EURO TALKING POINTS – EUR/USD, German Industrial Production, German-Italian Bonds

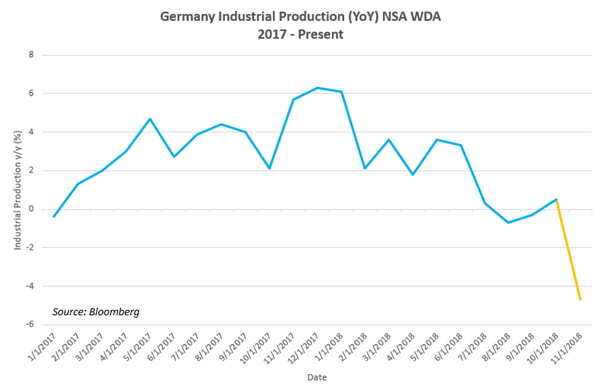

- Euro may suffer as Germany prepares release of Industrial Production

- Dismal Factory Orders spook markets as EU engine sputters and slows

- Italian-German 10-year bond yield spread widens as storm clouds brew

See our free guide to learn how to use economic news in your trading strategy !

The Euro may move on Germany’s month-on-month Industrial Production data after Factory Orders numbers came in at -1.6 percent, substantially undershooting the 0.3 percent forecast. For over a year now, industrial production data has been on a downtrend since last year but has recently accelerated as the European economy slows down. The current forecast for tomorrow’s report is 0.8 percent growth with the previous at -1.9 percent.

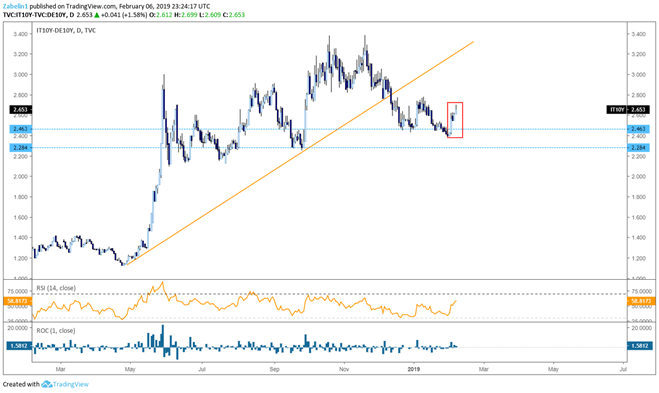

This comes as the three largest Eurozone economies are slowing down with Italy now in a technical recession, opening the door for another potential Eurozone crisis. With Germany slowing down as the region struggles with sluggish growth and political fragmentation, risk is beginning to grip the market. The spread between Italian and German bond yields has widened after a brief respite.

Spread Between Italian and German 10-Year Bond Yields

In this environment, investors are not looking for a compelling rate of return but instead are focused on preserving capital. This trend might accelerate as European headwinds – such as Brexit and the European Parliamentary elections – begin to blow. This may be compounded by the uncertainty over the US-China trade war and concern that the ECB might start tightening at a time when looser credit conditions are required.

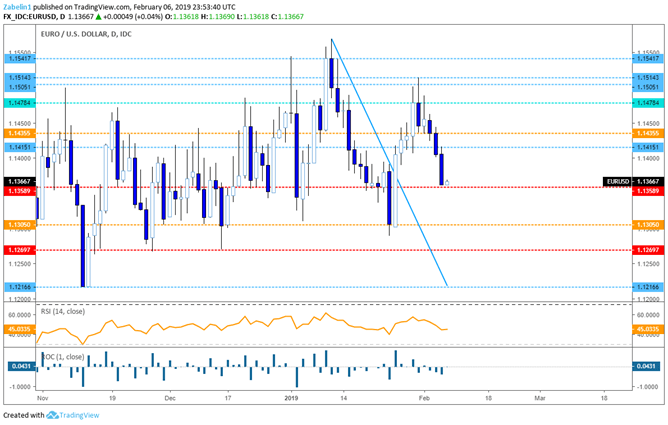

The Euro may dip if the data undershoots. The potential magnitude will vary and could amplify the amplitude of the Euro’s movement, especially given the current economic conditions. EUR/USD appears to be struggling to aim higher after hitting 1.1358. The next possible price barrier the pair will have to overcome stands at 1.1415. Given the fundamental outlook, it is difficult to say with confidence the Euro has much room to grow.

EUR/USD – Daily Chart

EUR/USD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started?

- See our beginners’ guide for FX traders Having trouble with your strategy?

- Here’s the #1 mistake that traders make

-- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter