Gold & Silver Price Forecast:

- Total known gold ETF holdings have surged to a 6-year high of nearly 80 million troy ounces

- Not to be outdone by its more-glamorous peer, total ETF holdings of silver have spiked to the highest on record

- Interested in an ETF-based view on various global markets? Sign up for our Weekly Equity Webinar.

Gold & Silver Price Forecast: Rallies to Receive Boost from Massive ETF Ownership

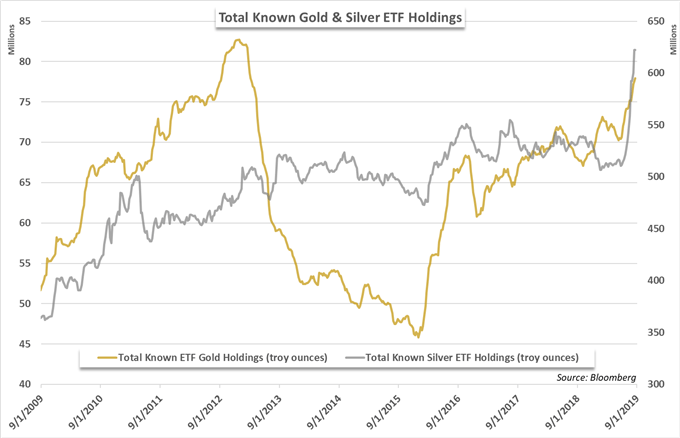

Total holdings of gold and silver have exploded in 2019 as investors grasp for safety amid slowing global growth, trade war uncertainty and a multitude of recessionary warning signs. The seemingly incessant demand has seen the total known ETF holdings of gold surge to the highest since 2013 and easily surpass the levels seen during the immediate years following the Great Financial Crisis. Like it often does with price, silver holdings have followed suit and investors now own more silver through exchange traded funds than ever before.

Gold & Silver Holdings Swell

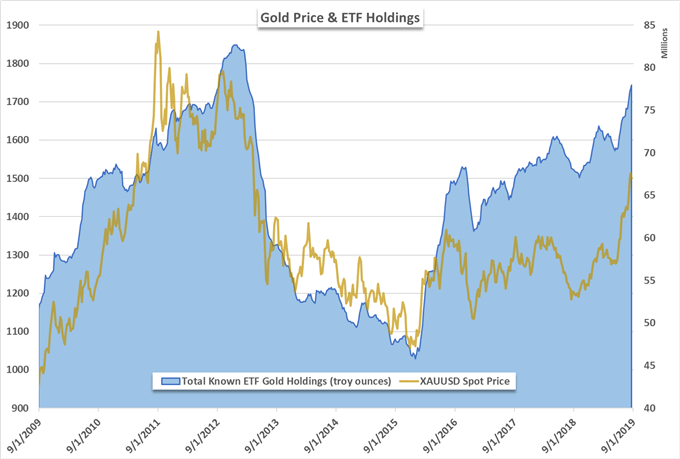

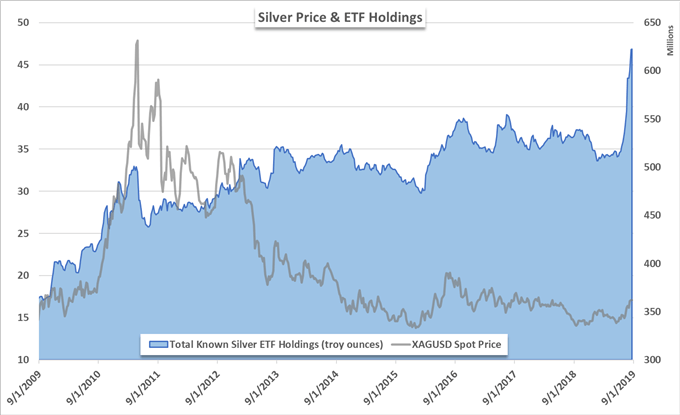

The substantial increase in ownership has been reflected in both gold and silver prices which have climbed roughly 17% and 10% respectively in the year-to-date. Simultaneously, gold ETF ownership has increased by 6.3 million troy ounces or roughly 9%. Silver ETF holdings have ballooned by 105 million troy ounces – a whopping 20% increase in total ownership. Using the 2019 average gold spot price of $1,340, the added holdings equate to roughly $8.4 billion while the increase in silver ownership – using a spot price of $15.5 – is over $1.6 billion.

Gold Rush

Data source: Bloomberg

With the recent inversion of the 2-year, 10-year US yield curve, fears of an impending recession are mounting and the future is arguably more uncertain than months prior and the nearly parabolic increase in holdings over the last three months suggests similar. Thus, it seems likely the demand for both gold and silver will continue for the foreseeable future. Consequently, the two precious metals may continue to receive a boost from the increased ETF ownership which offers a glimpse at the global demand for the commodities.

Silver Scrapes

Data source: Bloomberg

That said, spot prices may still occasionally fall prey to passing Fed commentary and trade war updates, but the case for trend continuation higher appears robust. For more ETF data on gold, silver and various equities, follow @PeterHanksFX on Twitter.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Canadian Dollar Price Forecast: USD/CAD Strength May Fade