Talking Points

- Bitcoin is a new asset class and ETFs will follow futures says CBOE.

- Segwit2x headwinds persist but BTC continues to eye new highs.

- Ethereum (ETH) wallet provider Parity freezes accounts due to accidental code deletion.

The DailyFX Bitcoin Glossary is designed to provide traders with a reference for important terms and concepts essential for understanding the emerging cryptocurrency universe.

Bitcoin (BTC): ETFs Likely to Follow Futures

CBOE president Chris Concannon said that Bitcoin Exchange Traded Funds (ETFs) will likely follow after the BTC futures are released in a major boost for the crypto-currency heavyweight. According to Concannon in an earnings call this week,

“With regulated futures of a certain asset class like Bitcoin, you do have an opportunity to introduce ETFs and over time we do envision ETFs coming to the market.”

Both the CBOE and the Chicago Mercantile Exchange (CME) have said that they will offer BTC futures by the end of 2017 provided that they get regulatory approval. Exchange-traded funds (ETFs) are regulated, marketable securities, based on an underlying holding, and trade like a common share on a stock exchange. In March this year the SEC turned down an application by the Winklevoss twins for a Bitcoin ETF due to unregulated nature of Bitcoin exchanges. A regulated futures market and a liquid ETF would add another layer of respectability to Bitcoin and help to attract new investors and financial institutions.

The ETF news was seen as a driver behind the move higher in the last 24 hours with BTC adding nearly $400 and closing in on its all-time high of $7,600. The rally came despite the upcoming Segwit2x fork, expected mid-next week, which is expected to boost price volatility until the market and miners decide which chain to follow.

We discussed the importance of regulation, hard-forks and Parity problems at our Weekly Bitcoin Webinar (attached). If you would like to register for the webinar, every Wednesday at 12:00PM, please click here.

Chart: Bitcoin (BTC) Daily Timeframe (June 12 – November 8, 2017)

Parity Freezes $100s of millions of Ether Tokens due to Individual Error

Crypto-currency wallet provider Parity Tuesday announced that due to an individual coding accident, hundreds of millions of dollars’ worth of Ether tokens were now frozen with account holders unable to access them. The company said that it had found a vulnerability in its code that allowed users to change codes and become owners of wallets that didn’t belong to them. This is not the first time that Parity has had problems. In late-July this year, hackers stole around 153,000 ether tokens after exploiting a vulnerability in Parity’s multi-signature wallet.

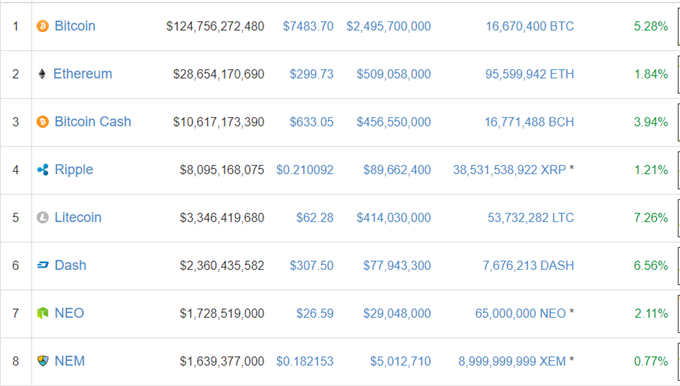

Market Moves/Top 8 Capitalizations – November 8, 2017

If you are interested in trading digital pairs and would like to practice trading either BTC or ETH, you can create a Quick and Free Demo Account Here

--- Written by Nick Cawley, Analyst.

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1