Silver Price Forecast:

- Silver price action remains within a well-defined range

- Fundamentals may continue to drive short-term price action for XAG/USD

- Symmetrical Triangle continues to provide support and resistance in the short-term

Fundamental drivers have continued to support the demand for Silver, Gold and other safe-haven assets as additional Fiscal aid and the Fed’s further dovish tone continue to support risk-on sentiment. Despite a combination of the vaccine rollout program and a drastic decrease in the number of Coronavirus cases both contributing to renewed hopes of an economic recovery, inflationary concerns ensuing from the Federal Reserve’s continued dovish tone have hindered the ability for US Dollar bulls to achieve further gains, with Fed Chairman Jerome Powell emphasizing both the importance and necessity of the larger stimulus package, with higher employment remaining at the forefront of policy objectives for the foreseeable future.

Visit the DailyFX Educational Center to discover why news events are Key to Forex Fundamental Analysis

Silver (XAG/USD) Technical Analysis

With Silver prices catalyzing off of US Dollar weakness, price action remains encapsulated within the boundaries of the symmetrical triangle, currently holding both bulls and bears at bay, for now.

Silver (XAG/USD) 2 Hour Chart

Chart prepared by Tammy Da Costa, IG

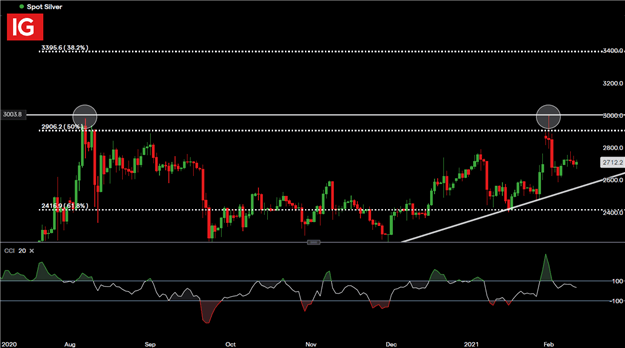

Meanwhile, key Fibonacci retracement levels of the 2008 – 2011 historical move continues to provide support and resistance for XAG/USD, with the Commodity Channel Index (CCI) falling back within range after Silver bulls failed to surpass the key psychological level of 3000 earlier this month.

Silver (XAG/USD) Daily Chart

Chart prepared by Tammy Da Costa, IG

For now, support potential remains around the key psychological level of 2600 with the 50% Fibonacci retracement level providing additional support at 2409.8.

On the contrary, resistance remains at 2800, with the 50% Fibonacci retracement level forming an additional layer of resistance at 2906.2.

Silver Client Sentiment

| Change in | Longs | Shorts | OI |

| Daily | 3% | 2% | 3% |

| Weekly | 4% | -9% | 2% |

At the time of writing, retail trader data shows 89.18% of traders are net-long with the ratio of traders long to short at 8.24 to 1. The number of traders net-long is 3.98% lower than yesterday and 6.93% lower from last week, while the number of traders net-short is 1.38% lower than yesterday and 18.31% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Silver prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Silver trading bias.

--- Written by Tammy Da Costa, Market Writer for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707