Swiss Franc, Euro, EUR/CHF Analysis – TALKING POINTS

- EUR/CHF showing signs of bottoming out

- But recent risks may pressure upside gains

- EUR/CHF aiming to test critical resistance

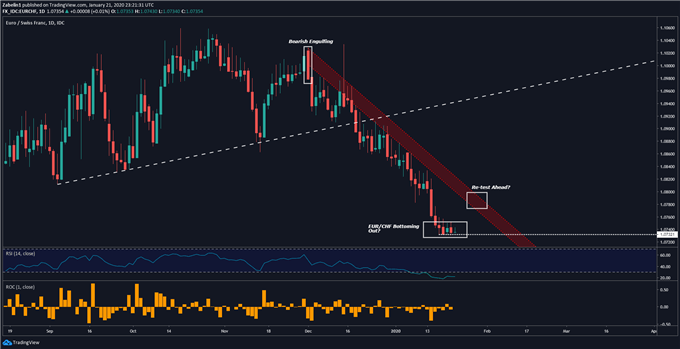

EUR/CHF appears to be showing signs that it is bottoming out after suffering an over-three percent decline following the Bearish Engulfing on December 2, 2019. The pair has since traded below a steep descending resistance channel (red parallel lines), though recent price action suggests a recovery and re-test of the multi-layered ceiling may be in the cards.

EUR/CHF – Daily Chart

EUR/CHF chart created using TradingView

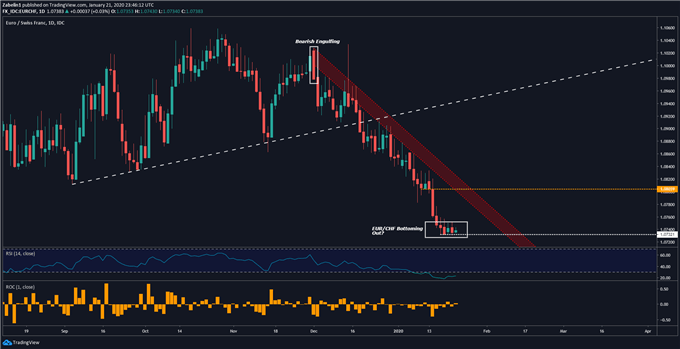

If EUR/CHF bounces back from key support at 1.0732 but fails to clear resistance, it could lead to a selloff if disappointed bulls exit their positions. On the other hand, if upside momentum continues to stay strong and the pair crack the ceiling with follow-through, the pair may then aim to break resistance at 1.0803 (gold-dotted line).

EUR/CHF – Daily Chart

EUR/CHF chart created using TradingView

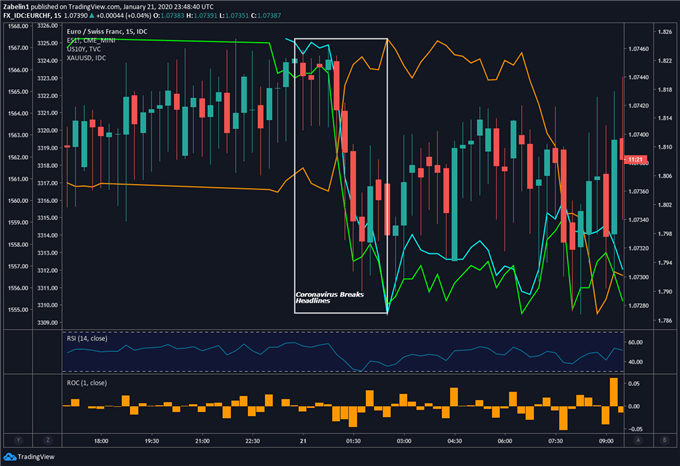

As mentioned in my prior EUR/CHF piece, there are numerous fundamental forces pushing the Swiss Franc higher. However, new developments may also support the Swissy’s rise and make a EUR/CHF recovery more difficult. Market panic about the prospect of contagion from the coronavirus in Asia during Lunar New Year pushed APAC equities lower and subsequently spread into Wall Street and infected risk appetite.

EUR/CHF, 10-Year Treasury Yields, S&P 500 Futures, Gold Prices – Daily Chart

EUR/CHF chart created using TradingView

When the news first broke, EUR/CHF declined with Treasury yields while the anti-risk Japanese Yen rose along with gold prices. Risk aversion from this event kicked in after the World Health Organization issued a statement saying it intends on holding an emergency meeting. If more cases are reported, it could accentuate market panic and push demand for anti-risk assets like the Swiss Franc higher.

EUR/CHF TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter