NFP and Forex Trading: MAIN TALKING POINTS

- Non-Farm Payrolls (NFP) releases create volatility in the forex market.

- NFP measures net changes in employment jobs.

- Forex traders use an economic calendar to prepare for NFP releases.

What is the NFP?

The non-farm payroll (NFP) figure is a key economic indicator for the United States economy. It represents the number of jobs added, excluding farm employees, government employees, private household employees and employees of nonprofit organizations.

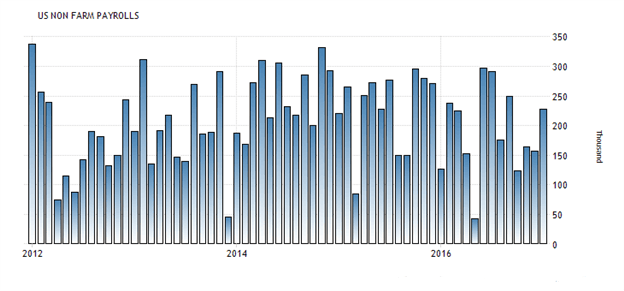

NFP releases generally cause large movements in the forex market. The NFP data is normally released on the first Friday of every month at 8:30 AM ET. This article will explain the role NFPs play in economics and how to apply NFP release data to a forex trading strategy.

How does the NFP affect forex?

NFP data is important because it is released monthly, making it a very good indicator of the current state of the economy. The data is released by the Bureau of Labor Statistics and the next release can be found on an economic calendar.

Employment is a very important indicator to the Federal Reserve Bank. When unemployment is high, policy makers tend to have an expansionary monetary policy (stimulatory, with low interest rates). The goal of an expansionary monetary policy is to increase economic output and increase employment.

So, if the unemployment rate is higher than usual, the economy is thought to be running below its potential and policy makers will try to stimulate it. A stimulatory monetary policy entails lower interest rates and reduces demand for the Dollar (money flows out of a low yielding currency). To learn exactly how this works, see our article on how interest rates effect forex.

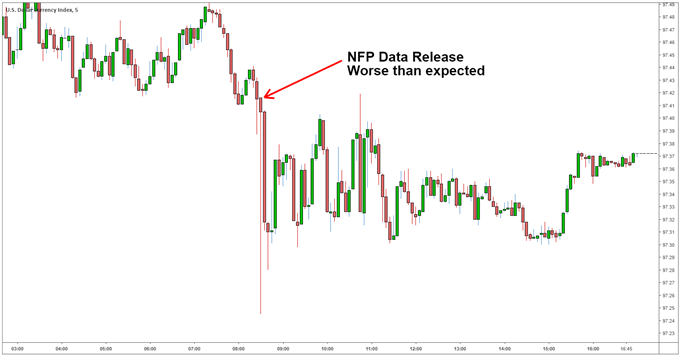

The chart below shows how volatile forex can be after an NFP release. The expected NFP results for March 8, 2019 were 180k (job additions), the actual result disappointed with only 20k jobs being added. As a result, the Dollar Index (DXY) depreciated in value and volatility increased.

Forex traders must be wary of data releases like the NFP. Traders could get stopped-out due to the sudden increase in volatility. When volatility increases, spreads do too, and increased spreads can lead to margin calls.

Which currency pairs are most affected by NFP

The NFP data is an indicator of American employment, so your currency pairs that include the US Dollar (EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF and others) are most affected by the data release.

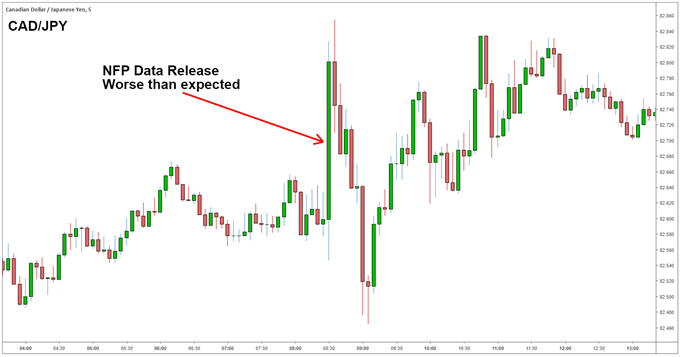

Other currency pairs also display an increase in volatility when the NFP releases, and traders must be aware of this as well, because they may get stopped out. The chart below shows the CAD/JPY during the NFP data release. As you can see, the increase in volatility could stop a trader out of their position even though they are not trading a currency pair linked to the US Dollar.

Non-farm payroll release dates

The Bureau of Labor statistics normally releases the NFP data on the first Friday of each month at 8:30 AM ET. The release dates can be found on the Bureau of Labor Statistic’s website.

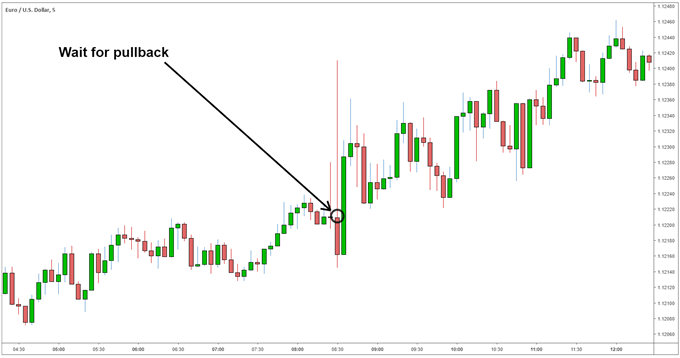

Due to the volatile nature of the NFP release, we recommend using a pull-back strategy rather than a breakout strategy. Using a pullback strategy, traders should wait for the currency pair to retrace before entering a trade.

Using the same example as above (NFP results 20k vs 180k expected) we expect the US Dollar to depreciate. In the example below, we use the EUR/USD. Because the NFP data came out worse than expected, we forecast the EUR/USD to appreciate.

Trading the NFP data releases: Top tips & further reading

Here are a few tips to remember when using NFP data releases to inform your forex trading:

- NFP data is released on the first Friday of every month.

- The NFP data release is accompanied with increased volatility and widening spreads.

- Currency pairs not related to the US Dollar could also see increased volatility and widening spreads.

- Trading the NFP data release can be dangerous due to the increase in volatility and possible widening of spreads. To combat this, and to avoid getting stopped-out, we recommend using the appropriate leverage, or no leverage at all.

Other important data releases to watch:

While the NFP generally moves the market, data like CPI (inflation), Fed funds rates, and GDP growth are important data releases too.

If you want to know more about trading the news and data releases, see our trading the news beginner guide. We also suggest reading our traits of successful traders guide to avoid the number one mistake traders make when trading forex.

Further reading on forex fundamentals

We also recommend finding out more about the role of central banks in the forex market, and what central bank interventions involve.

Use the DailyFX economic calendar to keep an eye on all the important economic data releases, including central bank speeches and interest rate data. Don’t forget to bookmark our Central Bank Rates Calendar so you can prepare for regular announcements.