GBP Technical Forecast Talking Points:

- The British Pound put in weakness against both the US Dollar and Japanese Yen this week while offering a small gain against the Euro.

- The big driver this week was Mark Carney’s final ‘Super Thursday’ rate decision atop the Bank of England, with a surprising two votes cast for a rate cut, helping to bring sellers into the British currency.

- GBP/USD’s previously strong topside trend remains on hiatus after the 1.3000 resistance that showed in October trade. GBP/JPY remains in a near-term range which can make bullish themes in the British Pound a bit more attractive.

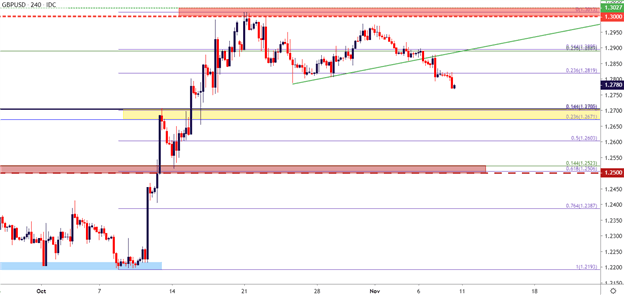

The British Pound continued to pullback this week against the US Dollar. The big item on the economic calendar out of the UK was the final ‘Super Thursday’ rate decision at the Bank of England for Mr. Mark Carney, in which the BoE offered an updated inflation forecast to go along with the rate decision and press conference. Perhaps a bit surprising was the fact that two members voted for a rate cut at that meeting, and when combined with what’s become a really strong US Dollar a deeper pullback showed in GBP/USD. The bull pennant formation that was being tested on Tuesday saw a downside break and sellers continued to push into the weekly close, making a fast run at the 1.2750 psychological level.

Given the fact that price action remains above the 38.2% retracement of the October breakout, this isn’t quite a bearish scenario yet although the bullish theme remains on pause as a deeper pullback may develop. The 38.2% retracement of that prior major move shows in a key area on the chart around 1.2700, of which multiple Fibonacci levels exist within close proximity. This confluent zone can be followed for support potential and a show of buyers upon re-tests can re-open the door to bullish strategies. Until then, the technical forecast will remain at neutral.

Technical Forecast for GBP/USD: Neutral

GBP/USD Four-Hour Price Chart

Chart prepared by James Stanley; GBPUSD on Tradingview

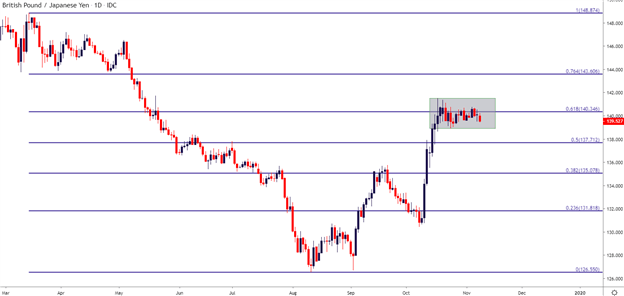

GBP/JPY Tests Range Support

Perhaps more attractive for topside British Pound plays is GBP/JPY. The pair put in a similar bullish breakout in the month of October and while GBP/USD resisted at 1.3000, GBP/JPY put in a move above the 140.00 level. Buyers were unable to hold the bid, however, as price action fell back to range support around the 139.00 level, and that range has held through this week’s trade. This helps to keep the door open for bullish scenarios in the pair.

Technical Forecast for GBP/JPY: Bullish

GBP/JPY Daily Price Chart

Chart prepared by James Stanley; GBPJPY on Tradingview

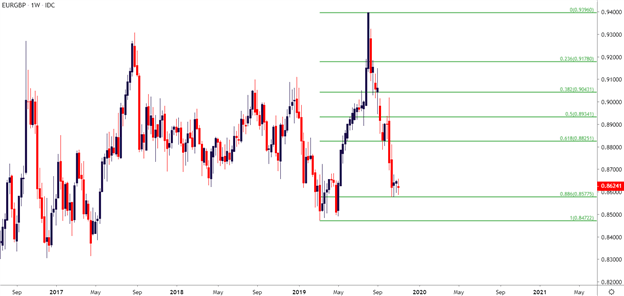

Against the Euro the British Pound posed a minor gain throughout this week’s trade. Noteworthy, however is the fact that price action remains at a key spot of support on the longer-term EUR/GBP chart. This shows around .8578, which is the 88.6% retracement of the March-August bullish move, and this support level came into play a couple of different times in October and has yet to give way. The 88.6% retracement will often be approached for reversal potential and given the continued support that’s been seen above that price since it came into play last month, traders looking for deeper reversal potential in the British Pound can focus on topside plays in EUR/GBP.

Technical Forecast for EUR/GBP: Bullish

EUR/GBP Weekly Price Chart

Chart prepared by James Stanley; EURGBP on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX