GBP PRICE CHARTS IN FOCUS AS BRITISH POUND IMPLIED VOLATILITY SKYROCKETS – TECHNICAL LEVELS TO WATCH

- Spot GBP prices have edged higher over recent months on the back of growing hopes that Brexit ‘paralysis’ will soon come to an end and reduce uncertainty that has crippled the UK economy

- British Pound implied volatility derived from overnight forex options contracts are at extreme highs and leaves the Sterling at risk of exceptionally-large swings in spot prices

- Check out this Brexit Timeline for details on how Brexit talks have affected the markets

Currency volatility has been relatively non-existent this year across the broader forex market, though GBP price action certainly stands out as an exception. Recent volatility in the British Pound can be explained overwhelmingly by traders reacting to the latest Brexit developments.

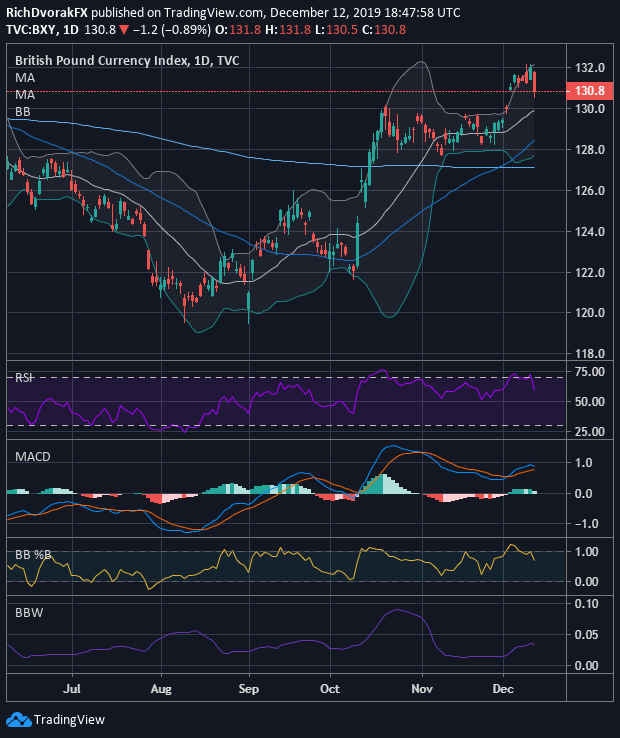

BRITISH POUND CURRENY INDEX PRICE CHART: DAILY TIME FRAME (JUNE 07, 2019 TO DECEMBER 12, 2019)

Chart created by @RichDvorakFX with TradingView

Uncertainty stemming from Brexit has sent the British Pound on a rollercoaster ride since the June 2016 referendum. The BXY British Pound Currency Index is currently trading about 2% away from year-to-date highs printed back in March, which was subsequently followed by a 10% slide over the following 5 months.

Enhance your market knowledge with our free Forecasts & Trading Guides available for download

That said, it appears that the Pound may soon see its next big jolt considering heightened ambiguity that surrounds major event risk on the horizon – like whether or not UK Parliament will be able to deliver Brexit by the current January 31, 2020 deadline (or at all).

Until a Brexit Withdrawal Agreement is formally ratified or another resolution is agreed upon, however, debilitating uncertainty around the UK’s departure from the EU will likely continue to dominate spot GBP price action.

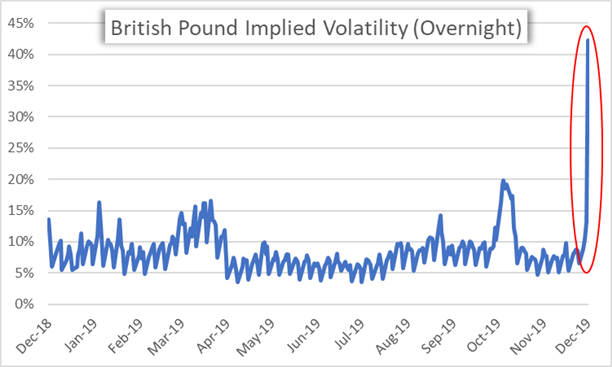

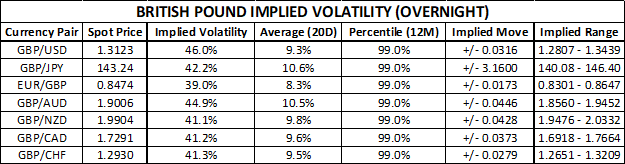

CHART OF BRITISH POUND IMPLIED VOLATILITY (OVERNIGHT)

Correspondingly, British Pound overnight implied volatility just spiked to its highest level since June 2016 judging by an equally-weighted average of GBP/USD, GBP/JPY, EUR/GBP, GBP/AUD, GBP/NZD, GBP/CAD and GBP/CHF overnight implied volatility readings.

This reflects the high degree of uncertainty and significance Sterling forex traders are placing on upcoming Brexit headlines expected to cross the market’s wires over the next 24-hours.

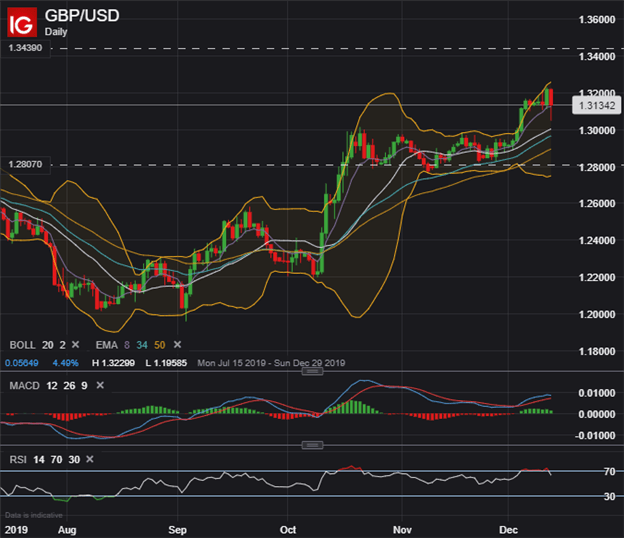

GBP/USD PRICE CHART: DAILY TIME FRAME (JULY 15, 2019 TO DECEMBER 12, 2019)

GBP/USD is estimated to fluctuate between 1.2807-1.3439 with a 68% statistical probability judging by its overnight implied volatility reading of 46.0%.

| Change in | Longs | Shorts | OI |

| Daily | 17% | -13% | 3% |

| Weekly | 11% | -4% | 5% |

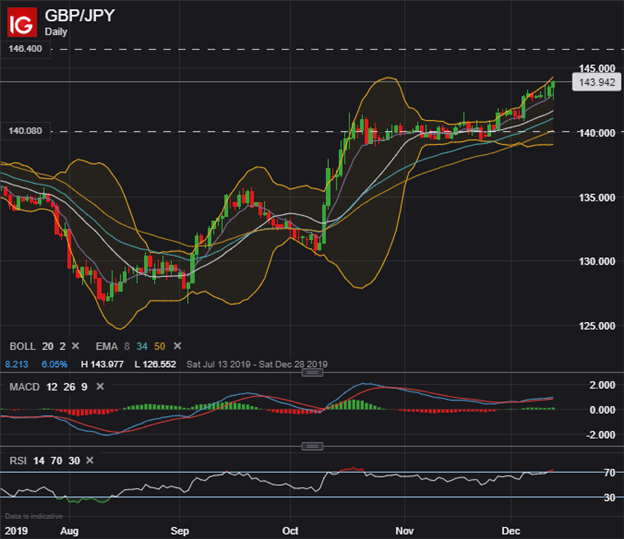

GBP/JPY PRICE CHART: DAILY TIME FRAME (JULY 15, 2019 TO DECEMBER 12, 2019)

GBP/JPY is estimated to fluctuate between 140.08-146.40 with a 68% statistical probability judging by its overnight implied volatility reading of 42.2%.

| Change in | Longs | Shorts | OI |

| Daily | -4% | 5% | 2% |

| Weekly | 30% | -13% | -3% |

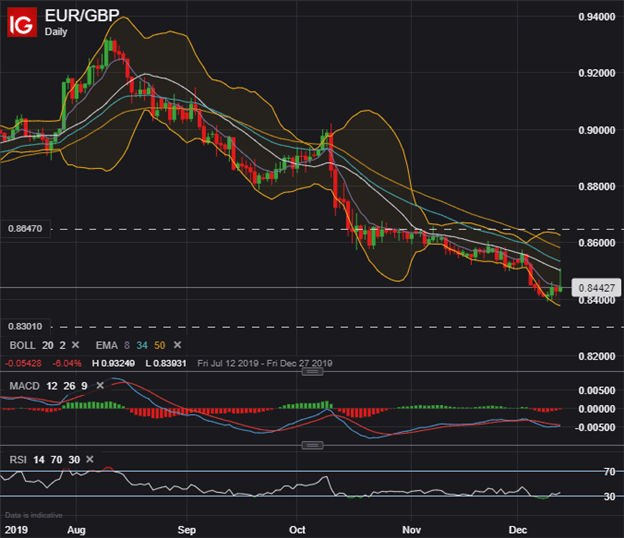

EUR/GBP PRICE CHART: DAILY TIME FRAME (JULY 15, 2019 TO DECEMBER 12, 2019)

EUR/GBP is estimated to fluctuate between 0.8301-0.8647 with a 68% statistical probability judging by its overnight implied volatility reading of 39.0%.

| Change in | Longs | Shorts | OI |

| Daily | -10% | 17% | -1% |

| Weekly | -29% | 54% | -9% |

CHART OF BRITISH POUND IMPLIED VOLATILITY & TRADING RANGES (OVERNIGHT) – GBP/USD, GBP/JPY, EUR/GBP, GBP/AUD, GBP/NZD, GBP/CAD, GBP/CHF

Take a look at this insight on how to trade the Top 10 Most Volatile Currency Pairs

GBP/USD is expected to be the most volatile currency pair over the next 24-hours with an overnight implied volatility of 46.0%, which ranks in the top 99th percentile of readings over the last 12-months and compares to its 20-day average reading of 9.3%.

Options-implied trading ranges are calculated using 1-standard deviation (i.e. 68% statistical probability price action is contained within the implied trading range over the specified time frame).

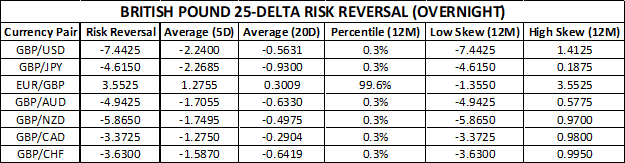

CHART OF BRITISH POUND RISK REVERSALS (OVERNIGHT) – GBP/USD, GBP/JPY, EUR/GBP, GBP/AUD, GBP/NZD, GBP/CAD, GBP/CHF

Broadly speaking, options traders give the impression that they hold a bearish bias toward GBP price action according to the latest overnight GBP risk reversals.

A risk reversal reading above zero indicates that the demand for call option volatility (upside protection; bullish) exceeds that of put option volatility (downside protection; bearish).

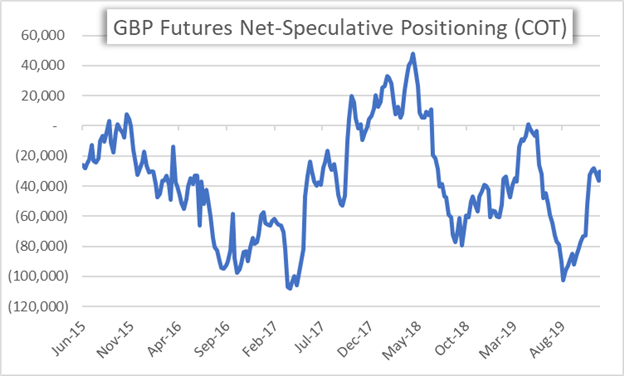

CHART OF BRITISH POUND FUTURES NET-SPECULATIVE POSITIONING (COT REPORT)

Looking to the most recent COT Repot reveals the aggressive unwinding of GBP shorts over the last few weeks, yet futures traders continue to hold a net-short speculative position on the British Pound.

For additional insight on market positioning and bullish or bearish biases, traders can turn to the IG Client Sentiment data, which is updated in real-time and covers several currency pairs, commodities, and equity indices.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight