EUR/USD ANALYSIS

- Peace talks bolster Euro.

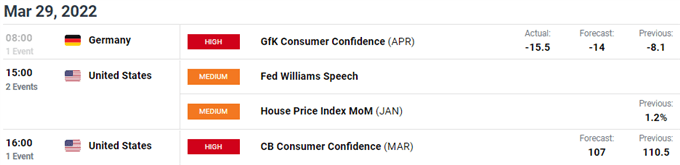

- GfK Consumer Confidence (April) - ACT: -15.5; EST: -14.

EURO FUNDAMENTAL BACKDROP

As many expected, GfK Consumer Confidence figures slumped for the month of April which reflects the ongoing situation in Ukraine. Unfortunately, actual data printed far worse than expected at -15.5 – last seen in May 2021. Surprisingly, the Euro dismissed the data primarily due to a stronger U.S. dollar.

Later today, we look forward to U.S. Consumer Confidence for March (also expected lower) along with the Fed’s Williams and Harker speeches. Acting as a support for EUR/USD bulls is the optimism around peace talks between Russia and Ukraine which may provide some respite short-term should it be realized but the central bank divergence strongly favors dollar appreciation.

EUR/USD ECONOMIC CALENDAR

Source: DailyFX economic calendar

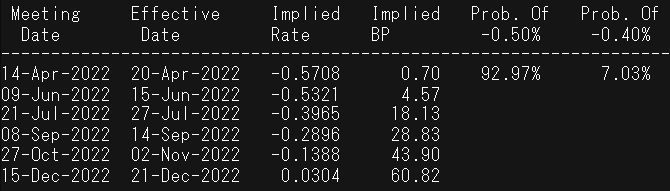

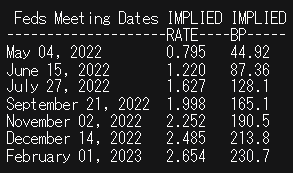

The interest rate probabilities for both the ECB and Federal Reserve respectively are shown in the tables below and echo their contrasting narratives. Money markets are already pricing in an extremely aggressive Fed which some may feel could limit dollar upside but we are yet to see this hawkish stance translate over to the dollar since late 2021. Therefore, my long-term outlook remains skewed towards the USD even if the situation in Ukraine eases.

ECB RATE PROBABILITIES

Source: Refinitiv

FEDERAL RESERVE RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Yesterdays lower long wick candle is suggestive of additional upside today which seems to be developing. Price action showed EUR/USD pushing above the 1.1000 psychological level but finding resistance around the 20-day EMA (purple) zone.

The current doji print for todays candle is indicative of hesitancy by markets ahead of key economic data releases. As mentioned above, my partiality is with the USD but geopolitics could give the Euro a brief boost before continuing its downward trajectory.

Resistance levels:

Support levels:

- 1.1000

- Triangle support (black)

- 1.0867 (March 2022 swing low)

INDECISION SHOWN BY IG CLIENT SENTIMENT

IGCS shows retail traders are currently LONG on EUR/USD, with 63% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positions have resulted in a mixed bias.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

Contact and follow Warren on Twitter: @WVenketas