Bitcoin Price Forecast:

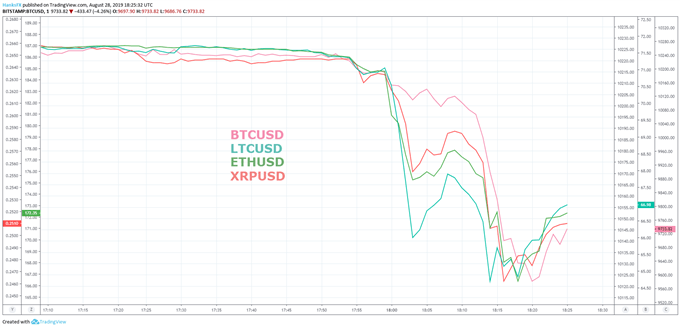

- Bitcoin prices plummeted on Wednesday after a series of stark declines in coins like ETHUSD, LTCUSD and XRPUSD exacerbated a crypto selloff

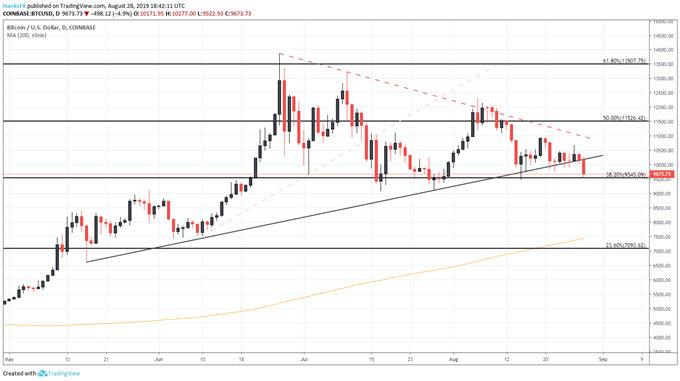

- Price action has pressured BTCUSD to nearby support around $9,545

- Last week, I noted an uncertain fundamental backdrop and waning influence from technical support as a potential catalyst for further Bitcoin declines

Bitcoin Price Plunges After LTC, ETH and XRP Lead Crypto Selloff

Bitcoin plunged to technical support in afternoon trading on Wednesday alongside a series of sharp declines in various altcoins like ETHUSD, LTCUSD and XRPUSD. Like with many cryptocurrency price moves, the root cause behind the decline is unknown. It could be argued Bitcoin’s inability to recapture the ascending trendline from May sparked a more widespread appetite for digital assets and the thinner liquidity of the various altcoins resulted in more abrupt price moves - which in turn accelerated Bitcoin losses – but this is mere speculation.

Bitcoin Price Chart: 1 - Minute Time Frame (August 28) (Chart 1)

Chart created with TradingView.

Regardless, Bitcoin’s precipitous decline does not speak to investor confidence in the coin in the short and medium terms. Last week I noted BTCUSD was straddling an ascending trendline from May, highlighting that it could speak to waning bullishness. Now, the trendline will likely resist an attempted rebound while BTC will now look for support at the 38.2% Fibonacci retracement around $9,545 – which seemingly helped to stall Bitcoin’s decline.

Bitcoin Price Chart: Daily Time Frame (May – August) (Chart 2)

Chart created with TradingView

Going forward, recent price action suggests the outlook for Bitcoin is becoming increasingly bearish. A series of lower highs from June help to display tiredness from bulls and the confirmed break beneath trendline support on Wednesday provides further evidence. Consequently, a break beneath the support around $9,545 could open the door for a continuation lower to the $7,093 area. Nevertheless, Bitcoin still boasts a staggering 153% return in the year-to-date. To put this into perspective, Bitcoin could suffer another $5,000 hit to its price and still enjoy a greater return than the S&P 500 in 2019. As the various digital assets look to recover, follow @PeterHanksFX on Twitter for updates and analysis.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Gold Price Forecast: Rally to Receive Boost from Massive ETF Holdings