Equity Analysis and News

- S&P 500 | Dovish Fed and Easing US-China Trade Tensions Needed for 2800

- DAX | EU-US Trade Tensions Back in Focus

| Price | 200DMA | RSI | IG Sentiment | |

|---|---|---|---|---|

| Europe | ||||

| FTSE 100 | 6970 | 7394 | 43 | Bearish |

| DAX | 11248 | 12276 | 41 | Bearish |

| CAC 40 | 4998 | 5325 | 38 | Bearish |

| FTSE MIB | 19195 | 21536 | 47 | - |

| US | ||||

| S&P 500 | 2738 | 2761 | 43 | Bullish |

| DJIA | 25321 | 25095 | 40 | Mixed |

| Nasdaq 100 | 6912 | 7146 | 54 | - |

| Asia | ||||

| Nikkei 225 | 22338 | 22504 | 57 | - |

| Shanghai Composite | 2588 | 2921 | 43 | - |

| ASX 200 | 5667 | 6042 | 27 | - |

As of 1650GMT Nov 30th

.

Pre-OPEC Meeting at G20 Summit

Elsewhere, the meeting between MBS and Russia’s Putin will likely yield some interest in oil markets. This will also be important as it could build to framework as to what may happen at the OPEC meeting. As it stands, Russia have recently changed their tune, suggesting that there is a need to cut oil production in order to stabilize the oil market. The question will be on the size of the potential cut.

Federal Reserve Beginning to Shift Stance

Recent Federal Reserve Commentary

| Jerome Powell | Chair | Policy rate “just below” estimates of neutral, adds that there is no pre-set policy path. (Nov 18) |

|---|---|---|

| Richard Clarida | Vice Chair | Rate is currently “just below” Fed’s longer-term neutral estimates. (Nov 18) |

| Raphael Bostic | Voter | The positive overall economy leaves pockets of distress (Nov 18) |

| Esther George | Voter | Unemployment is very low in the US, causing labour shortages (Nov 18) |

| James Bullard | Voter in 2019 | Rates are already at or near neutral, adds that he expects slower growth over next two years making it tougher for Fed to continue rate hikes (Nov 18) |

| Neel Kashkari | Voter in 2019 | Thinks the Fed should pause on rate hikes now (Nov 18) |

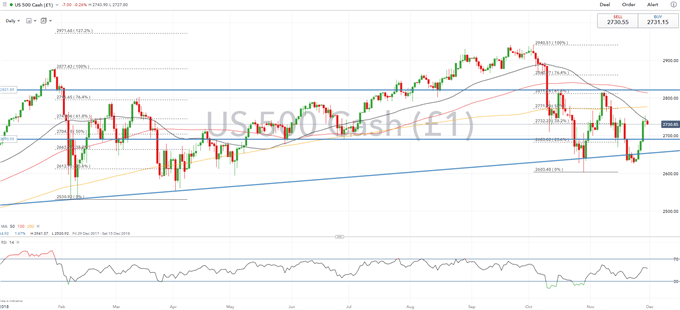

S&P 500 | Dovish Fed and Easing US-China Trade Tensions Needed for 2800

With the Federal Reserve providing a somewhat cautious stance in recent weeks, expectations for further rate hikes has decreased, which in turn has kept the S&P 500 afloat. However, for a return towards 2800, the upcoming G20 summit will be key. President Trump and Xi are set to meet with investors hoping for a positive update post the G20 summit to buoy equity markets. Although, failure to yield notable progress in the US-China trade war could take the S&P back towards 2600. As it stands, the S&P 500 is struggling to overcome the 38.2% Fibonacci retracement at 2732.

S&P 500 Price Chart: Daily Price Chart (Dec 2017 – Nov 2018)

DAX | EU-US Trade Tensions Back in Focus

Increased talk that the Trump administration could place auto-tariffs on the EU before the year-end has raised the bar for EU’s Malmstrom and Juncker, who will look to ease tensions at the summit and avoid an escalation in EU-US trade tensions. The outlook for the DAX is bearish, and a failure in talks between the EU and the US could increase the downside risks to the DAX and see the auto-heavy index move towards the 11000 level. Of note, auto-names, Daimler, Volkswagen and BMW make up roughly 11% of the DAX. The technical outlook remains bearish for the index given the series of lower highs. Failure to reach the 23.6% Fibonacci retracement opens up room for a test of the YTD lows.

Growth outlook for has deteriorated notably with the most recent GDP report contracting for the first time since 2015, if indeed tariffs are implemented, this would raise the risk of German slipping into a technical recession. Elsewhere, mounting concerns over Deutsche Bank, which trades at record lows amid reports that their HQ has been raided will continue to dampen sentiment for German assets.

DAX Price Chart: Daily Time Frame (Jan 2018 – Nov 2018)

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX