EUR/GBP Price Analysis & News

THE VACCINE TRADE IN FULL SWING FOR GBP BULLS

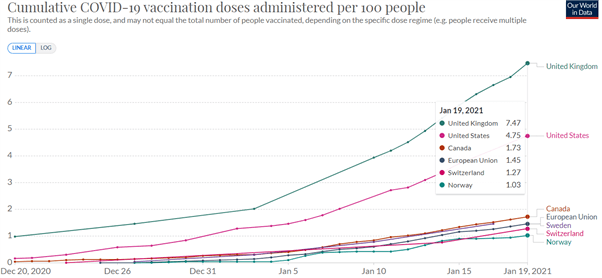

The Pound has gone from strength to strength in recent sessions with the vaccine trade in full swing, in which EUR/GBP is now trading at it lowest level since May 2020. The UK government has had a rare success with their vaccine rollout program, whereby 4.6mln people have received their first dose of the COVID vaccine as of yesterday. As can been seen in the chart below, the number of doses administered per 100 people, is noticeably higher in the UK at 7.47 compared to the rest of the G10 countries, in particular against the EU which is tracking at 1.45.

UK WINNING THE VACCINE RACE

Source: Our World Data

| Change in | Longs | Shorts | OI |

| Daily | -4% | -2% | -4% |

| Weekly | -9% | 5% | -6% |

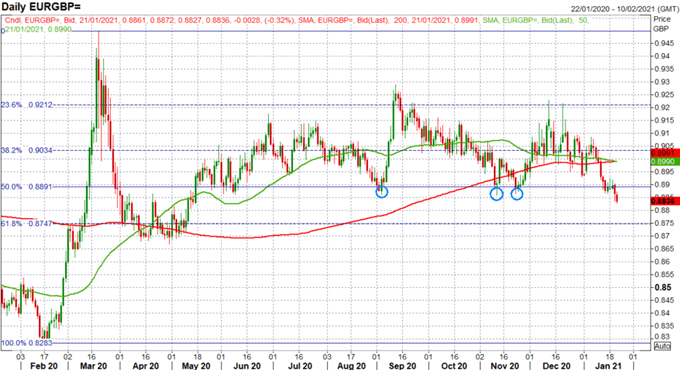

EUR/GBP BREAKING DOWN TO A NEW RANGE

That said, with the UK the front runner in the vaccine race, the outlook looks rather rosy for the UK economy to make a bounce back. In turn, when comparing against the less successful rollout program for the EU, which has had to reduce COVID vaccine shipments from Pfizer, EUR/GBP looks to extend losses further. As I noted in the our Q1 2021 GBP forecast, a break below support at 0.8860 could see the cross trade in a new 0.8600-0.8800 range. Keep in mind, that with a massive cloud of uncertainty regarding Brexit now removed, GBP has become that more attractive against EUR, which had long been a guide for Brexit sentiment.

THE SETUP

With a clean break below key support at 0.8860, the next level of interest is at circa 0.8750, which coincides with the 61.8% fib, below this level and downside risks could extend towards 0.8700, while bounce backs to 0.8860 and 0.8900 are likely to be faded. Elsewhere, for those who favour their technicals, a 50/200DMA death cross suggests risks are tilted to the downside for EUR/GBP.

Source: Refinitiv

DailyFX Education: A trading journal is an important tool for a trader at any level. It will help you identify your trading style as well as evaluate your thought process and review your past behaviours.For more on a trading journal, check out the link below.