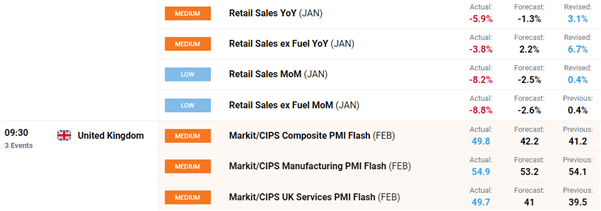

GBP/USD, EUR/GBP Price Analysis & News

GBP Bulls Hit 1.40 Target

GBP bulls continue to take charge as GBP/USD breaks 1.40 for the first time since April 2018. The narrative behind the GBP bull case remains unchanged with a successful vaccine program and reduced political uncertainty with Brexit now behind us. That said, this morning’s data has been mixed overall with soft retail sales and better than expected PMI data shrugged off. Going forward, while the current narrative remains in play for GBP, given the substantial rise since the beginning of the year and with the psychological 1.40 barrier being taken out, I wouldn’t be surprised to see some profit taking occur, particularly as GBP crosses trade at overbought levels.

GBP/USD Chart: Reaction to UK Data

Source: Refinitiv

Find out more on trading GBP with our comprehensive guide

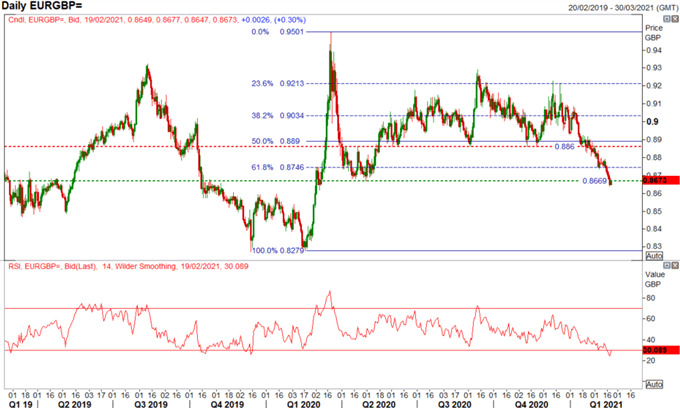

EUR/GBP | Short Term Reprieve, But Long Term Slide

EUR/GBP is trading slightly firmer to break its recent streak of daily losses. Keep in mind, that the cross has been trading in oversold conditions throughout the week and thus a slight bounce back shouldn’t be seen as the beginning of a new trend, merely a slight positioning adjustment. Downside risks remain for the cross, even when comparing relative vaccine programs, to which the UK has been far superior. On the technical front, near-term resistance is situated at 0.8700 and 0.8745-50. Elsewhere, it is also worth touching on GBP/CHF which has backed off key resistance at 1.2532 (Jan 2020 double bottom). However, the long term bull scenario would be for a move to 1.30.

EUR/GBP Chart: Daily Time Frame

| Change in | Longs | Shorts | OI |

| Daily | 26% | -24% | 2% |

| Weekly | 10% | 0% | 6% |