Apple Stock Talking Points:

- Once the largest corporation by market cap, Apple retraced significantly in the last three months and has shed over $350 billion from its valuation

- The company announced it will revert to setting iPhone prices in local currency in an effort to revive sales

- On the semiconductor front, Advanced Micro Devices reported a miss on revenue a day after competitor Nvidia lowered their Q4 guidance

See Q1 2019 forecasts for the Dow, Dollar, Bitcoin and more with the DailyFX Trading Guides.

Apple’s stock price tiptoed higher in Tuesday's after-hours trading after the company reported earnings slightly above analyst expectations. Revenue came in at $84.3 billion versus the expected $84.1 billion. while earnings per share (EPS) read $4.18, a marginal beat to the $4.17 expected. Despite the beat, the results were widely expected to match the lowered forecasts issued by the company nearly a month ago. At the time, many blamed the earnings revision for a USDJPY flash crash. Today’s market response was within status quo as Apple shares traded slightly higher and currencies looked to Brexit concerns.

Apple Stock Price (AAPL), January 29th (Chart 1)

Chart source: Marketwatch

Still, some concerns linger. The corporate behemoth previously attributed the miss to slowing sales in China amid receding global growth and the US-China trade war. Today, Apple CEO Tim Cook announced the company will revert to pricing iPhones in a country’s local currency in an effort to revive sales. Apple forecasts $55 billion to $59 billion in revenue next quarter, compared to forecasts of $58.97 billion. Next quarter's report will provide evidence on the strategy's efficacy.

Chipmakers Remain Troubled, but AMD Stands Tall

Similarly, Advanced Micro Devices (AMD) announced Q4 earnings after the close. AMD missed analyst expectations on revenue at $1.42 billion versus $1.44 billion but met on EPS $0.08 versus $0.08. The chip-maker also revised Q1 forecasts lower, with expected revenue at $1.2 billion versus analyst forecasts of $1.47 billion.

Advanced Micro Devices (AMD) Stock Price, January 29th (Chart 2)

Chart source: Marketwatch

The miss comes one day after competitor Nvidia (NVDA) lowered guidance for their Q4 earnings. Further, Intel (INTC) missed earnings last week while attributing much of their lost revenue to a slowdown in China. Follow @PeterHanksFX on Twitter for live updates and analysis of earnings reports. Despite AMD’s miss, the performance was robust given the results from competing chipmakers. Thus, shares of AMD traded 7% in after-hours.

The robust earnings performance from the two tech companies could help to boost equity sentiment for Wednesday’s session. After the rocky trading on Monday and Tuesday, the broader market could be primed for a rally if FANG members Facebook and Amazon impress later in the week.

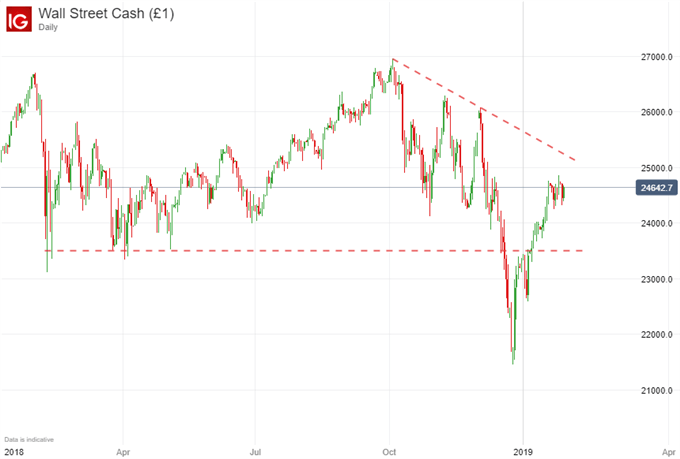

Dow Jones Price Chart, Daily Timeframe January 2018 – January 2019 (Chart 3)

Similarly, China’s e-commerce giant Alibaba reports Wednesday before the market’s open. A surprise performance could stave off some concerns on consumer spending in the world’s second largest economy. On the other hand, a complete miss would further confirm a slowdown in China.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Will the Stock Market Crash in 2019?

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.