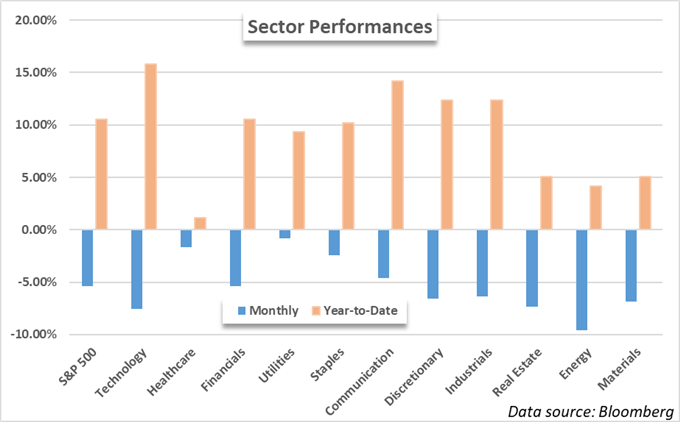

S&P 500 Sector Performances:

- With a monthly return of -5%, May has fulfilled the “Sell in May and Go Away” phenomenon

- Trade wars and slowing economic growth has seen defensive sectors outperform

- Retail traders are overwhelmingly short the Dow Jones and S&P 500, find out how to use IG Client Sentiment Data with one of our Live Sentiment Data Walkthroughs

S&P 500 Sector Performances Highlight Prevailing Headwinds

As the S&P 500 and Dow Jones tread lower on the back of renewed concerns regarding trade wars and global growth, investors have begun to seek exposure in sectors that can withstand a continuation of May’s price action. With one session remaining, May looks poised to end the month -5.05% lower – marking the first down month in 2019 thus far. Across a broader timeframe, May is on pace to post the third worst monthly return since the beginning of 2016, behind only October and December 2018.

On a sector basis, conventional market wisdom has resulted in the more-defensive sectors heralding strength at the end of May. Utilities, healthcare and consumer staples have been relatively unfazed by the recent market turbulence – suggesting investors are digging in their heels for continued pressure. The three sectors are typically viewed as defensive because of their inelasticity and consistent returns. Specifically, utilities have enjoyed the prospect of waning yields elsewhere and a prolonged low interest rate environment – making their consistently high dividend relatively attractive.

On the other hand, the energy, industrials and technology sectors are some of the Index’s biggest laggards. Weakness in the energy industry is partially attributable to waning demand forecasts as global growth slips -a headwind that also weighs on crude oil prices. Industrials share a similar position as economic forecasts project lower output and fewer purchases. The industry has also been plagued by a single-stock’s weakness, as Boeing fumbles for a fix to its 737 Max issues.

Finally, the high-flying tech sector has suffered pain of its own. Responsible for much of this bull run’s return, the tech industry has been hit from all angles this month. As valuations soar, investors have begun to shy away from the riskier edge of the industry, passing up on stocks with uncertain cash flows like Tesla and Uber. Similarly, a licensing ban on Huawei has thrust demand into question for many suppliers of high-tech components like semiconductors. In the month of May alone, the SOX semiconductor ETF has shed -15.45%. In the year-to-date, it is up just under 13%.

Although US equity markets were given a brief reprieve in Thursday trading, a crucial break beneath 2,800 will continue to weigh on the market’s outlook. While the bearish arguments are mounting, there are some bright spots heading into June.

On June 28 to 29, world leaders will meet at the G20 Summit in Osaka Japan. The event will provide President Trump and President Xi Jinping the opportunity to meet and discuss trade, along with nations that face potential auto tariffs. Any indication that the heads of state will meet to specifically discuss the trade war could rejuvenate the depleted optimism of the stock market. That said, the Index will hope to tread water in the interim, but hope is a terrible trading strategy.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Trade Wars and Tariffs Have Put the US Auto Industry in Peril

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.