MARKET DEVELOPMENT –Euro Breakout of Downtrend, Swedish Krona Finds Relief on CPI Beat

DailyFX 2019 FX Trading Forecasts

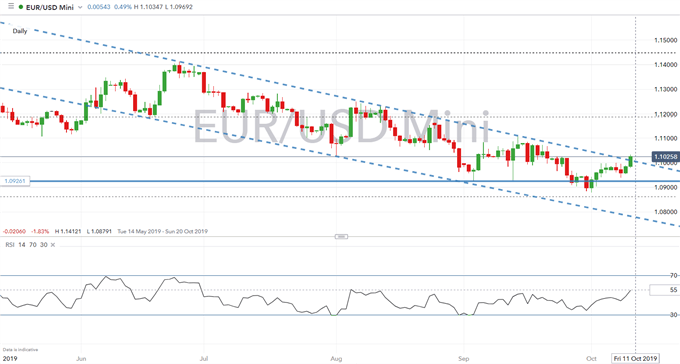

Euro breaks out of 3-month downtrend, suggesting that the pair looks to have based out from 1.0870-80. However, in light of the ECB renewed QE, Germany more or less stagnated and US-China trade tensions continuing to cloud the economic outlook, there is a risk that the Euro will resume its broader downtrend with gains relatively limited.

ECB minutes unsurprisingly highlighted the divide amongst members in regard to the central bank’s latest stimulus measures.

- QE was opposed by a number of members who said it should be a last resort.

- Policymakers would have supported 20bps cut if QE was excluded.

- Reservations expressed about tiering.

- QE had clear majority, tiering had majority and 10bps had very large majority.

Chart of the Day: EUR/USD

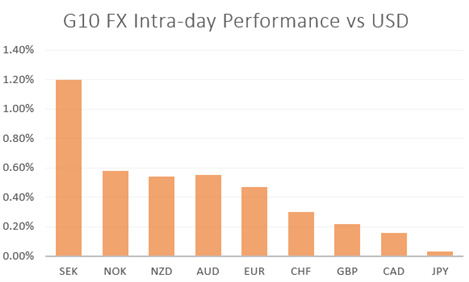

The Swedish Krona finds some much-needed reprieve after today’s inflation figures. The CPIF Y/Y rose 1.3% (Exp. 1.2%), which had been in-line with the Riksbank’s forecast, consequently, given the recent pessimism priced in the Swedish Krona, the higher than expected inflation readings has sparked an aggressive move to the upside in the currency against the Dollar and Euro. While the data point may also see the Riksbank refrain from giving up on its current rhetoric that it expects a rate rise from the turn of the year. That said, given the macro backdrop of slowing global growth weighing on the domestic economy, risks are for the Riksbank to alter its forward guidance, thus leaving the SEK vulnerable.

Source: DailyFX, Refinitiv

WHAT’S DRIVING MARKETS TODAY

- “EUR/GBP Price Analysis - Running into Fibonacci Resistance” by Nick Cawley, Market Analyst

- “FTSE 100 Forecast: Death Cross Signals Bad Omen for FTSE 100” by Justin McQueen, Market Analyst

- “Gold Price & Silver Outlook: Dip, Then Rip?” by Paul Robinson, Currency Strategist

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX