JAPANESE YEN TECHNICAL FORECAST: Bullish

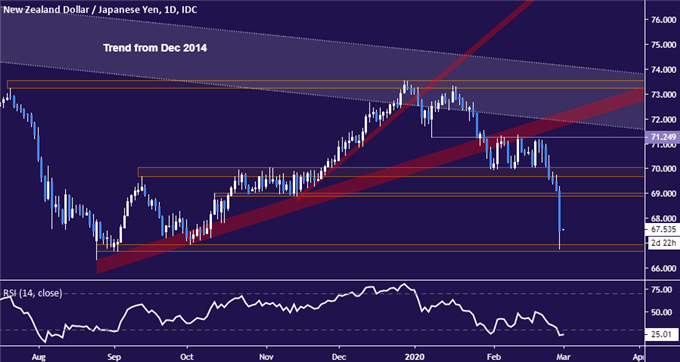

- Yen roars higher after testing trend support from December 2014

- Retail trader sentiment studies setting the stage for further gains

- Key crosses might retrace latest moves before Yen rally resumes

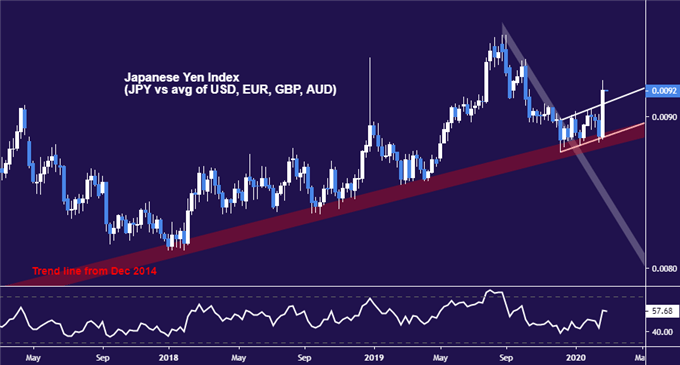

The Japanese Yen has seemingly made clear its intentions after testing trend support leading the currency higher against an average of its major counterparts since December 2014. A would-be bearish Flag chart pattern flagged last week now seems to be conclusively unraveled after the Yen roared higher to post the largest weekly rise in almost four years.

Japanese Yen weekly chart created with TradingView

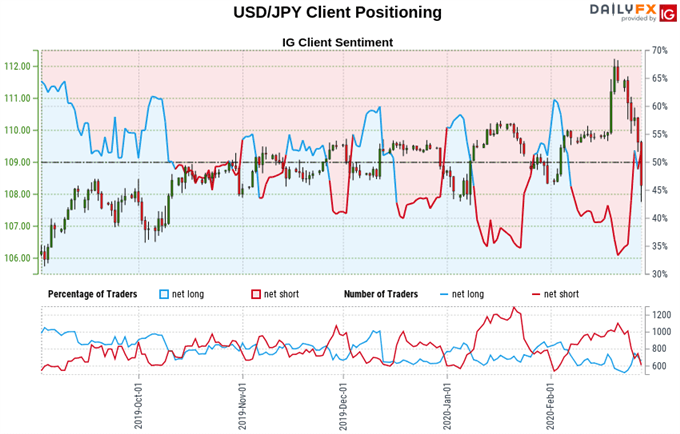

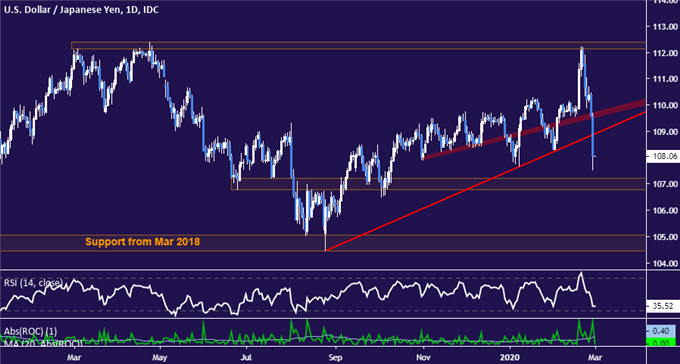

Trader positioning studies seem to support the case for continued Yen strength. The IG Client Sentiment (IGCS) gauge – a typically contrarian indicator – shows 62.31% of traders with exposure to the benchmark USD/JPY exchange rate are net-long, with the long-to-short ratio at 1.65 to 1. This suggests that the currency pair remains biased downward.

Furthermore, the number of traders net-long is 3.89% lower than yesterday, but the net-short count is 34.07% lower. Taking a longer-term view, the net-long number of traders net-long is 31.12% higher from while the tally of those net-short is 60.68% lower compared with last week. On balance, this speaks to a deepening net-long skew that strengthens the case for a USD/JPY-bearish (Yen-bullish) trend bias.

See the full IGCS sentiment report here.

YEN MAY PULL BACK BEFORE RALLY RESUMES

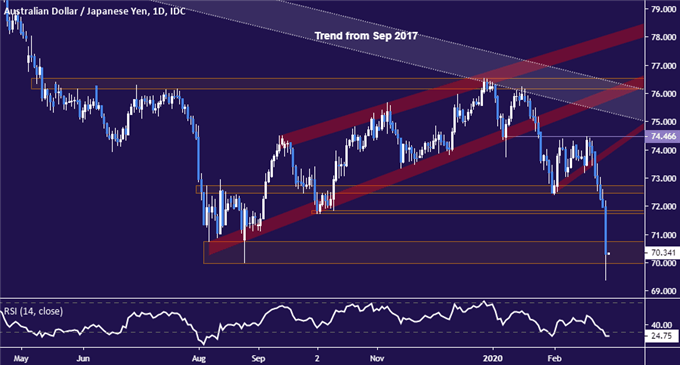

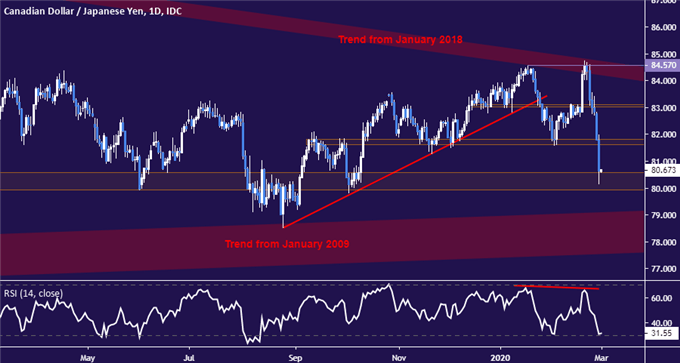

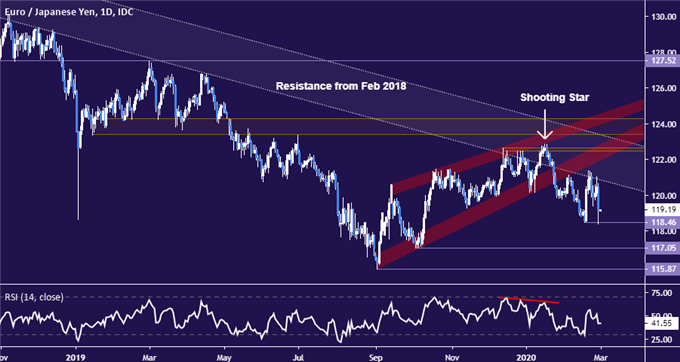

Nevertheless, surveying the Japanese unit’s individual pairings with top-tier currency counterparts reveals prices have run into meaningful technical barriers to further Yen appreciation. AUD/JPY, CAD/JPY, NZD/JPY and EUR/JPY finished last week sitting squarely at daily-chart support. USD/JPY itself is not quite there but seems close enough to tilt risk/reward parameters against sellers.

AUD/JPY daily chart created with TradingView

CAD/JPY daily chart created with TradingView

NZD/JPY daily chart created with TradingView

EUR/JPY daily chart created with TradingView

USD/JPY daily chart created with TradingView

This means that potential new entrants on the short side might be discouraged on tactical grounds, figuring the move is too far gone to be chased. If this proves to set the stage for a digestive pause, some opportunistic bearish bets with a relatively near-term horizon might be unwound. This could translate into a corrective pull-up, which may offer would-be sellers an improved risk/reward profile.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

JAPANESE YEN TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free live webinar and have your trading questions answered