- Weekly technicals on NZD/USD- reversal targeting key lateral support zone at 6507

- Check out our 2019 projections in our Free DailyFX USD Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

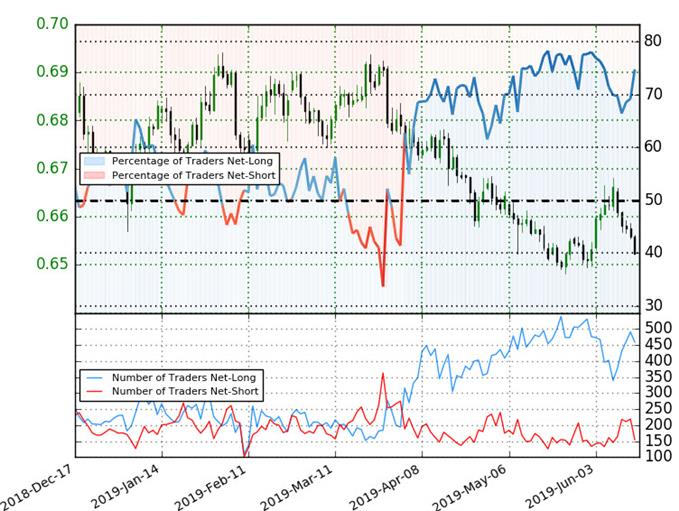

In this series we scale-back and look at the broader technical picture to gain a bit more perspective on where we are in trend. The New Zealand Dollar is down more than 2% against the US Dollar this week after reversing just ahead of confluence resistance and it’s the moment of truth for Kiwi as price approaches key support nearly the yearly lows. Review this week’s Strategy Webinar for an in-depth breakdown of this setup and more.

New to Forex Trading? Get started with this Free Beginners Guide

NZD/USD Price Chart - Kiwi Weekly

Notes: In my latest Kiwi Weekly Price Outlook we noted that, “Failure to mark a weekly close below 6507 would leave the immediate short-bias vulnerable heading into the start of June trade.” The subsequent rebound saw NZD/USD rally more than 3% off the lows early in the month with price failing just ahead of the upper parallel / yearly open resistance at 6705. A decline of more than 2.2% this week has Kiwi once again challenging the 2018 low-week close at 6507 - the focus is on this region into the close on Friday.

A downside break targets the 2015 trendline, currently ~6470s, backed by the 2018 low at 6424- look for a bigger reaction there IF reached. Resistance remains with the upper parallel with a breach above the yearly open needed to shift the broader focus higher-(bearish invalidation).

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

Bottom line: Kiwi has broken the monthly opening-range lows with the decline taking price into weekly support – risk remains for possible downside exhaustion. A weekly close below 6507 is needed to keep the bears in control. From a trading standpoint, a good spot to reduce short-exposure / lower protective stops. Review my latest NZD/USD Price Outlook for a closer look at the near-term Aussie trading levels.

Even the most seasoned traders need a reminder every now and then- Avoid these Mistakes in your trading

NZD/USD Trader Sentiment

- A summary of IG Client Sentiment shows traders are net-long NZD/USD - the ratio stands at +2.96 (74.8% of traders are long) – bearish reading

- Traders have remained net-long since April 2nd; price has moved 5.1% lower since then

- Long positions are 5.4% lower than yesterday and 12.0% higher from last week

- Short positions are 27.2% lower than yesterday and 6.6% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Kiwi prices may continue to fall. Traders are further net-long than yesterday & last week, and the combination of current positioning and recent changes gives us a stronger NZD/USD-bearish contrarian trading bias from a sentiment standpoint.

See how shifts in NZD/USD retail positioning are impacting trend- Learn more about sentiment!

---

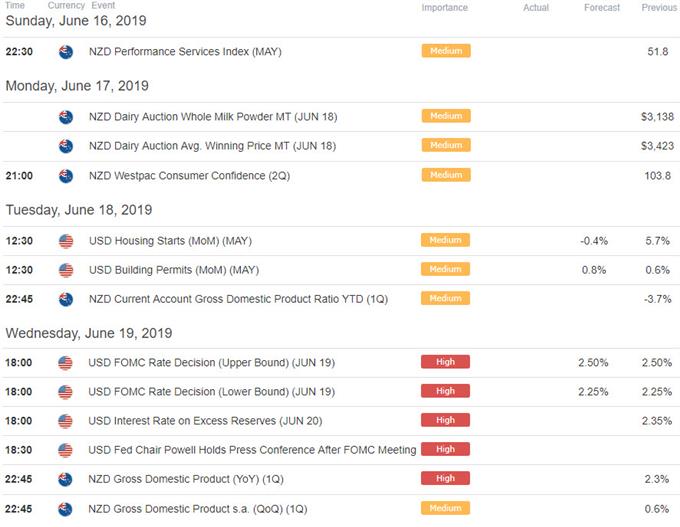

Key New Zealand / US Data Releases

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide !

---

Previous Weekly Technical Charts

- Crude Oil (WTI)

- Japanese Yen (USD/JPY)

- Aussie (AUD/USD)

- Euro (EUR/USD)

- Swissy (USD/CHF)

- US Dollar (DXY)

- Gold (XAU/USD)

Learn how to Trade with Confidence in our Free Trading Guide

--- Written by Michael Boutros, Technical Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex