EURO TALKING POINTS – EURO, ITALY CPI, RECESSION

See our free guide to learn how to use economic news in your trading strategy!

The Euro may dip on Monday after Italian inflation data is released, potentially dampening bullish sentiment as investors eye the recession in Italy and the risk it may pose to the Eurozone. Inflation forecasts for month-on-month and year-on-year EU Harmonized CPI stand at -1.9 percent and 0.8 percent respectively.

Given the slower economic growth in Italy, it is more likely these numbers will undershoot forecasts. However, the potential magnitude of each indicator will vary and could amplify the amplitude of the Euro’s movement, especially given the current economic circumstances.

Forecasts from the IMF and World Bank indicate that the European economy will be slowing down 2019. It is therefore not outlandish to suggest that the Euro may have trouble recovering from its decline in 2018 amid the gloomier outlook and potential risk of another Eurozone crisis. This comes against the backdrop of the Brexit stalemate with longer-term fears over the European parliamentary elections in May.

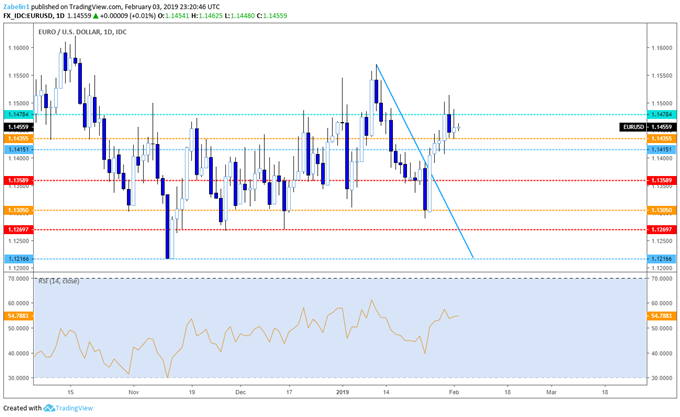

The Euro may close closer to 1.1435 if the data falls short. This comes after EUR/USD reached 1.1478 and subsequently retreated after underlying momentum failed to carry the pair above the resistance. The Euro may trade between 1.1478-1.1435 as investors attempt to gauge the potential risks of an Italian recession and peril from a no-deal Brexit.

EUR/USD Daily Chart

EUR/USD TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter