Oil Price Weekly Outlook: Crude Rebound Face First Test of Resistance

- Weekly technicals on Crude Oil prices (WTI)- Support bounce testing initial resistance

- Check out our 2019 projections in our Free DailyFX Crude Oil Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Crude Oil prices are on a tear with a rebound off key support posting a near 14% rally off the monthly lows. While the advance bodes well for oil prices near-term, the rally remains within the confines of the broader descending pattern we’ve been tracking. These are the updated targets and invalidation levels that matter on the crude oil weekly price charts (WTI). Review this week's Strategy Webinar for an in-depth breakdown of this oil price setup and more.

New to Oil Trading? Get started with this Free How to Trade Crude Oil Beginners Guide

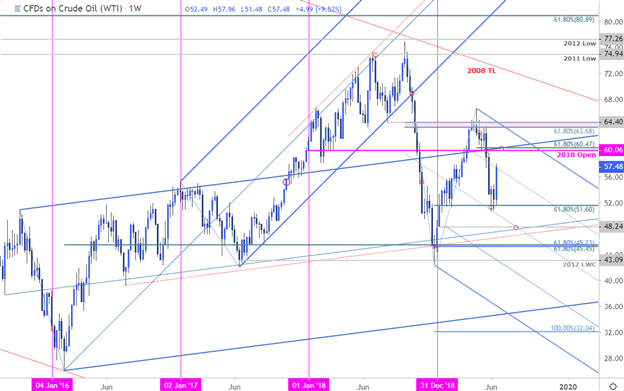

Crude Oil Price Chart – WTI Weekly

Notes:In my last Crude Weekly Price Outlook we noted that, “The crude breakdown has taken oil prices into secondary support targets here and leaves the immediate short-bias at risk near-term while above 51.60.” The low registered that week at 50.59 held for the next three-week with the subsequent advance now testing the 75% line of the descending pitchfork formation we’ve been tracking off the 2018 / 2019 highs.

The risk remains for a stretch higher in oil prices with more significant resistance eyed at the 2018 open / 61.8% retracement of the April decline at 60.06/47 – look for a bigger reaction there IF reached. Broader bearish invalidation rests with the upper parallel at 63.68/40.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line:This week’s reversal in crude prices does shift the near-term focus higher but keeps the broader advance within the confines of the descending price pattern we’ve been tracking for weeks now. From a trading standpoint, look for a reaction / topside exhaustion on a push towards the 60-handle – a good spot to reduce long-exposure / raise protective stops. Review my Top 2019 Trading Opportunities for a look at the longer-term Crude Oil outlook.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

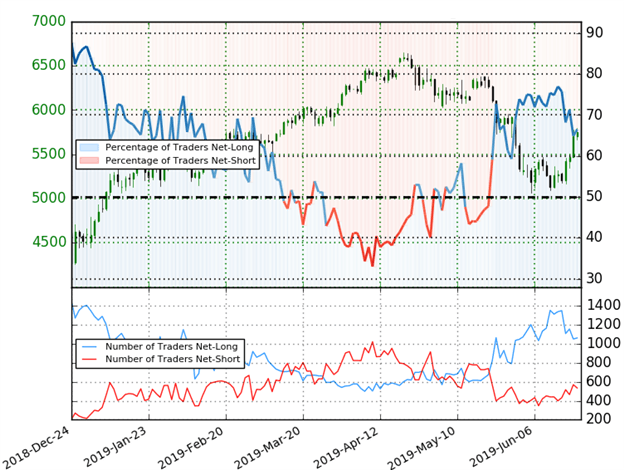

Crude Oil Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long Crude Oil- the ratio stands at +1.99 (66.5% of traders are long) – bearishreading

- Traders have remained net-long since May 22nd; price has moved 9.9% lower since then

- Long positions are16.0% lower than yesterday and 26.1% lower from last week

- Short positions are21.6% higher than yesterday and 16.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests oil prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current crude oil price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in Crude Oil retail positioning are impacting trend- Learn more about sentiment!

---

Previous Weekly Technical Charts

- US Dollar (DXY)

- Gold (XAU/USD)

- Kiwi (NZD/USD)

- Japanese Yen (USD/JPY)

- Aussie (AUD/USD)

- Euro (EUR/USD)

- Swissy (USD/CHF)

Learn how to Trade with Confidence in our Free Trading Guide

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex