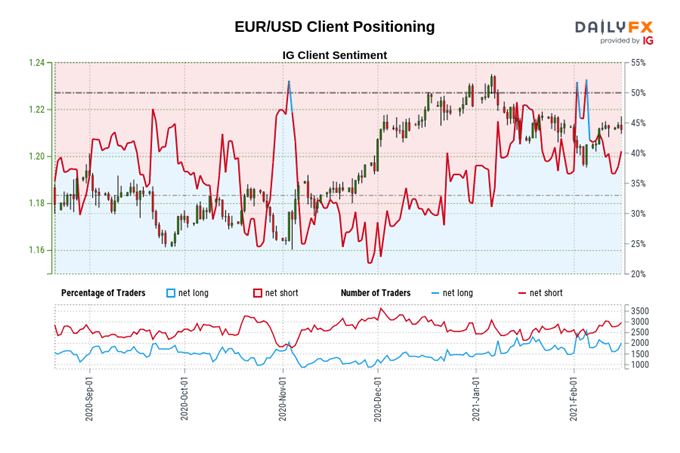

IG Client Sentiment Index: EUR/USD Rate Forecast (February 16, 2021) (Chart 3)

EUR/USD: Retail trader data shows 43.98% of traders are net-long with the ratio of traders short to long at 1.27 to 1. The number of traders net-long is 1.33% lower than yesterday and 1.14% lower from last week, while the number of traders net-short is 15.87% lower than yesterday and 11.73% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

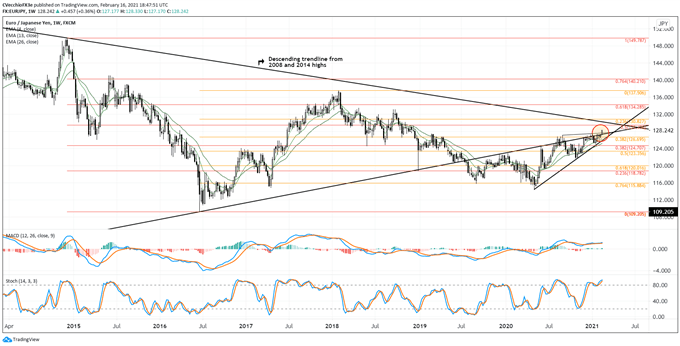

EUR/JPY RATE TECHNICAL ANALYSIS: WEEKLY CHART (March 2014 to February 2021) (CHART 4)

It’s been previously noted that “the symmetrical triangle that’s formed at the start of 2021, in context of the preceding bullish move, would suggest that EUR/JPY rates have a bias for a bullish breakout.” EUR/JPY rates have broken out to the topside, trading above the rising trendline dating back to the 2012, 2016, and 2018 lows. In fact, by returning into this decade-plus symmetrical triangle, EUR/JPY rates have setup the technical posture to trade higher into 130.00 in the near-term, before attempting to break the downtrend from the 2008 (all-time high) and 2014 highs.

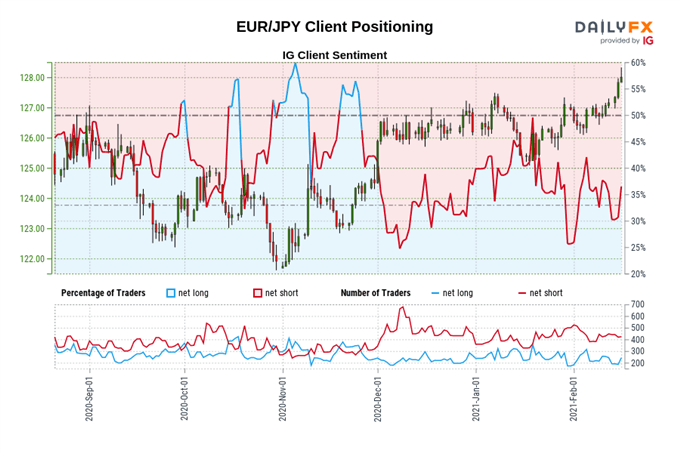

IG Client Sentiment Index: EUR/JPY Rate Forecast (February 16, 2021) (Chart 5)

EUR/JPY: Retail trader data shows 34.89% of traders are net-long with the ratio of traders short to long at 1.87 to 1. The number of traders net-long is 5.88% lower than yesterday and 1.32% lower from last week, while the number of traders net-short is 3.72% higher than yesterday and 13.28% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/JPY trading bias.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist