NZD/USD is little changed from our last report, though the forecast remains the same. It appears the Elliott Wave pattern is incomplete to the downside.

Traders need to be made aware of event risk coming up Wednesday November 8 as RBNZ releases its latest interest rate target. The analysis below is presented in advance of the news event so we can keep grounded to the key levels to watch should NZD/USD become volatile in the wake of the release.

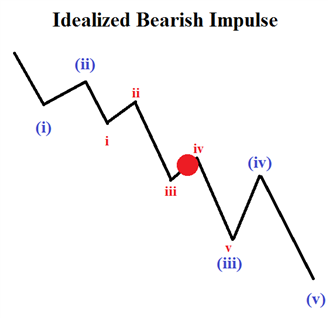

The Elliott Wave model we are following suggests we are in a wave (iii) lower and this third wave is not yet completed.

Are you new to FX trading? This ebook was created just for you.

The key level we are watching is the October 10 low of .7055. A move above this level negates the pattern as we have labeled and will force us to move to an alternative count.

For those familiar with Elliott Wave analysis, you may remember that third wave will subdivide as impulse waves. We think NZD/USD is currently in the fourth wave of that five wave impulse. As a result, we are looking for resistance to form between .6965-.7010 prior to another sell-off towards lower levels.

Bottom line, NZD/USD appears to be in wave iv of (iii). This hints at continued weakness on the horizon so long as prices remain below .7055. For those traders who are bullish USD, trading NZD/USD may be the vehicle to trade a strong US Dollar.

Want to learn more about Elliott Wave analysis? Grab the Beginner and Advanced Elliott Wave guides and keep them near your computer.

Why do traders lose money? This could be why.

NZD/USD Daily Elliott Wave Pattern

---Written by Jeremy Wagner, CEWA-M

Jeremy is a Certified Elliott Wave Analyst with a Master’s designation. These articles are designed to illustrate Elliott Wave applied to the current market environment.

Discuss this market with Jeremy in Monday’s US Opening Bell webinar.

Follow on twitter @JWagnerFXTrader .

Join Jeremy’s distribution list.

Other Elliott Wave forecasts by Jeremy:

Gold price forecast points towards lower levels.

USD/JPY stalls but holds above support.

Price action analysis for AUDUSD, NZDUSD, EURUSD [Webinar recording]