THE MACRO SETUP OVERVIEW:

• Rising Delta cases have had little impact on the stock market so far

• Smaller cap stocks may be signaling a possible wider correction

• Gold continues to show weak form as it attempts to recover from last week’s flash crash

WILL GEOPOLITICAL TENSIONS HAVE AN IMPACT ON THE MARKET?

In this week’s edition of the Macro Setup, featuring Guy Adami and Dan Nathan, we discussed the impact of rising geopolitical tensions and new Covid cases across various asset classes.

US equity markets continue to push higher, with their 200-day moving averages trailing behind. The breadth in the market has shown some divergence between the different indices, with only 48% of the members in the NASDAQ above their 200d MA, compared to 84% for the S&P 500, as highlighted in a tweet by Liz Ann Sonders. That said, the NASDAQ is only trailing the S&P by 4% year to date, which highlights the weight of the five major stocks (Apple, Microsoft, Amazon, Facebook, and Google) in the index and their impact on price performance.

Keeping to the stock market, renewed concerns about growth and the spread of the delta variant have done little to derail the performance of equities, as they continue to push new boundaries. Even with talk about inflation possibly being less transitory as initially thought which would lead to a reduction in the amount of stimulus coming from the Fed, equities continue to outperform other asset classes, which makes you wonder “what has got to give?” in order for a greater pullback to happen.

Well, smaller-cap stocks may be the leading indicator for a soon to happen correction, as the Russell 2000, which is composed of those more economically sensitive stocks, has been trending sideways pretty much since February after a strong rebound in November on the back of the vaccine news.

Elsewhere, crude oil continues to pullback as geopolitical tensions are added to the already dampening sentiment on the back of Delta concerns. The commodity has been one of the most sensitive to recent Covid-19 spreads as concerns about demand and built-up inventories are on the table again with renewed lockdown measures in some parts of the world.

And a prime example of this is New Zealand, where we’ve seen a snap 3-day lockdown imposed after one case of Covid-19 was detected in Auckland. Whilst the reaction may seem pretty extreme, the impact on the economy is likely to be limited, but the New Zealand Dollar (Kiwi) has a potentially volatile 12 hours ahead as economists have scaled back their predictions for a rate hike at tomorrow’s RBNZ meeting, after calling for up to three 25bps hikes by year-end.

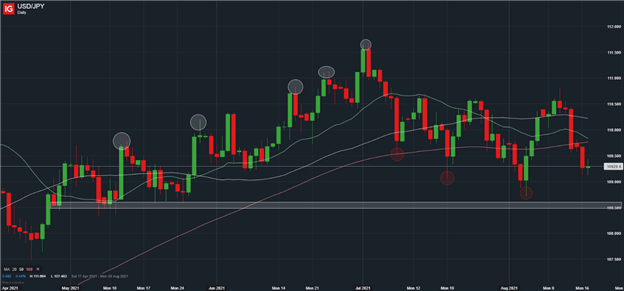

Finally, we talked about a flight to safety towards the Japanese Yen, with an interesting technical picture against the Dollar, and of course, we touched upon what Gold is doing.

*For commentary from Dan Nathan, Guy Adami, and myself on the New Zealand Dollar, the Japanese Yen, the Euro/Sterling pair, the CAC 40 and Gold amongst others, please watch the video embedded at the top of this article.

CHARTS OF THE WEEK

NZD/USD TECHNICAL ANALYSIS: DAILY CHART (CHART 1)

USD/JPY TECHNICAL ANALYSIS: DAILY CHART (CHART 2)

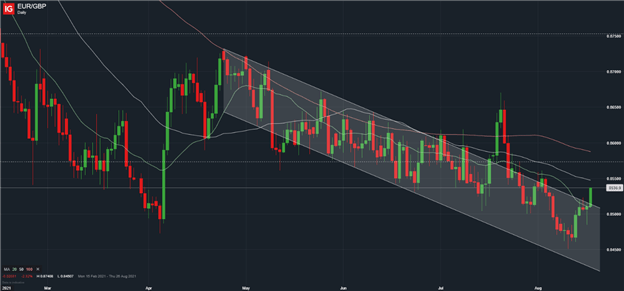

EUR/GBP TECHNICAL ANALYSIS: DAILY CHART (CHART 3)

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin