GBPUSD Technical Analysis

- A series of lower highs has been broken this week and may point to higher prices.

- Technical analysis may be moot as Brexit bill vote nears.

We have recently released our Q1 2019 Trading Forecasts for a wide range of Currencies and Commodities, including GBPUSD with our fundamental and medium-term term technical outlook.

Last Week’s GBPUSD Technical Report – Sterling Remains Weak.

GBPUSD Nudge Higher Helped by US Dollar Frailty

Before we look at GBPUSD technicals, please note that Brexit fundamentals, and Tuesday’s vote, continue to dominate the market.

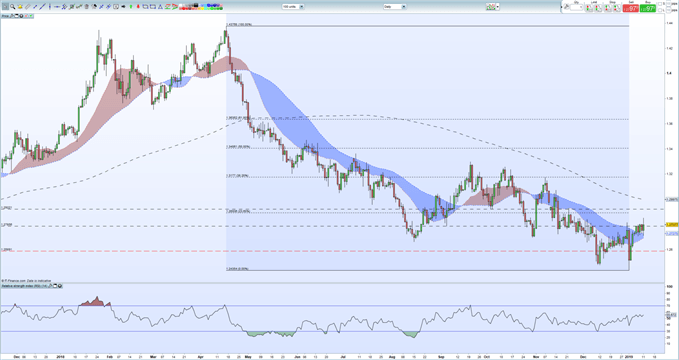

That being said, GBPUSD has thrown up a positive sign on the daily chart with the recent series of lower highs, started in late September 2018, seemingly broken this week. The move has been helped by a slightly weaker US dollar, but GBP has also shown resilience in the face of Brexit adversity. We will need further confirmation and upside to put more credibility in this move, but when combined with the pair trading back above the 20- and 50-day moving averages, the chart looks slightly more positive than of late. To have more confidence in further upside, GBPUSD needs to break and close above the 23.6% Fibonacci retracement level at 1.28936 and to close above the 200-day moving average, currently situated around 1.3000. This would leave the way clear for a larger move to the September 20 high at 1.3300.

To the downside, the 20-and 50-day moving averages between 1.2690 and 1.2725 will offer minor support before price action falls into the 1.236 to 1.2589 area. A break below – driven by further negative Brexit news – leaves the March 2017 low at 1.2109 as the next level of support.

GBPUSD Weekly Price Chart (December 2017 – January 11, 2019)

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1

Other Weekly Technical Forecast:

AUD Forecast –Prices May Add Gains to USD, EUR But JPY Holds