Euro Forecast Overview:

- What political risks? The Euro has roundly shrugged off concerns around the Italian and Dutch governments, and instead may be held back by a sluggish pace of vaccinations.

- EUR/USD rates have broken their downtrend from the nascent yearly high, while EUR/JPY rates continue to consolidate in a short-term triangle below a multi-year trendline.

- Per the IG Client Sentiment Index, the Euro still has a bullish bias in the short-term.

Euro Gains as Dollar Falls

The Euro continues to be hampered by poor vaccination rates, trailing both the UK and the US, but that’s about as far as the negativity goes. Elections are moving forward in a few months to find a new Dutch government, while former European Central Bank President Mario Draghi has been pulled from the sidelines to run a technocratic Italian government. Attempts by the ECB to jawbone the Euro lower have failed, the dual threats of an exchange rate study and a market underpricing rate cut odds shrugged off. With the US Dollar back in the throes of a potential bearish breakdown, the Euro may be gaining standing to attempt bullish breakouts of its own.

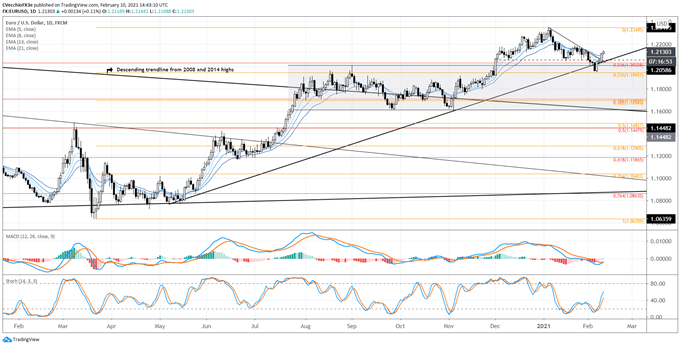

EUR/USD RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to February 2021) (CHART 1)

In the last update it was noted that “the rising trendline from the May and November 2020 lows comes into focus near 1.1950 through next week, in the midst of a confluence of significant technical levels: 23.6% Fibonacci retracement of the 2019 low/2020 high range at 1.1945; the August and September 2020 highs at 1.1967 and 1.2011, respectively; and the 23.6% Fibonacci retracement of the 2017 low/2018 high range at 1.2033. In aggregate, this major support zone is carved out between 1.1945 and 1.2033. Failure below here would be a significant bearish technical development.” EUR/USD fell towards 1.1945, but no further; instead, the pair has been able to retake the rising trendline from the May and November 2020 lows. In turn, the downtrend from the nascent intrayearly highs has been broken, suggesting that the continuation effort higher is beginning.

Having just broken the intrayearly downtrend, momentum is still evolving. EUR/USD rates are now above their daily 5-, 8-, 13-, and 21-EMA envelope, which is realigning towards bullish sequential order. Daily MACD has turned higher but remains below its signal line, while daily Slow Stochastics are rising through their median line. Once more, “EUR/USD rates now may be finding the footing needed before attempting another turn higher.”

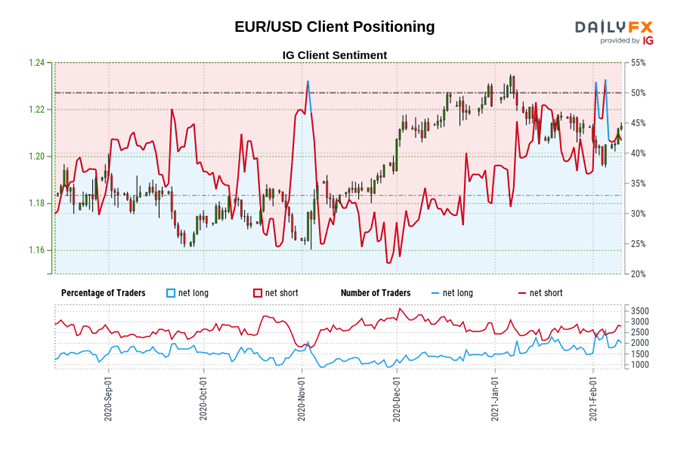

IG Client Sentiment Index: EUR/USD Rate Forecast (February 10, 2021) (Chart 2)

EUR/USD: Retail trader data shows 41.44% of traders are net-long with the ratio of traders short to long at 1.41 to 1. The number of traders net-long is 4.17% higher than yesterday and 7.71% lower from last week, while the number of traders net-short is 5.82% higher than yesterday and 5.60% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

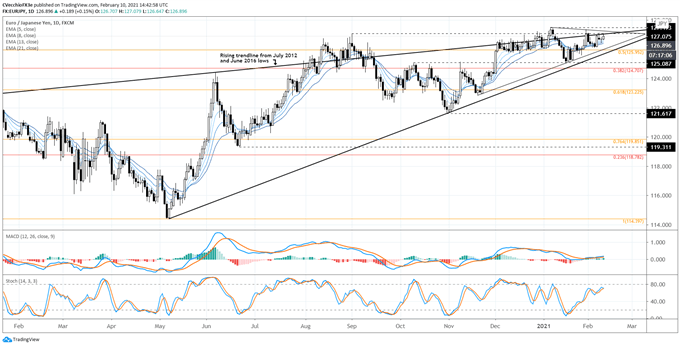

EUR/JPY RATE TECHNICAL ANALYSIS: DAILY CHART (February 2020 to February 2021) (CHART 3)

Given the consolidation seen in recent weeks, not much has changed for the EUR/JPY outlook since the prior update. “EUR/JPY remains below the rising trendline from the October and November 2020 swing lows at the end of the week, but has rebounded ahead of the rising trendline from the May and November 2020 lows, as well as the 38.2% Fibonacci retracement of the 2014 high/2016 low range at 124.71.”

Momentum is more bullish for EUR/JPY rates than previously, but it’s been a tedious process. Daily MACD continues to rise ever so slowly above its signal line, while daily Slow Stochastics have started to lose upward momentum prior to reaching overbought territory. The symmetrical triangle that’s formed at the start of 2021, in context of the preceding bullish move, would suggest that EUR/JPY rates have a bias for a bullish breakout.

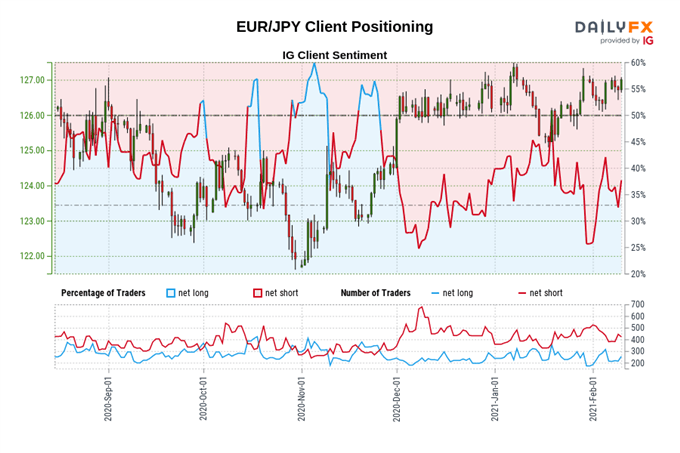

IG Client Sentiment Index: EUR/JPY Rate Forecast (February 10, 2021) (Chart 4)

EUR/JPY: Retail trader data shows 39.37% of traders are net-long with the ratio of traders short to long at 1.54 to 1. The number of traders net-long is 16.95% higher than yesterday and 0.36% lower from last week, while the number of traders net-short is 13.27% lower than yesterday and 16.50% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/JPY prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/JPY price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist