ASEAN Technical Outlook – USD/PHP, USD/SGD, USD/IDR, USD/MYR

- USD/MYR upside breakout could struggle to find follow-through

- Singapore Dollar uptrend eyed via the USD/SGD rising channel

- USD/IDR uptrend eyes resistance, USD/PHP rise may fall short

Trade all the major global economic data live as it populates in the economic calendar and follow live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

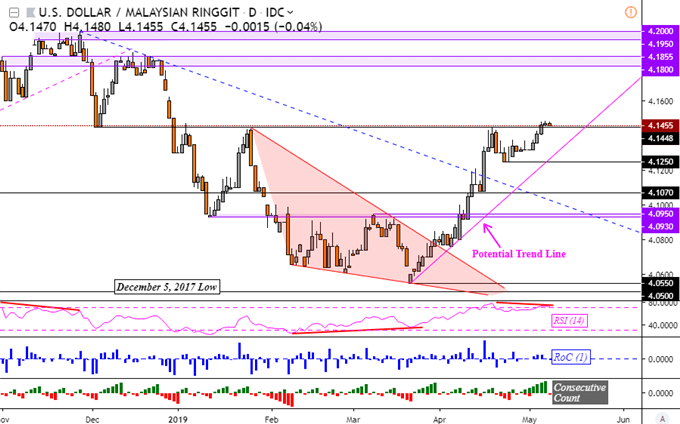

USD/MYR Technical Outlook

USD/MYR is attempting a break above near-term resistance at 4.1448 which if confirmed, may extend the dominant uptrend from March. This was initiated via the Falling Wedge bearish formation coupled with positive RSI divergence. This time, negative RSI divergence, which shows fading upside momentum, hints that the Malaysian Ringgit may appreciate in the near-term. As such, the push higher in USD/MYR ought to be treated with caution despite dovish support from a rate cut from Bank Negara Malaysia. Turning lower places support at what could be a potential rising trend line from the middle of March (pink line below).

USD/MYR Daily Chart

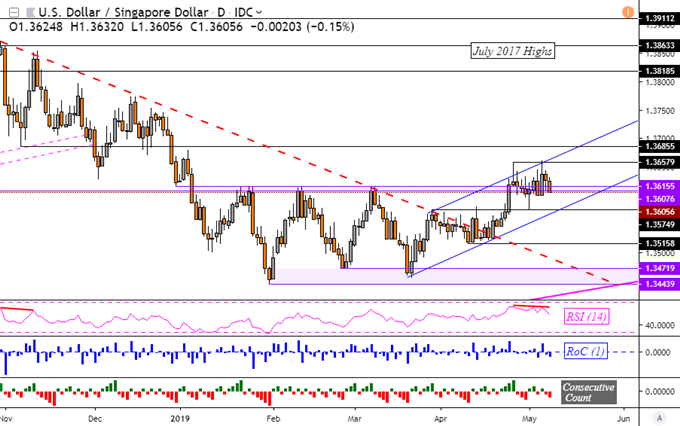

USD/SGD Technical Outlook

The Singapore Dollar brushed off the Shooting Star from last week which warned of indecision. The lack of confirmation via further closes lower overturned this potential bearish warning in USD/SGD. Rather, the focus now seems to be on a rising channel going back to late March which is represented by the blue parallel lines below. Negative RSI divergence warns of a turn lower which places support as the floor of the rising channel. However, the cautious uptrend from late March could still hold in the medium-term with resistance just under 1.3658.

USD/SGD Daily Chart

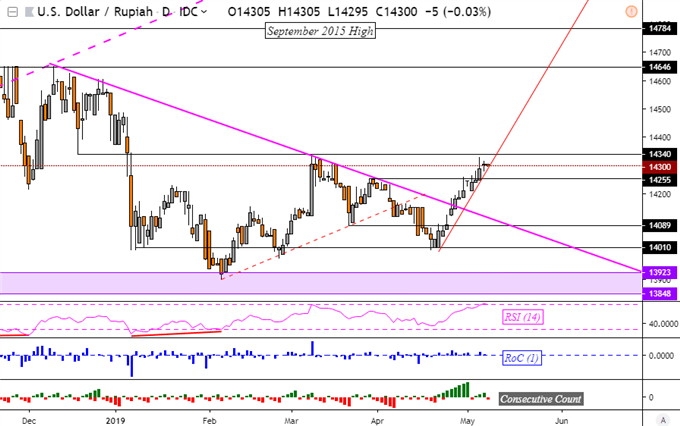

USD/IDR Technical Outlook

USD/IDR extended its uptrend from late April following the push above the falling trend line from December, also brushing off a Shooting Star candle. The Indonesian Rupiah thus finds itself sitting under immediate resistance at 14340. Meanwhile, just under it is a rising support line from late April which if broken, opens the door to testing 14255. Otherwise, extending its advance opens the door to testing 14646. You may feel free to follow me on Twitter @ddubrovskyFX for timely updates on ASEAN currencies.

USD/IDR Daily Chart

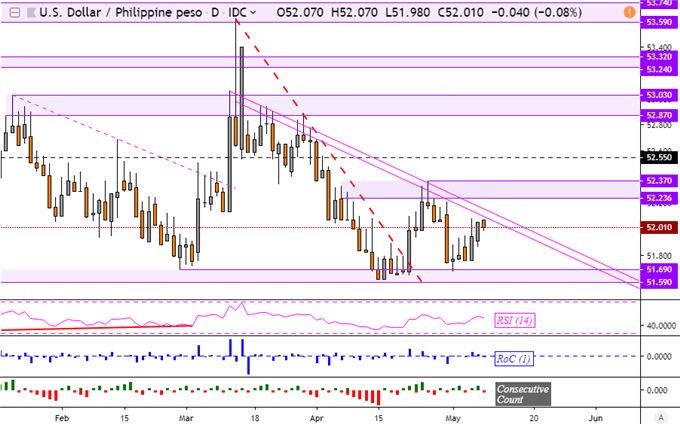

USD/PHP Technical Outlook

USD/PHP has been struggling to achieve upside follow-through after pushing above the near-term falling resistance line from the middle of March (red dotted line below). The Philippine Peso has largely been tamed by a downward-sloping resistance range from the same time (parallel pink lines below). If USD/PHP does breakout higher, it may struggle to find follow-through as a range of resistance (52.24 – 52.37) keeps the currency pair at bay. A turn lower has support eyed as a range between 51.59 and 51.69.

USD/PHP Daily Chart

**All Charts Created in TradingView

Read this week’s ASEAN fundamental outlook to learn about the underlying drivers for these currencies!

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter