ASEAN Technical Outlook – USD/PHP, USD/SGD, USD/IDR, USD/MYR

- USD/PHP may be readying up for a new uptrend next

- USD/MYR uptrend is taking a break under resistance

- USD/SGD aiming for range ceiling as USD/IDR rises

Trade all the major global economic data live as it populates in the economic calendar and follow live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

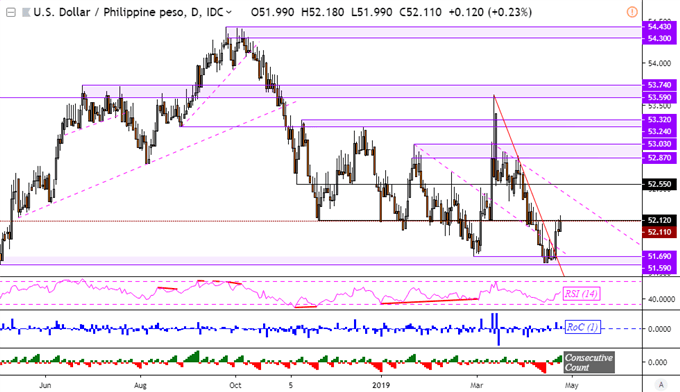

USD/PHP Technical Outlook

The Philippine Peso weakened against the US Dollar after support held above 51.59, sending USD/PHP prices reversing above a falling resistance line from the middle of March (red line on chart below). This occurred amidst a surge in crude oil prices on Iranian supply disruption fears. PHP is aiming for a close above near-term resistance at 52.12. If cleared and confirmed, this may open the door to testing 52.55 in the medium-term. Feel free to follow me on Twitter @ddubrovskyFX for more timely updates on ASEAN currencies.

USD/PHP Daily Chart

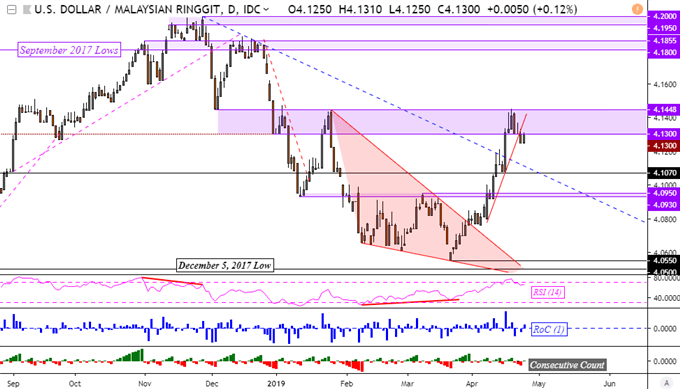

USD/MYR Technical Outlook

Extensive weakness in the Malaysian Ringgit seems to have taken a pause. USD/MYR’s uptrend since late March was unable to clear the psychological barrier at 4.1448, as noted in last week’s outlook. This does come after confirming closes above the descending trend line from November (blue-dashed line below). Clearing resistance will be needed to confirm uptrend extension. But, the close under the near-term rising support line from early April (rising red line below) warns of a turn lower towards the next barrier at 4.1070.

USD/MYR Daily Chart

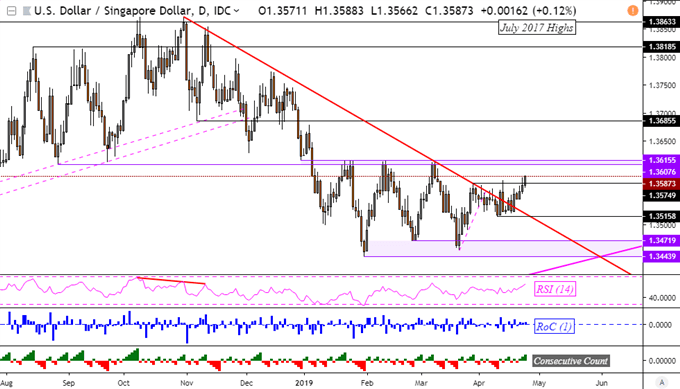

USD/SGD Technical Outlook

Meanwhile, the Singapore Dollar is coming under pressure from its US counterpart as USD/SGD remains in prolonged consolidation mode since the beginning of this year. Recent price action hints that the Singapore Dollar may weaken further towards range resistance at 1.36155. If cleared, this may overturn the dominant downtrend from November. Afterall, the pair has managed a close above the falling trend line from then (red line on chart below). Otherwise, near-term support appears to be at 1.3516.

USD/SGD Daily Chart

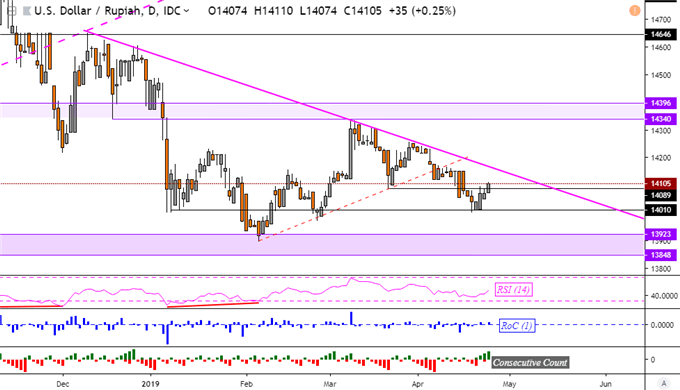

USD/IDR Technical Outlook

The Indonesian Rupiah appears to be aiming for another retest of the well-defined falling resistance line from December. This comes after near-term support at 14010 held, stemming USD/IDR declines after closing under the rising trend line from February (red-dashed line below). If resistance is broken, this may open the door to testing the psychological barrier just under 14340. Otherwise, support appears to be above 13848.

USD/IDR Daily Chart

**All Charts Created in TradingView

Read this week’s ASEAN fundamental outlook to learn about the underlying drivers for these currencies!

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how the US Dollar is viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter