Gold prices are consolidating since our previous report though the outlook remains the same. The gold price forecast is for gold to work lower and possibly retest $1200.

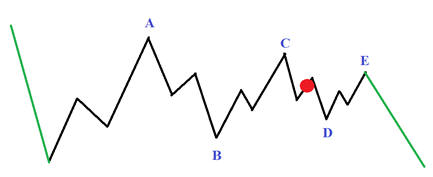

It appears gold prices are stuck in an Elliott Wave triangle pattern. We think gold prices are working lower in the ((D)) wave of the triangle. Potential stopping points for the ((D)) wave is near $1217 or $1162. Therefore, the opportunity remains to the downside so long as gold prices remain below $1357.

Since it appears we are in the ((D)) wave of the triangle, we are expecting this wave to take the shape of a zigzag pattern. We are almost halfway through the zigzag pattern. We illustrated two potential options on the intraday chart in our previous report “Gold prices may see $1200 in the coming weeks”. Both options are still possible so zoom out and keep an eye on key levels. For example, any strength up towards $1306 may be temporary. A break down below the October 6 low of $1260 may hint that the ‘c’ wave of the zigzag is already underway.

Struggling with your trading? This could be why.

Gold Price Elliott Wave Count Nov 6 2017

The Elliott Wave models are pointing to an eventual sell off towards $1200 so long as gold prices remain below the September 8 high of $1357. Shorter term traders could use the $1306 high to maintain a bearish bias against. As mentioned above, a move higher than $1306 does not turn the bias to bullish, but simply delays the bearish pattern we are following.

From a sentiment perspective, the ratio of net long to net short traders has remained positive and currently reads +3.1. This indicates the majority of traders are positioned net long in gold. Sentiment is a good contrarian tool so with the majority of traders net long, we would use that as a signal to short. Follow the sentiment of live traders through our sentiment page.

The bottom line is we look for gold prices continue its trend lower towards $1200 in the ((D)) leg of an Elliott Wave triangle. We are viewing rallies to be temporary and partial retracements with selling pressure eventually coming back. The key level for this analysis is the September 8 high of $1357. Above $1357, we will need to reassess the Elliott wave count.

Learn more about the Elliott Wave patterns by receiving our beginner and advanced Elliott Wave guides.

---Written by Jeremy Wagner, CEWA-M

Jeremy is a Certified Elliott Wave Analyst with a Master’s designation. These articles are designed to illustrate Elliott Wave applied to the current market environment.

Learn more about triangle patterns by watching this one hour long webinar recording devoted to triangles. Here is another one hour long webinar recording devoted to zigzag patterns.

Discuss this market with Jeremy in Monday’s US Opening Bell webinar.

Follow on twitter @JWagnerFXTrader .

Join Jeremy’s distribution list.

Recent Elliott Wave articles by Jeremy:

USD/JPY stalls but holds above support.

Price action analysis for AUDUSD, NZDUSD, EURUSD [Webinar recording]