EUR/GBP TECHNICAL OUTLOOK:

- EUR/GBP has traded within the confines of a bearish channel for the past five months

- The pair bias is negative, but a technical short-term bounce could occur soon as price hovers above a key support area

- In this article we present the most important technical levels for EUR/GBP

Most read: British Pound Third Quarter Technical Forecast

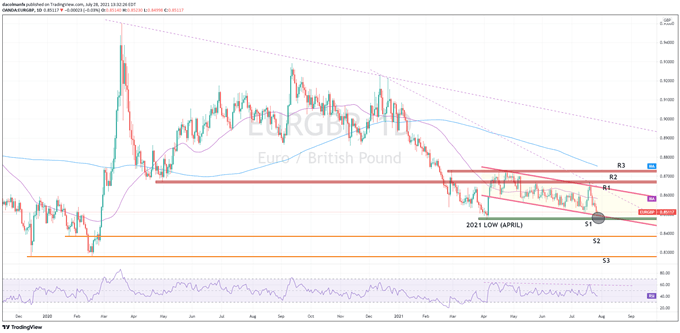

For the past five months, EUR/GBP (euro – pound sterling) has moved flawlessly within the confines of a descending channel, a technical pattern composed of two downward sloping parallel lines – an upper trendline that represents resistance and a lower one that marks support.

With the sell-off that sprung last Wednesday, price has retreated towards the lower limit of the bearish formation, near 0.8510/0.8475. This zone can be considered strong technical support, especially as it has already acted as a floor at the beginning of April, bringing declines to a screeching halt and paving the way for a fleeting rally.

Although the EURGBP’s medium-term bias is clearly negative, as reflected in the series of lower highs, a temporary rebound should not be ruled out entirely given the pair's proximity to confluence support. This situation may create opportunities for counter-trend and tactical traders who want to speculate on a possible reversal. That said, should a bounce occur, buyers could drive the exchange rate towards the upper boundary of the channel near 0.8640 before the downtrend resumes.

Conversely, if EUR/GBP breaks lower and falls below the 0.8500/0.8475 barrier decisively, all bets are off. In this scenario, sellers could set in motion a large sell-off capable of pushing price towards 0.8385, followed by the 2019/2020 low in the 0.8275 area.

From a fundamental point of view, the bearish case for EUR/GBP looks more likely. The ECB's new inflation framework will ensure that monetary policy remains loose for a long time. Meanwhile, in the UK, the Bank of England could start to withdraw accommodation as soon as next month, in light of the strong performance of the economy and the fall in COVID-19 cases. In a sense, the divergence in monetary policy can be seen as a bullish catalyst for sterling.

EUR/GBP TECHNICAL CHART

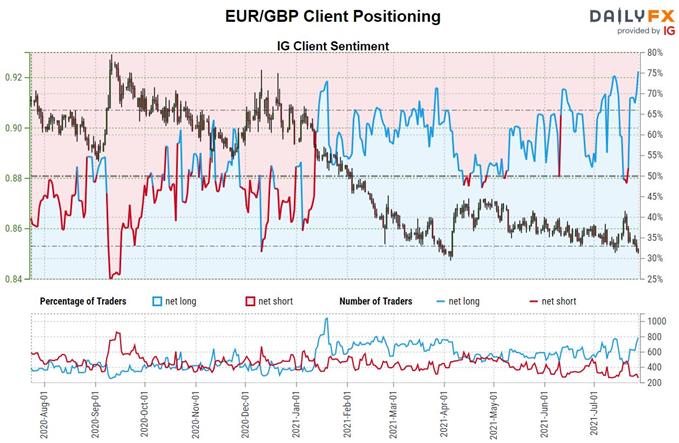

| Change in | Longs | Shorts | OI |

| Daily | -4% | -2% | -4% |

| Weekly | -9% | 5% | -6% |

IG CLIENT SENTIMENT DATA

IG retail data shows that 76.36% of clients are net-long with the ratio of traders long to short at 3.23 to 1. The latest report shows that traders are now at their most net-long EUR/GBP since Jul 13 when the pair traded near the 0.85 mark. Moreover, the number of traders net-long is 13.08% higher than yesterday and 82.42% higher from last week, while the amount of traders net-short is 17.63% lower than yesterday and 46.46% lower than last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.

EUR/GBP VS CLIENT POSITIONING

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download our beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take our quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

- Subscribe to the DailyFX Newsletter for weekly market updates and insightful analysis

---Written by Diego Colman, DailyFX Market Strategist