SEK TALKING POINTS – USD/SEK, SWEDEN UNEMPLOYMENT RATE, BREXIT VOTE

- Swedish Krona watching unemployment rate

- UK will vote on extension of Brexit deadline

- USD/SEK also watching US economic data

See our free guide to learn how to use economic news in your trading strategy !

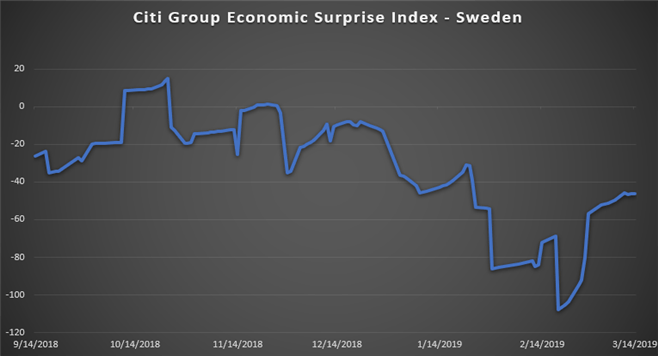

USD/SEK may be at risk from all sides as the US prepares to unveil new home sales, Krona traders wait for Sweden’s unemployment rate data, and the UK votes on extending the March 29 Brexit deadline. While unemployment in Sweden has been declining and recently reached its lowest point since July 2018, the economy continues to underperform relative to economists’ expectations. Meanwhile, the OMX has climbed.

In February, Sweden’s CPIF came in 1.9 percent, falling short of the median analyst estimate at 2.0 and far below the central bank’s forecast of 2.4. The Riksbank stated at its last two policy meetings that it intends on raising rates once this year. However, concern over rising household indebtedness and external risk s make it increasingly difficult for policymakers to justify raising rates at a time when the economy is so vulnerable.

In the US, new home sales are scheduled to be released which may move the Greenback before markets get jittery leading up to the Brexit vote. The House of Commons will decide on whether they want to extend the March 29 deadline in order to secure a plan that can appeal to the majority of lawmakers. The outcome could ripple out into global financial markets and shift investor’s priorities from chasing yields to preserving capital.

If the outcome elicits a strong haven-demand, the cycle-sensitive Krona will likely fall as traders flock to the anti-risk US Dollar. Because there are so many factors that may influence the pair and push it any given direction, it is difficult to gauge the exact magnitude each element will have on USD/SEK. Leading up to each respective event, liquidity may be thin as traders wait to see the result before executing their trades.

Click here to see my weekly Nordic technical forecast !

SWEDISH KRONA TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter