FINTWIT TRENDS

- U.S. listed Chinese tech firms are being punished by both the U.S. and China

- Could falling U.S. treasury yields be pre-empting another COVID-19 spike?

- Ongoing talks between OPEC+ nations continue to add market uncertainty

CHINESE CRACKDOWN ON DIDI COULD HAVE CONTAGION EFFECT ACROSS GLOBAL STOCK MARKETS

US-China tensions are resurfacing as Chinese companies are being hurt by both nations; specifically U.S. listed Chinese companies and companies with alleged links to the military and/or surveillance technology. President Joe Biden signed an order prohibiting U.S. investment in several Chinese companies on June 3, creating havoc around index listings globally as many publishers are now planning to revise their issuances by removing said Chinese companies.

Making headlines this week was DiDi (DIDI) – the Chinese equivalent of Uber, who recently listed on the NYSE. Unfortunately, the Cyberspace Administration of China (CAC) put the company under review accompanied by a ban on onboarding new users last Friday. The ban has since been upgraded to a removal of the ride service from the app store citing allegations regarding the misuse of client information – this comes after a directive from the Chinese government to clamp down on big technology firms.

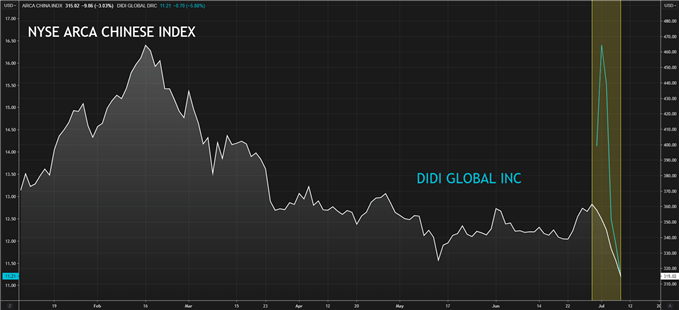

RECENT BROADBASED DECLINE OF CHINESE COMPANIES LISTED IN THE U.S.

Chart prepared by Warren Venketas, Refinitiv

The chart above reflects the drop-off in U.S. listed Chinese firms “with large exposures to the Chinese economy” (Source: NYSE.com) following the Chinese and U.S. announcements respectively. The sharp decline in DiDi is not alone as other peer listings are suffering a similar fate (Alibaba, Baidu etc.). US-China communication will be crucial going forward as to avoid another scrap between the two heavyweights as their actions have significant consequences around the world.

FALLING U.S. 10-YEAR TREASURY YIELDS MAY PERSIST AS GLOBAL COVID-19 CASES RISE

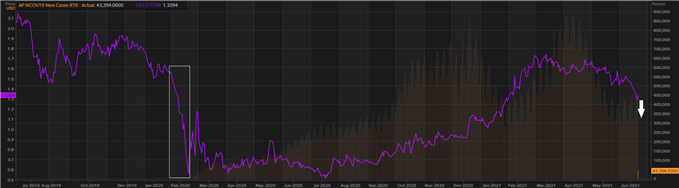

Lingering behind all other financial market trends the COVID-19 pandemic is beginning to creep into the minds of analysts as the recent fall in U.S. treasury yields could be a repeat of the initial drop seen towards the end of 2019 (see chart below - white). With the Delta variant of the virus spreading across the globe, new cases are incrementally increasing (orange) thus causing concern for policy makers.

If this cannot be contained, a risk-off approach may ensue causing a flock to U.S. treasuries and hence a decline in yields. This is worrying because vaccine rollouts are underway in most countries with developed nations close to ‘herd immunity’. Despite this, new cases are rising which could result in additional lockdowns disrupting markets across the globe.

Taper talk is also at the forefront of financial discussions which could support falling yields should the U.S. cut back on bond buying in the near future. The Federal Reserve will be closely monitoring this situation to make the correct decision without spooking markets.

GLOBAL COVID-19 (NEW CASES) VS U.S. 10-YEAR TREASURY YIELD

Chart prepared by Warren Venketas, Refinitiv

TWO SIDES TO THE CRUDE OIL COIN: FLOP OR FLY?

The Organsiation of the Petroleum Exporting Countries (OPEC) including Russia (OPEC+) has been at an imapasse this week as the UAE blocked attempts by the alliance to extend output restrictions to the end of 2022. This could result in either two likely outcomes:

- No agreement is made and member nations contest for supply dominance which will likely cause a sharp decline in crude oil prices.

- UAE agrees to the constrained output extension which could further float the current uptrend seen in crude oil prices.

WEEKLY BRENT CRUDE CHART

Chart prepared by Warren Venketas, IG

Learn more about Crude Oil Trading Strategies and Tips in our newly revamped Commodities Module!

The chart above represents the two drastically different outcomes by OPEC+ which can be significant for global markets. The graphic representation above shows just how far reaching the decision could be for crude oil prices which will ultimately have a knock-on effect on global manufacturing etc. It is rumored that Russia is acting in an intermediary with the UAE to come up with a resolution. This decision is vital especially considering the current economic climate so stay up to date with the latest crude oil news at DailyFX.com.

--- Written by Warren Venketas for DailyFX.com

Contact and follow Warren on Twitter: @WVenketas