NZD/USD PRICE OUTLOOK: NEW ZEALAND DOLLAR HINGES ON QUARTERLY INFLATION REPORT & CHANGES IN RBNZ MONETARY POLICY EXPECTATIONS

- The New Zealand consumer price index (CPI) for 4Q-2019 is set to cross the wires Thursday, January 23 at 21:45 GMT and puts NZD price action at risk of experiencing outsized moves

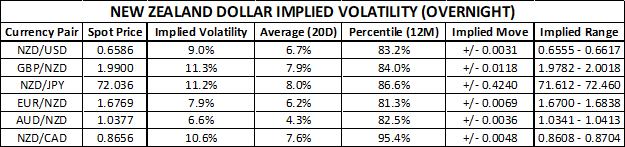

- NZD/USD, NZD/JPY, GBP/NZD and NZD/CAD overnight implied volatility readings jump to 1-month highs ahead of the New Zealand CPI data release

- Currency volatility in the New Zealand Dollar is expected to rise considering the quarterly inflation report can have a material impact on monetary policy outlook from the RBNZ

The Kiwi comes into focus as Thursday’s trading session enters its final hours with New Zealand consumer price index data due for release at 21:45 GMT. The latest New Zealand inflation report is expected to provide a dose of volatility to NZD price action considering it has high potential to weigh on future monetary policy decisions from the Reserve Bank of New Zealand (RBNZ).

Anticipated currency volatility in NZD/USD, NZD/JPY, GBP/NZD and NZD/CAD was just clocked at 1-month highs and reflects the above-average impact upcoming New Zealand inflation data typically has on the direction of the New Zealand Dollar.

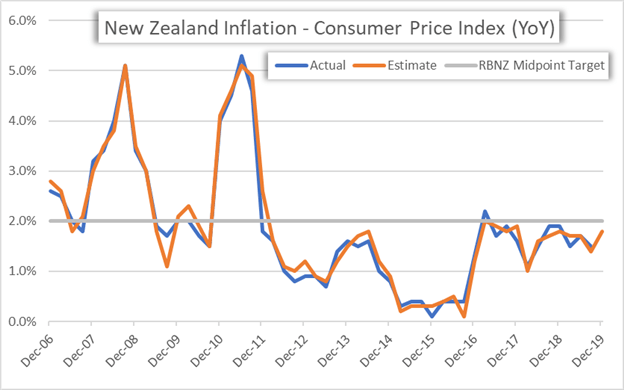

CHART OF NEW ZEALAND INFLATION: CONSUMER PRICE INDEX (CPI) YEAR OVER YEAR CHANGE

New Zealand CPI reports tend to steer NZD price action seeing that RBNZ monetary policy is focused on maintaining inflation between 1-3% on average and near the 2% target midpoint. As such, the recent slide in NZ inflation largely prompted the RBNZ to slash the central bank’s official cash rate (OCR) by 75-basis points last year.

According to the last RBNZ interest rate decision press statement “interest rates will need to remain at low levels for a prolonged period to ensure inflation reaches the mid-point of our target range.” The RBNZ Monetary Policy Committee (MPC) also noted how they “are committed to achieving our inflation and employment objectives,” adding how the central bank “will add further monetary stimulus if needed.”

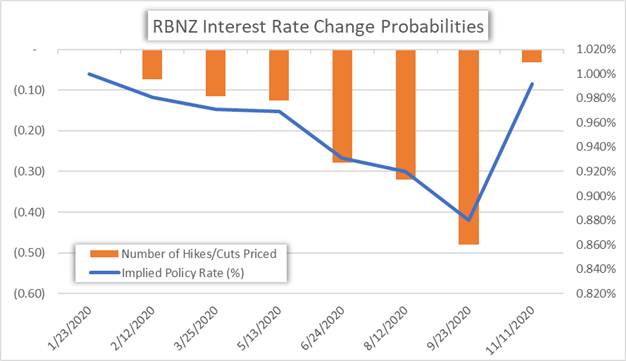

CHART OF RBNZ INTEREST RATE EXPECTATIONS: RESERVE BANK OF NEW ZEALAND FUTURES-IMPLIED OVERNIGHT CASH RATE PROBABILITIES

The 4Q-2019 consumer price index on tap for release thus has serious potential to send the Kiwi swinging relative to other major currency pairs as forex traders react the latest inflation data and readjust their expectations for RBNZ outlook.

Overnight swaps are currently pricing a rough 90% probability that the RBNZ will decide to leave its policy interest rate unchanged at a record-low 1.00% following its February 12 meeting. Futures traders have increasingly dovish expectations that the central bank will cut rates later in the year as they are pricing in about a 50% chance of another 25-basis point interest rate cut by the September 23 meeting.

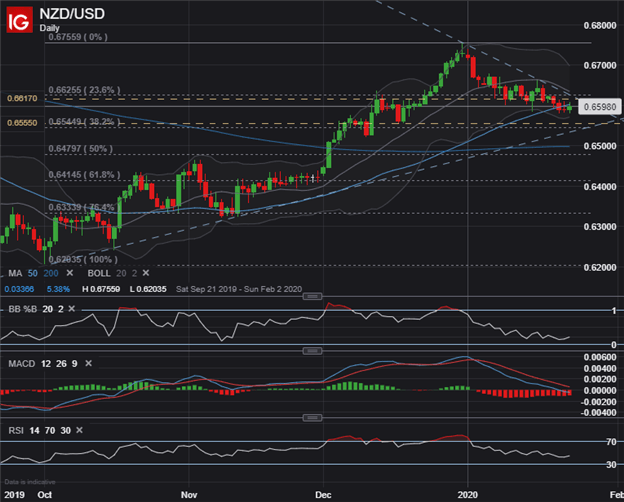

NZD/USD PRICE CHART: DAILY TIME FRAME (SEPTEMBER 2019 TO JANUARY 2020)

That said, evidence that New Zealand inflation is firming with the headline CPI reading fluctuating close to the midpoint target of 2% outlined by RBNZ could underscore a ‘wait-and-see’ approach by the MPC and provide a positive tailwind to the Kiwi.

On the other hand, the New Zealand Dollar will likely come under pressure if stubbornly-low inflation persists, or if the 4Q-2019 CPI report misses market estimates.

NZD PRICE OUTLOOK – NEW ZEALAND DOLLAR IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT)

Learn More: How to Trade the Top 10 Most Volatile Currency Pairs

That said, spot NZD/USD is expected to maintain a 62-pip trading range between 0.6555-0.6617 with a 68% statistical probability judging by its overnight implied volatility reading of 9.0%. This compares to its 20-day average overnight implied volatility reading of 6.7% (implied range of 46-pips) for NZD/USD.

| Change in | Longs | Shorts | OI |

| Daily | 6% | -13% | 2% |

| Weekly | 40% | -35% | 15% |

GBP/NZD is expected to be the most active New Zealand Dollar currency pair over the next 24-hours with an overnight implied volatility reading of 11.3%. NZD/JPY overnight implied volatility stands at 11.2% and ranks in the top 86th percentile of measurements taken over the last 12-months.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight