US Dollar, USD/PHP, BSP Talking Points

- US Dollar may appreciate versus Philippine Peso after local CPI data

- Rising external risks may pressure BSP to cut rates more aggressively

- Emerging markets at risk to capital outflows, downside USD/PHP risk

Trade all the major global economic data live as it populates in the economic calendar and follow the live coverage for key events listed in the DailyFX Webinars. We’d love to have you along.

The US Dollar may appreciate against the Philippine Peso after the latest round of local inflation data. In July, Philippine CPI clocked in as expected at 2.4% y/y, which is down from 2.7% in June. However, the month-over-month print clocked in at 0.3%. That was an uptick from June. Overall, domestic inflation has been slowing after peaking at 6.7% y/y growth last year.

Since then, we have seen the Philippine Central Bank (BSP) cut rates to help stem fading inflationary pressures as prices fell below the BSP’s target. In fact, the markets are anticipating a further 25 basis point reduction in the overnight borrowing rate from 4.50% to 4.25% later this week on Thursday. Over the past 24 hours, BSP Governor Benjamin Diokno hinted at potential 50bps cuts this year as external risks boil.

Last week, we saw an escalation in US-China trade wars after President Donald Trump threatened a further 10% tariff rate on about $300b in Chinese imports. Since then, we have seen the world’s second-largest economy retaliate by threatening to impose a ban on US agricultural imports. An escalation in US-China tensions could add fuel to the selloff in emerging markets and extend into the Philippine Peso versus USD.

USD/PHP Technical Analysis

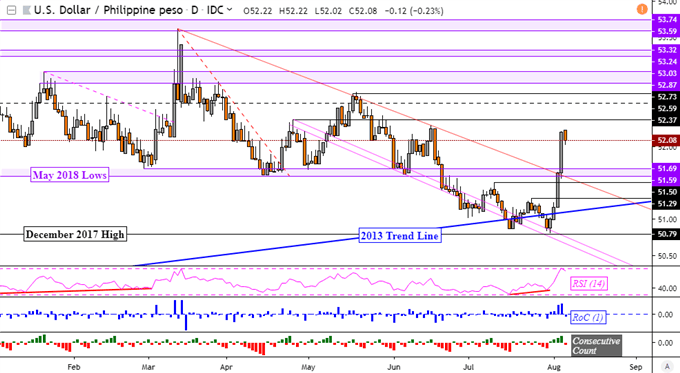

The USD/PHP, on the daily chart below, has broken above the critical descending resistance line from March. That has kept the dominant downtrend intact since and is increasingly at risk to reversing. This places the focus on near-term resistance at 52.37 with a break above it opening the door to 52.73. A near-term correction on the other hand has support eyed at the former lows from May 2018 between 51.69 – 51.59.

USD/PHP Daily Chart

MSCI PHILIPPINES ETF TECHNICAL ANALYSIS

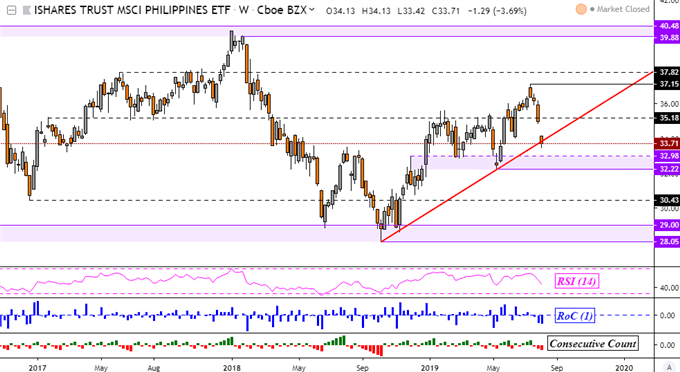

Focusing my attention to the MSCI Philippines ETF, the weekly chart is showing a test of rising support from September 2018. Clearing the trend line paves the way for a test of the 32.98 – 32.22 psychological barrier. Given a confirmatory close under it, the could open the door to testing lows from the end of 2018. Otherwise, near-term resistance appears to be around 35.18.

EPHE WEEKLY CHART

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See how currenciesare viewed by the trading community at the DailyFX Sentiment Page

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter